ABU DHABI // The UAE is experiencing a gold rush. With the credit crunch shaking the foundations of the financial world an increasing number of investors are buying bullion bars to stash in their homes rather than deposit cash in banks, according to jewellers. Falling gold prices have led to a flurry of sales of ingots, with some shops reporting a 300 per cent leap in demand. Dilip Popley, the managing director of Popley jewellers, said sales for October and November were the highest in the Dubai store's 15-year history.

"Nobody wants to invest in stocks and shares at the moment," he said. "Banks across the world are having problems and people do not feel it is safe to keep their money in banks. It is better to keep their money close. "As least with gold bricks you can put them in your cupboard and sleep well at night." The trend has taken hold in Europe and America as well. Gold traders in Britain report a noticeable shift out of banks and into gold, particularly since the collapse of Lehman Brothers, the New York-based securities firm, in mid-September.

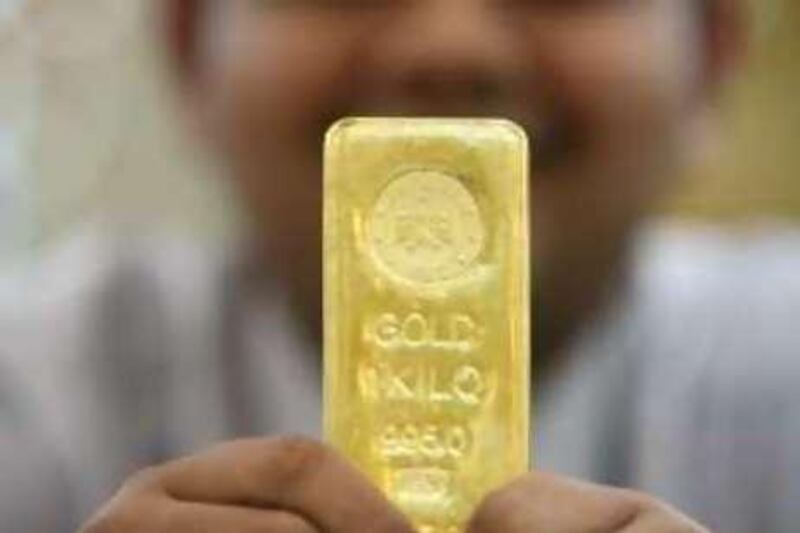

Ravi Prasad, the general manager of Pamp Gold, a Swiss gold wholesaler, said fears over the financial security of banks and stocks had coincided with a dip in gold prices, leading to a rush in sales of 100g "small bar" bricks and 1kg bullion bars. The ingots are made of 24-carat gold, with a 100g bar costing about US$2,800 (Dh10,200) and a 1kg bar around $28,000. "Sales of small bars and bullion have doubled from around August to November," said Mr Prasad. "It is normal, middle-class people who are buying small bars, particularly people from the Indian subcontinent. "Buying gold is part of the Asian culture. Gold is always seen as a safe haven for investors in times of financial crisis." Figures released last month by the World Gold Council showed UAE domestic retail sales in the third quarter topped Dh4.3 billion (US$1.17bn), up from Dh2.8bn in the same period last year. The price of gold dropped to $720.35 an ounce at the end of October from a record high of $1,030.80 an ounce in March. The price drop occurred when banks began feeling the effects of the economic slowdown and started selling gold held in their investment portfolios to boost liquidity, flooding the market for the precious metal. The lower prices also spurred sales during the run up to Ramadan and the Indian festivals of Dhanteras and Diwali, a traditional time for buying treasures. Demand was so high it led to stock shortages at some gold retailers in Dubai, the UAE's biggest market for gold. Venu Gopal, general manager for the jewellery retailer Joy Alukkas said the firm had seen a 25 per cent rise in bullion and small bar sales during the past two months. "People's confidence in banks has gone down. They feel safer buying gold bars which they can store at home and can touch." chamilton@thenational.ae