New digital art investment platform Artcels is launching its second share-based art portfolio.

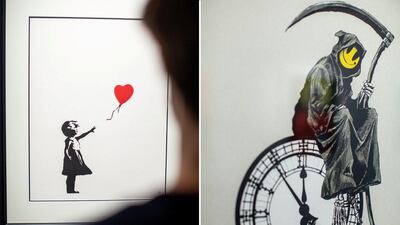

The Millennials collection includes works from world-renowned contemporary artists such as Banksy, Nina Chanel Abney, Jonas Wood, Josh Sperling and Yoshimoto Nara.

In keeping with the modern theme, the artworks will be available to investors as equity in the form of non-fungible tokens (NFTs). The acronym has become ubiquitous in the art world as investors look to make money from the latest technological trend. An NFT is a one-of-a-kind digital asset that gets stamped with a distinctive code and uploaded to the block-chain virtual ledger.

While there has been a lot of buzz recently around NFTs and the money they have attracted – last month Christie's was the first major auction house to sell an intangible piece of art for $69.3m by digital artist Beeple. Artcels' co-founder Elio D'Anna told The National that he saw the changing technology tides in this market early on. After putting on a show where art could be bought using cryptocurrencies at the House of Fine Art Gallery (Hofa) he founded in 2012, Mr D'Anna co-created a fund of blue-chip art with commodities trader Gijs de Viet last year.

The duo said they designed Artcels as an alternative to traditional art investment and to allow for greater accessibility. The curated pieces are not from one of the 40 artists exclusively represented by Hofa Gallery, but from those who – from a growth market perspective – were the most sought after.

“It was extremely successful, the first release sold out pretty instantly. We also sold 85 per cent of the collection in the first year and gave a great return to all the subscribers,” said Mr D’Anna. The return on investment was 11.8 per cent in 11 months, he said.

This year’s Millennials collection has only 12 pieces, collectively valued at just over $1 million, with a share price offering of $1,000, but only 300 shares will be made available to the public, the remaining 700 being held by Artcel. Mr D’Anna said the artwork is valued internally and independently and, because it is the majority stakeholder in the funds, Artcel has a vested interest in ensuring good returns.

"It's in everyone's interest to know that we are the main investor," Mr D'Anna told The National. "It's in our interest that it grows, because our money is on the line."

Mr D’Anna said they have already acquired most of the works for their next release, which in sharp contrast to this year’s collection will be called Masters. As an early mover in the NFT art space, Mr D’Anna wants to keep what he calls Artcels' "avant garde" approach to the business and is launching an app that allows investors to create their own art investment portfolios.

“You can take a piece of art and you can basically submit it, and if it's approved, it can go in the marketplace, or you can also be contacted by one of our specialists to include it in one of our future releases. So everyone becomes kind of a part of it.”

[ Banksy hates the art world, but the art world hates the art world, too ]

[ World Art Dubai 2021: Everything you need to know about the affordable art fair ]