As global inflation pushes up the price we pay for goods at the tills, UAE residents are adjusting their shopping habits to keep pace with change.

Countless factors affect the value of the dirhams in our wallets, and trends are often cyclical.

After a rocky 2021, during which widespread vaccines enabled much of the world’s population to slowly emerge from the Covid-19 pandemic, climate events and the war in Ukraine have placed pressure on prices for everyday items.

Agriculture and shipping is being disrupted in 2022, with most goods and services affected ― from the amount paid at the petrol pump, to the price of a weekly shop, transport, rent and how much the banks now charge to borrow.

Last month, Dubai lender Emirates NBD revised its UAE inflation estimate for 2022 to between 4 per cent and 4.5 per cent, from 2 per cent to 2.5 per cent.

That is significantly lower than the 8 per cent to 9 per cent the United States and United Kingdom recorded in April, but higher than the percentage by which most UAE workers' wages will rise.

Shopping

A few savvy shoppers shared their tips and advice on how to manage these tricky financial times.

Nora Ahmad, 36, from Egypt uses the Savi ME app to find better deals when doing her family’s weekly shop in Ajman.

The app tells you which supermarket has the best price for a particular product, and lists 2,000 items from about 40 retailers.

“Friends shared it with me few months ago,” said Ms Ahmad, a mother of three.

“We have all been using it because we need to cut costs with the recent price increases.

“I use the app regularly to hunt for bargains in Emirates Markets, Viva, Middle East Discount Centre, Nesto and LuLu hypermarkets.”

Jordanian Jumana Yousef in Ajman follows helpful money-saving tips on social media.

“I follow a Jordanian man who has been announcing major discounts at different stores for almost a year now,” she said.

“He promotes all types of items ― food, furniture, appliances, clothes ― and I save good money shopping at these discounted stores.”

Ms Jumana earns about Dh10,000 a month, and with no increase in salary to compensate for inflation to provide for her family of four, she is always mindful about her spending.

“With the recent hike in prices across all items, I needed to be more careful,” she said.

“I know it means I have to shop from different stores, which is not easy, but I soon noticed the difference in prices from one to another.

“Items like milk, rice, cooking oil, and tea were costing from Dh10 to Dh20 more in some hypermarkets.

“For example, the price of a five-litre bottle of cooking oil was Dh47.99 in one store, Dh37 in a second one and Dh17 in a third.”

Bargain hunting

As budget-conscious consumers tighten their belts, retailers are offering discounts and firming up sourcing chains for uninterrupted supply of essential commodities.

The UAE’s Ministry of Economy in April said it would regularly monitor 300 frequently bought basic food items and products that people use daily.

The ministry also approved a policy to rein in the prices of basic consumer such as eggs, bread, salt and flour.

“The global food industry is going through many challenges especially in product categories like frozen poultry, wheat, flour and edible oil,” said Shabu Abdul Majeed, Lulu Group’s director retail operations and procurements.

“We have established our own sourcing and logistic hubs across major markets in USA, UK, Spain, Turkey, Egypt, India, Far Eastern countries and China, which has helped us to not only ensure uninterrupted supply but also keep the prices stable.”

He said his team has been working closely with local suppliers to come up with value offers particularly in food and essential products to help shoppers save more.

During the coronavirus pandemic, the group focussed on strengthening stocks and the supply chain.

Retailers in the UAE have been reaching out to consumers on social media with updates on offers and promotions.

The UAE ministry has said more than 40 outlets and co-operative societies in the country are being regularly monitored to keep prices of essential commodities in check.

Transport

Transport can be one of the costliest expenses in an era of rising fuel prices, and while Dubai has an excellent public transport network ― those living farther out often have little choice but to call a taxi.

The choice of ride and time of day can have a significant bearing on cost.

A Dubai taxi operated by the Roads and Transport Authority from Damac Hills to Dubai Marina would typically cost between Dh40 and Dh50 depending on the time of day.

If ordering a care through Careem, the price can be significantly greater ― up to Dh30 more at peak times, an increase of about 60 per cent.

Bassel Al Nahlaoui, managing director of mobility at Careem, said rising costs were largely a result of increased demand.

"Careem operates as a marketplace that matches demand for ride-hailing services with a supply of captains,” he said.

“When demand is higher than supply in a certain area, a peak is levied on trips to incentivise captains to accept bookings and to attract more to that area so that everyone can get a ride.

“We’ve seen a massive increase in demand for ride-hailing in recent months caused by the growth of the economy and an increase in tourism.

“While we’ve been working on addressing this, recent supply chain challenges have made car availability a challenge.

“We’ve been doing everything we can to increase supply to meet this demand, including working with limo companies and the government to increase the overall supply in the city.”

The alternatives to taxis are provided by a widespread and affordable public transport network in Dubai that connects trams, water taxis, a monorail, Metro and buses to most city districts.

The RTA Wojhati mobile app helps commuters navigate the most efficient, and affordable route around Dubai.

