The National will be taking a biweekly look at the world of billionaires. This time we find George Soros is offering $500 million to help refugees and migrants; a conservative billionaire politician has ambitions to run his country; and a Chinese magnate wants to build a Batmobile-ish electric car.

Andrej Babis

He is a vivacious billionaire businessman who has emerged as his country’s most popular politician, offering Czechs a break with old parties tainted by graft; but opponents who see in Andrej Babis a threat to democracy are pressing him to choose between his commercial empire and political power.

Mr Babis, a product of the disillusionment with elites that has shaped politics from Rome and Madrid to London and Washington, is favourite to win an the October 2017 election with his ANO movement. He is, he says, no politician – despite his five years in politics – but a businessman who gets things done.

Besides being the Czech Republic’s finance minister, Mr Babis is the biggest private employer in the European country with more than 30,000 workers in over 250 companies from chemical firms to newspapers and fertility clinics. His also runs a Michelin-starred restaurant in France, sponsors pop bands and sends wry tweets.

Earlier this year, though, Mr Babis faced accusations that he had bent rules in 2008 by temporarily transferring ownership of a conference centre project to his family members so it could qualify for an EU development subsidy only meant for small firms. He denied any wrongdoing.

And the Czech parliament on September 14 approved a conflict of interest law aimed at limiting politicians’ business interests. The law, backed by all parties except Mr Babis’s ANO movement, would ban all members of future cabinets from owning media outlets, and any companies in which they own large stakes would be barred from public contracts and non-automatic subsidies.

Mr Babis, who has been likened to the US presidential candidate Donald Trump and the former Italian prime minister Silvio Berlusconi in the way he has mixed commerce and politics, has protested against the law, which was passed by 135 votes in the 200-seat chamber. “They are losers who do not know how the world works,” news website idnes.cz (which Mr Babis owns) quoted him as saying while watching the vote in parliament’s lobby.

Mr Babis is a former Communist party member and trade official who has built up his Agrofert conglomerate since the mid-1990s through a series of acquisitions. As a young man, Mr Babis went to high school in Geneva while his father represented Czechoslovakia at General Agreement on Tariffs and Trade talks.

Forbes says Mr Babis is worth about US$2.6 billion.

Emilio Azcarraga

A Mexican pay-TV titan’s channels lost 3 million viewers overnight.

Emilio Azcarraga (net worth: $2.2bn) is the controlling shareholder in Televisa, whose channels have got the boot from Megacable, one of the country’s last independent cable operators. By chopping Televisa’s expensive offerings, Megacable hopes to avoid having to raise the prices that it charges its customers.

The Televisa channels in question include the soap-opera network TLnovelas, whose current programming line-up includes La Intrusa, the story of a woman who inherits her husband’s wealth but is in love with his adult son – squabbles ensue; and Fuego en la Sangre, a vengeance saga whose title translates as “fire in the blood”. The most-watched of the networks that Megacable cut, Distrito Comedia, averages 90,000 viewers an hour with a line-up mostly of old comedy shows such as ¡Que Madre tan Padre!, which concerns a family where the mother works and the father cares for the many children – hilarity ensues.

Televisa controls nearly 70 per cent of Mexico’s pay-TV market.

Mr Azcarraga took over Televisa at age 29 upon the death of his father. The succession was not entirely seamless, and indeed was in some respects worthy of an episode of a telenovela. The Azcarraga patriarch’s will had divvied up his Televisa ownership six ways, with shares going to his son, his three daughters, his fourth wife and his mistress Adriana Abascal. The mistress complained that her cut was not big enough and began legal action. In the end, Emilio Azcarraga emerged with control of the company.

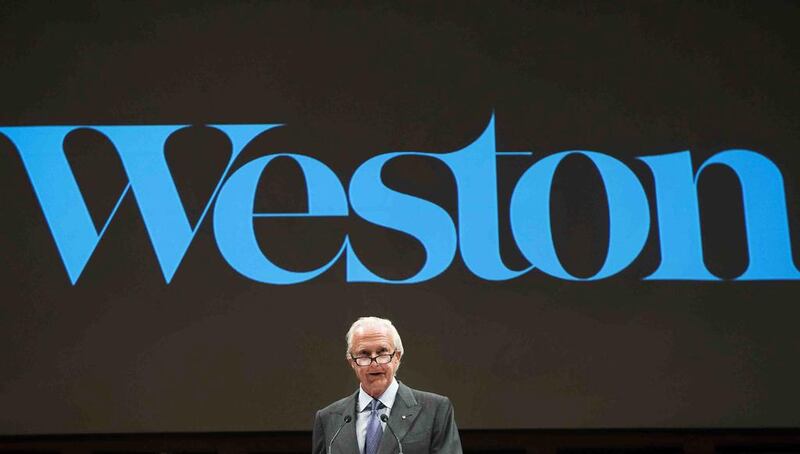

Galen Weston

Canada’s Weston family could have taught the Azcarragas a thing or two about smooth succession.

