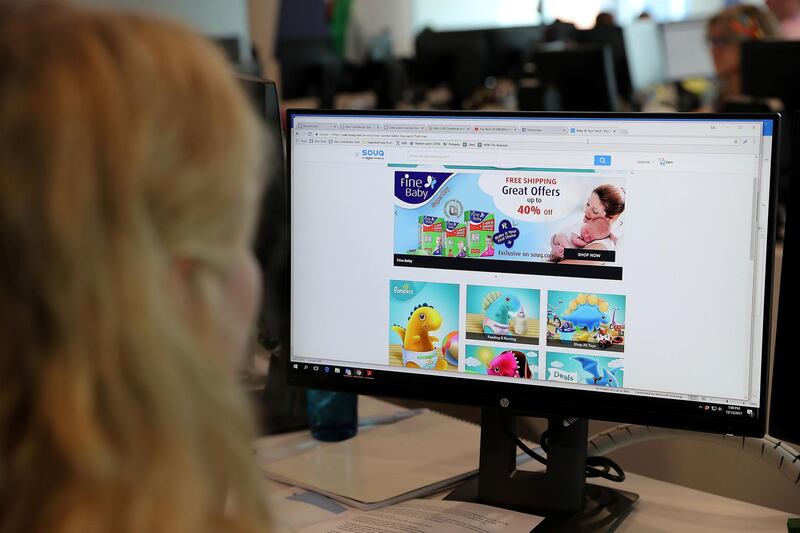

All online purchases received in the UAE will be subject to the same 5 per cent VAT as items bought from traditional retailers, the Federal Tax Authority has confirmed.

The FTA issued a notice offering the latest advice to retailers and consumers.

In accordance with Federal Decree-Law No. (8) of 2017 on Value Added Tax and its Executive Regulations, all online sales are subject to VAT where a seller’s supplies exceed the mandatory registration threshold of Dh375,000 over the previous 12 months or the coming 30 days.

The department has extended the period for some companies to file their VAT returns from one month to three, to help those subject to the 5 per cent tax to comply with procedure.

______________

Read more:

[ Government should be commended for getting shops to give correct change ]

[ UAE clarifies import rules for companies not registered for VAT ]

_________________

Tax on many goods and services was introduced on January 1, but financial analysts have said many small and medium sized businesses have struggled to comply, particularly those that delayed registration.

An expected Dh12 billion has been forecast to be generated from VAT revenue in 2018, with that figure rising to Dh20bn by 2020.