It offers route planning and information on real-time delays to identify the fastest route available.

Another is the RTA public transport app that allows users to accumulate reward points as they travel across the network to access bonus travel features and discounts.

It also has a secure payment system to top up a traveller’s Nol card.

Rent

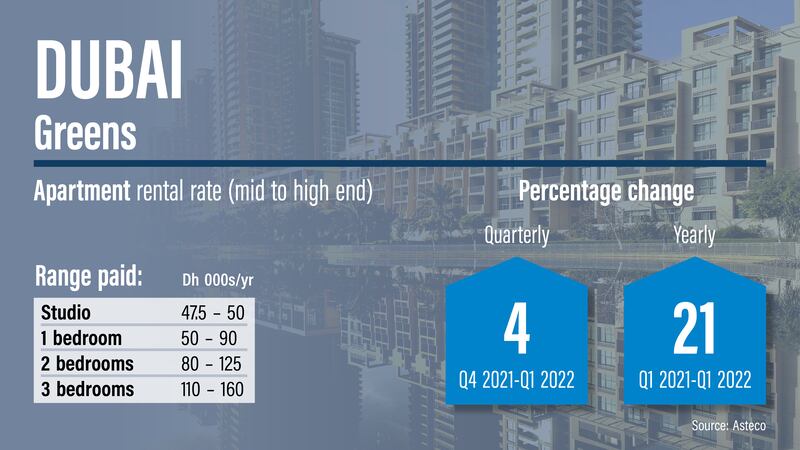

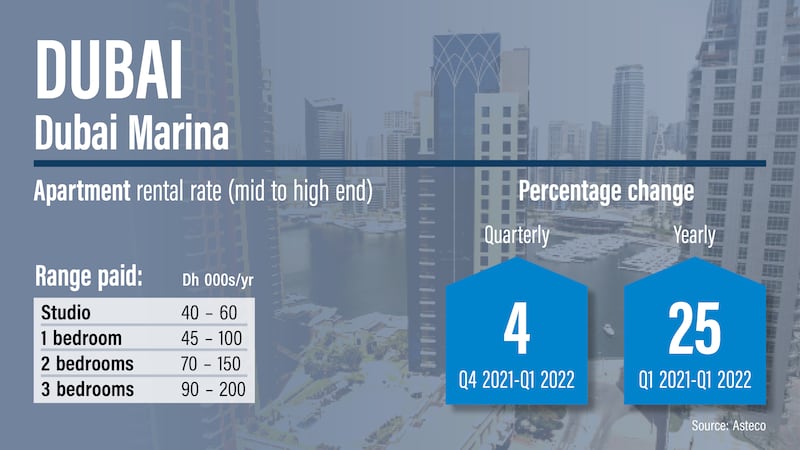

Rents have soared in most parts of Dubai, Abu Dhabi and elsewhere in the UAE over the past six to eight months.

