The family of a British woman who fell seriously ill while visiting her daughter in Dubai are struggling to bring her home after being left with almost Dh500,000 in medical bills.

The case is a stark reminder of the importance of buying travel insurance to cover the costs of unexpected medical bills.

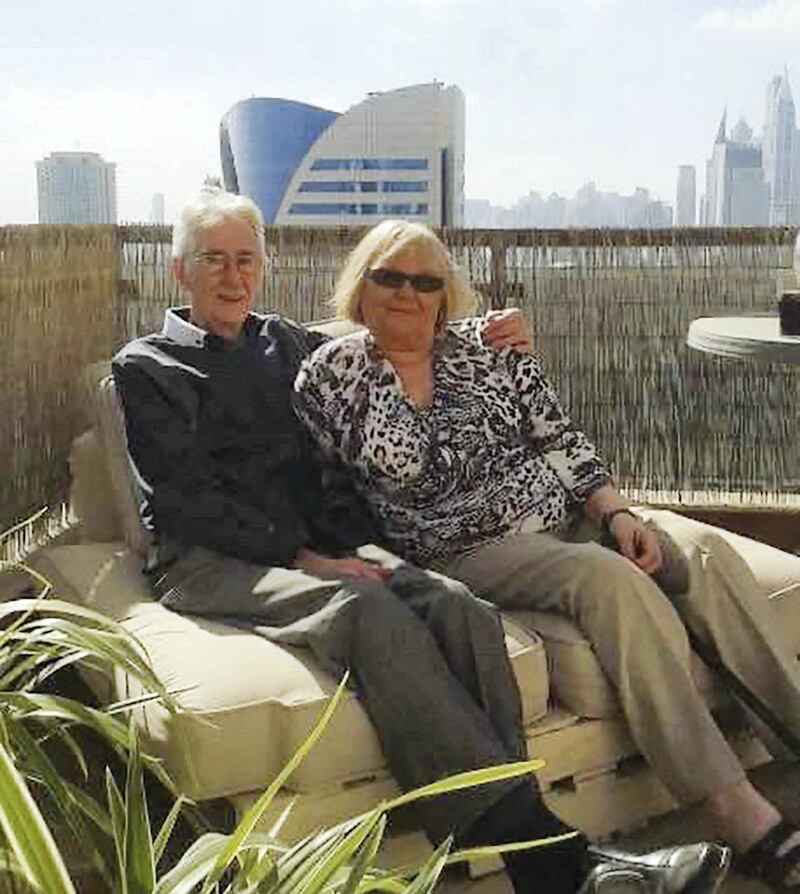

Margo Ashurst, 78, was offered a rare holiday with husband, Tom, to visit their daughter, Lydia, in January last year.

Her family bought the couple flights, but neither considered buying insurance.

Just days after arriving in Dubai for a pre-Christmas break in December, Mr and Mrs Ashurst were struck down with a mystery illness and then pneumonia before being admitted to hospital.

Care costs are now approaching Dh500,000 as Mrs Ashurst remains seriously ill as an in-patient.

“Mum collapsed in the bathroom on December 12 and my dad was taken ill and hospitalised two days later,” said Lydia, 57, a school administrator who lives in Damac Hills.

“Mum is breathing via a ventilator, has a blood infection and a fungal lung infection.

“We have tried to get her repatriated back to England, but she now needs an air ambulance, which is very expensive.”

Although Mr Ashurst, 81, has recovered after two weeks in hospital and flown home with his son, Stephen, his wife remains in the Mediclinic Parkview Hospital.

Doctors do not know where the couple picked up the virus.

If Mrs Ashurst can travel on a commercial airline, Lydia has been quoted about Dh80,000 for a flight back to Newcastle to continue her treatment in the UK.

A specific medical flight is about three times that figure, with additional care bills so far totalling Dh448,000.

Mr Ashurst was treated at the Dubai Health Authority Rashid Hospital, where the family paid his Dh25,000 medical treatment via a credit card.

Since flying home to the north east of England, Mr Ashurst is recovering well.

It is the longest he has been apart from his wife in the 57-years they have been together.

The case has highlighted the importance of adequate travel insurance that covers medical bills.

Travel insurance comparison sites said prices range from about four per cent to 10 per cent of a trip’s total cost, depending on any pre-existing medical conditions that could increase the price.

About 30 per cent of all travel insurance claims are due to medical costs.

The Ashurst family aim to raise Dh120,000 (£25,000) to help pay the rising bills, and have so far collected almost Dh52,000 (£11,000) in the UK.

“My parents rarely travel so travel insurance was not something they thought about," Lydia said.

“My niece, Amy, has set-up a GoFundMe page in the UK, but the repatriation costs and medical bills are very expensive.

“I don’t have the money yet to pay this money off.

“We had hoped to get mum home to be with dad by Valentine’s Day as he is lost without her, but we were unable to do that.

“We all just want her to be able to go home.”

Mediclinic Middle East operates seven hospitals in the UAE with more than 900 inpatient beds.

The Mediclinic Parkview Hospital in Dubai is the most recent addition to the group’s UAE facilities.

“Mediclinic, for reasons of confidentiality, cannot discuss the details of individual patients,” said Barry Bedford, hospital director.

“In all cases, quality of care and the wellbeing of patients are our priorities, and we work with the families to assist in any way we can.”

Julien Audrerie, head of consumer lines at the Oman Insurance Company, said tourists heading to the UAE often forget to buy health cover for their trip.

“Most tourists are looking forward to spending quality time at their destination countries and do not consider getting travel insurance plans,” he said.

“More awareness is needed in this regard as the benefits of having a travel insurance plan far outweigh its cost, especially in case of an unexpected event like this.

"General travel insurance plans for UAE residents provide coverage for a host of unforeseen events like flight cancellation, loss of travel documents, accidental and medical expenses to name a few.

“However, travel insurance for inbound tourists generally covers emergency medical expenses, accidental death and repatriation only.”