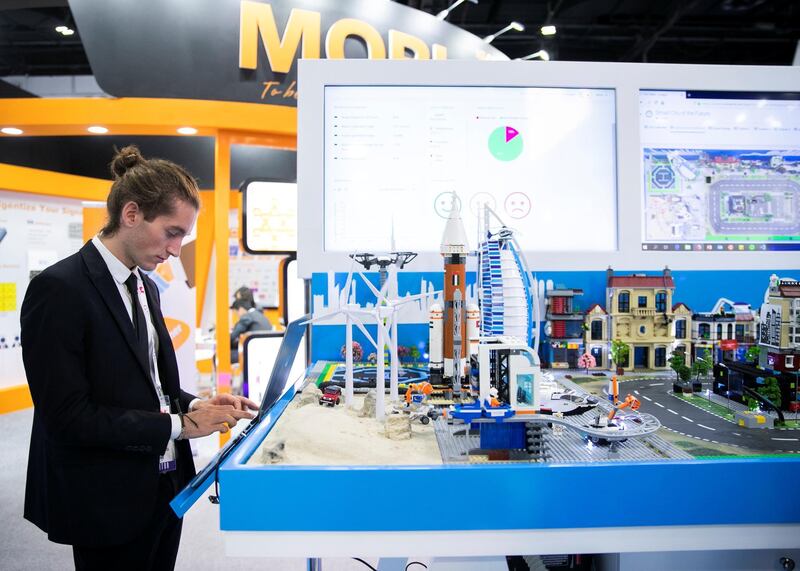

The flying bikes, robotic arms and self-driving taxis may have provided a distraction for most visitors to day two of Gitex Technology Week in Dubai – but much of the talk in the exhibition halls was on the booming cyber security industry.

An explosion of app-based technologies and a switch to online for many everyday services has led to an increase in the risk that cyber criminals pose to consumers.

Online security is now a hot topic as government services and banking institutions take customer service operations into a virtual world.

Technology has created a multi-billion dollar industry in cyber protection, with international firms like Fortnet constantly developing new solutions to keep consumers and businesses safe from increasingly sophisticated threats.

“Our work is everywhere,” said Nader Baghdadi, Fortnet regional enterprise director.

“Fortnet solutions are in almost every enterprise, from small businesses to big business and government entities.

“The more applications and technologies are introduced into the market, the more risk there is to the security of our personal information and data.

“The idea is for enterprises and customers to minimise their risk, and know how they can take action.

“Whenever someone is connected to a system that allows a financial transition to take place, there will always be a threat.”

It is a game of cat and mouse, as security experts attempt to stay a step ahead of faceless cyber criminals.

Fortnet has a centre of excellence with about 200 engineers, all PhD professionals with years of experience investigating the vulnerabilities on millions of devices around the world and how they can be protected.

Experts analyse threats and find solutions, but the number of threats to banking security and the complexity of those threats are on the rise, Mr Baghdadi said.

“We know these threats have increased by around 15 per cent in the past year or so,” he said.

“Most of the banks we see in the UAE have adopted very strong security measures, with multiple authentication steps required before accessing accounts.

“If a cyber criminal can breach a phone or laptop’s facial recognition or biometric access code, there is still a secondary level of authentication required to access an account.

“Those layers are crucial for cyber security, but not all banks around the world have these multiple precautions.”

Since 2016, more than 800 cases of bank fraud have been reported to authorities in Dubai.

Industry analysts Mimecast, a firm providing protected corporate email accounts, said 77 per cent of UAE phishing scam victims had money or valuable data stolen in 2018.

The company surveyed more than a thousand IT organisations, with two-thirds reporting an increase in identity fraud.

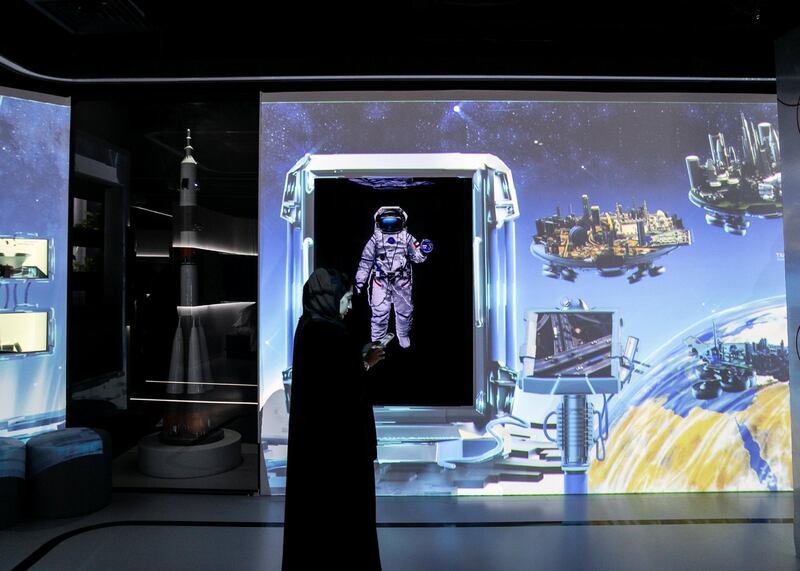

Elsewhere at Gitex, Etisalat displayed its latest efforts to put a super-fast 5G broadband network at the centre of future services.

Dubai aims to have 25 per cent of all its transport network become autonomous by 2030 and the development of a 5G network is crucial to its success.

Etisalat also displayed vehicles that could fit into that 5G vision, like the Renault EZ-ULTIMO, an electric robo-vehicle equipped with autonomous driving capability.

Like any other online service, the network it relies on will be vulnerable to hackers without sufficient protection in place.

Online security is offered by companies like Romania's Bitdefender.

“Cyber-security education is very important for users of most online services and particularly financial and government institutions,” said Cristina Vatamanu, a senior analyst at Bitdefender’s cyber-threat intelligence lab.

“In regards to banking, we know there are several kinds of attacks being used, mostly via phishing emails and false log-in credentials.”

Bitdefender investigations into global banking institutions found some were using unsupported or outdated operating systems within financial networks, leaving them exposed to hackers.

The company is working on a project analysing threats and passing them on to law enforcement teams to reduce consumer risk.

It already works with several UAE firms and government entities, although it would not disclose their identities.

“Cyber security is the responsibility of both service providers and consumers,” said Ms Vatamanu.

“They both must secure their own online environment.

“We all have a responsibility to be careful about our online activity, to recognise fraudulent websites and report suspicious emails.”