Last week, these stalwarts of the white-bread world announced that Galen Weston, having reached the age of 75, would step aside as chairman of the family baking business, George Weston, in favour of his son, also named Galen.

No muss, no fuss.

“Following my own father’s tradition of stepping down at the age of 75, I see this as a good time to create space for the next generation,” the older Mr Weston said in a statement.

His grandfather, who had grown up poor, started out as a baker’s apprentice and, as a young man in 1882, laid the foundation for the family firm when he bought a bread route in Toronto from his employer.

Today, Galen Weston is Canada’s wealthiest person, with a net worth $8.5bn, according to Bloomberg. The family’s assets include a major stake in the grocer Loblaw Companies.

Ajay Piramal

The phenomenally successful Indian billionaire Ajay Piramal is considering initial public offerings for two of his units and plans to expand his financial services division to boost the stock-market value of his conglomerate to $20bn by 2020.

Mr Piramal forecasts that he will get the financial services division listed in the “medium term” while his healthcare data management firm, Decision Resources Group, may sell shares in the US, he said in an interview. The 61-year-old is betting that growing demand for financial services in India and mounting pressure in the US to cut healthcare costs, will help him meet his goal.

He inherited a strife-hit textile mill in the 1980s and soon diversified into glass packaging, pharmaceuticals, realty and financial services. He helped turn around businesses and sell them profitably.

Shares of Piramal Enterprises in the past five years have risen by 435 per cent compared with a 78 per cent increase in the S&P BSE Sensex.

“If you had invested 100,000 rupees when we came into pharmaceuticals in 1988, today it would be worth about 130 million rupees,” Mr Piramal said. “So we believe we can create value for our investors.” He is worth $3.3bn.

Jia Yueting

A Chinese billionaire’s plan to develop an electric sports car that has drawn comparisons to the Batmobile is making headway.

Jia Yueting, the founder of Le Holdings, had said in April that financing was the weak link in the project. But this week came news that Le has raised $1.08bn from Chinese investors. This comes even as the Chinese government is imposing stricter technology standards on electric vehicles and considering limiting the number of manufacturers to 10.

Mr Jia grew up in rural China and began his career as a techie at a tax office. He then made the fateful decision to become his own boss, selling computer accessories and running restaurants. Acting on a tip from a relative, he began selling batteries to power cell phone tower antennas – just as China Telecom pushed into the hinterlands. Today he is worth $4.7bn.

His company’s electric car is to be called Le SEE, the initials standing for Super Electric Ecosystem. The low-slung, Nasa-inspired vehicle features a clear fin running along its length.

Eduardo Saverin

The Facebook co-founder Eduardo Saverin could be nearing an exit on one of his higher-profile investments.

Red Mart, a Singapore online grocer that Mr Saverin has backed, is believed to be seeking a buyer as competition intensifies in the city-state. The five-year-old company delivers everything from dragonfruit to frozen dumplings.

Finding a buyer is one option – another is a fresh round of financing. Red Mart’s $23 million funding round in 2014 attracted new investors SoftBank and San Francisco’s Visionnaire Ventures, as well as existing backers including Mr Saverin.

Mr Saverin, born in Brazil, moved to Singapore in 2009 after leaving Facebook. In 2011, he renounced his US citizenship, a move which saved him about $700 million in capital gains tax when Facebook went public. He is 34 and worth $7bn.

George Soros

George Soros, owner of the $25bn family office Soros Fund Management, has pledged to invest as much as $500 million to help refugees and migrants globally.

“We will invest in start-ups, established companies, social impact initiatives and businesses started by migrants and refugees themselves,” Mr Soros said in a statement on Tuesday. “These investments are intended to be successful.”

The investments will be owned by Mr Soros’ non-profit organisations and the profits will go to fund programmes at the Open Society Foundations, including programmes that benefit migrants and refugees. Mr Soros plans to work with organisations such as the United Nations High Commissioner for Refugees and the International Rescue Committee to establish investment principles for the initiative.

Mr Soros is worth $24.7bn, which according to Bloomberg makes him the 26th richest person alive.

business@thenational.ae

Follow The National's Business section on Twitter