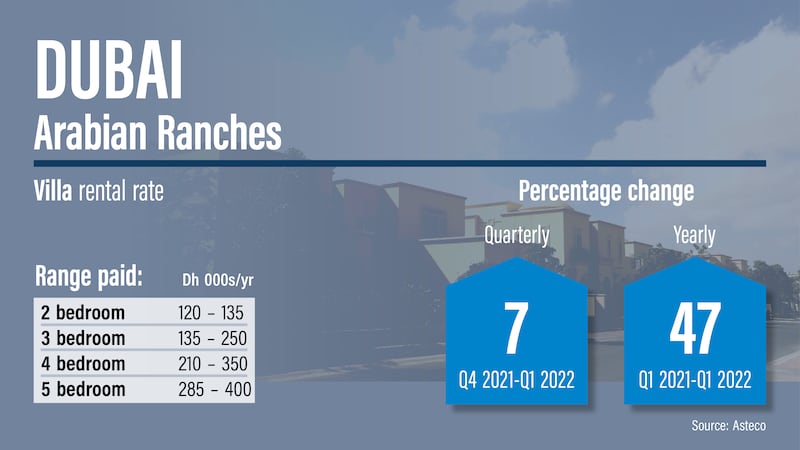

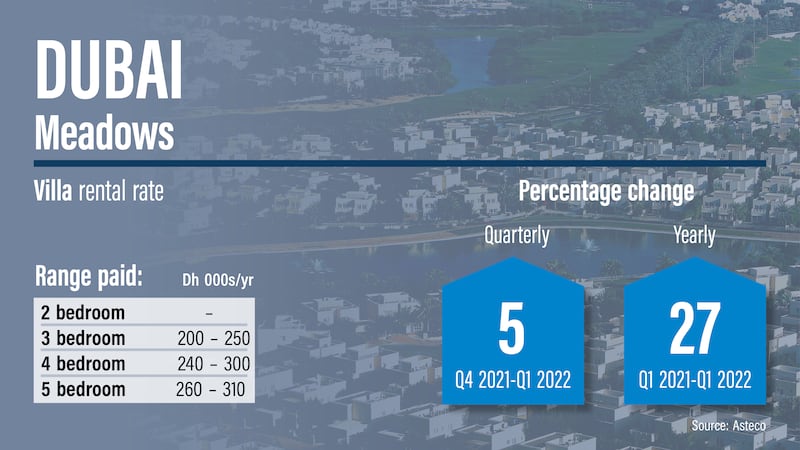

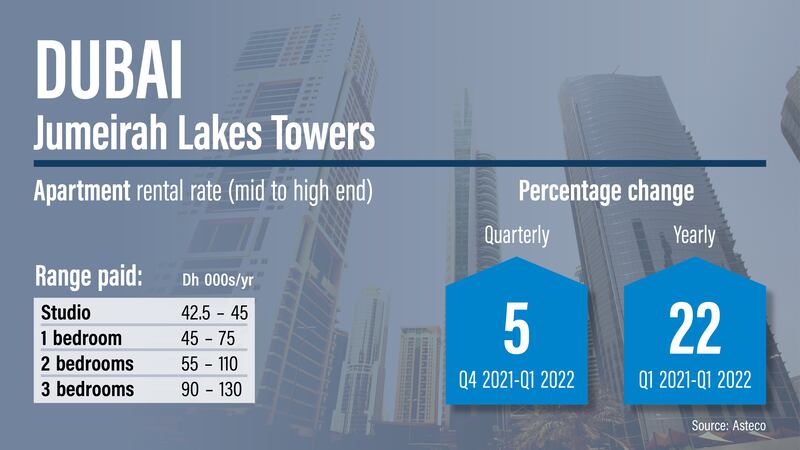

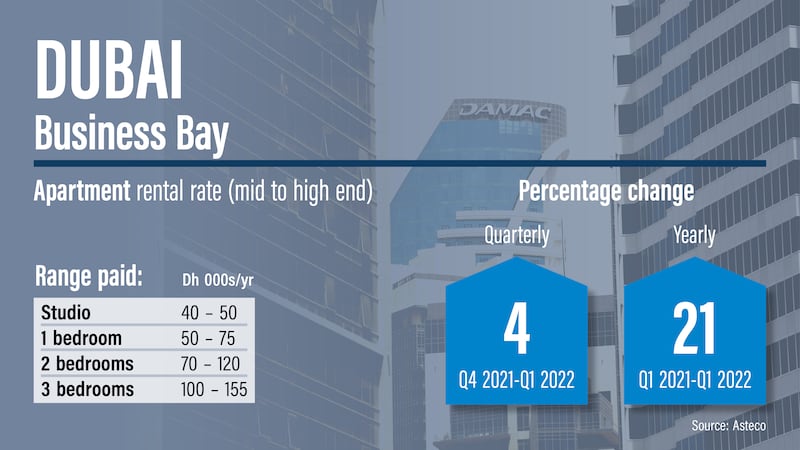

The average price demanded for an apartment or villa in Dubai rose more than 40 per cent annually in some areas during the first three months of 2022, according to property consultants Asteco.

Villas are particularly in demand, mainly driven by government initiatives such as residency permits for retirees and remote workers, as well as the UAE’s success in managing Covid-19.

Rents for villas in Abu Dhabi rose by 2 per cent on average in the first quarter of 2022, and 5 per cent annually although apartments were renting slightly cheaper than this time in 2021.

Renters should be aware of their rights before deciding to move, because Rera in Dubai has strict laws on how much landlords can increase rents by each year.

Mortgages

A rise in interest rates has created a boom in the cost of mortgages to buy a new home, and a rush on new applications as people aim to lock in rates before another increase.

For example, an interest rise from 2.69 per cent at the start of the year to 4 per cent in May, increased monthly repayments on a loan of Dh1 million by Dh600.

“Since the start of the year we have all witnessed an increase in mortgage interest rates, but in recent months the interest rates have had a drastic spike from just over 2.5 per cent to over 4 per cent,” said Rosie Patterson, mortgage channel manager at BetterHomes LLC.

“This has had a direct impact on the cost of mortgages.

“Although the interest rates have increased, we must be aware they are only just levelling back to the rates offered pre-Covid.

“This shows the market has recovered and highlights the strength in the economy, as interest rates tend to rise along with economic growth.

“This growth has been reflected in May, with the number of mortgage applications hitting an all-time high compared with the past two years.”

A 30 per cent increase in monthly mortgage applications compared with the start of the year, is a sure sign of an urgency to buy, Ms Patterson said.

“Banks are trying to recoup any losses they may have incurred in interest charges during the pandemic,” she said.

“For those who already have a mortgage, it would be wise to review your options before the rates increase further, as you could possibly get a better rate by switching your bank.”

Interest rate increases will also mean credit card bills will rise in the months ahead, as borrowing in general becomes more expensive.

But it will also be good news for savers, because banks gradually increase profit rates on savings accounts and certificates of deposit.