Only a month into the 2020s, we have already entered a pivotal period for the UAE's energy scene. The imminent activation of the Arab world's first nuclear power reactor and a massive new gas discovery have made headlines. The energy mix is transforming to greater diversity, self-sufficiency and environmental performance – setting the industry new challenges for the decade ahead.

The past decade saw the UAE wrestling with three linked energy issues. The country was running short of gas because of rapid growth in demand during an economic boom that collided with declining gas reserves outside Abu Dhabi. Major purchases through the Dolphin pipeline and of liquefied natural gas made the country a net importer, even though it had the world’s seventh-largest reserves, creating concerns over supply security. The energy system was almost entirely dependent on oil and gas, emitting significant greenhouse gas emissions at a time of growing concern over climate change.

Energy projects take a long time to build, so actions initiated a decade ago are only now bearing fruit. In 2008, the federal government issued a policy paper committing to civil nuclear power and founded the Emirates Nuclear Energy Corporation in 2009. The first reactor, of four totalling 5.6 gigawatts capacity, is intended to come online imminently.

This will represent a massive source of low-carbon electricity, equivalent to about a quarter of Abu Dhabi’s installed generating capacity. It has required not just heavy financial investment, but the development of an entire regulatory system, training of hundreds of UAE national operators and forging a working relationship with the partner, Korea Electric Power Corporation. The UAE is endeavouring to establish a gold standard for safety and non-proliferation to allay concerns about nuclear programmes in this region.

Dubai put together its 2011 Integrated Energy Strategy and 2015 Clean Energy Strategy, which by 2030 intend to save 30 per cent of energy consumption below “business as usual”. It will also move power generation from total reliance on gas to a more balanced mix – 61 per cent gas, seven per cent “clean coal”, seven per cent nuclear (from ENEC) and 25 per cent solar, mostly at the Mohammed bin Rashid Al Maktoum Solar Park, set to become the world’s largest single-site solar facility with five gigawatts of capacity. The UAE’s 2050 Energy Strategy, put forward in 2017, targets 50 per cent clean energy by 2050, and a 40 per cent improvement in energy efficiency. Energy subsidies have been cut and fuel prices raised to international levels.

Dubai Electricity and Water Authority has set a string of world records for the cheapest solar power, and has been followed by the newly-reorganised Emirates Water and Electricity Company, which is currently tendering a giant two-gigawatt solar farm in Al Dhafra. A move towards reverse osmosis for producing desalinated water saves energy and improves the system's flexibility. Both emirates have also created systems to permit smaller-scale solar installations on the roofs of factories, commercial buildings and homes, leading to a boom in private solar developers such as Enerwhere, Yellow Door and Enviromena.

These firms, along with the Abu Dhabi government’s clean energy vehicle, Masdar, and Saudi Arabia-based regional power champion, Acwa, have gone out to develop renewables regionally, including solar in Jordan and Egypt, and large offshore wind farms in the UK.

The Gulf’s first coal power plant, at Hassyan in the south of Dubai – a collaboration between Dewa, Acwa Power and China’s Harbin Electric and Silk Road Fund – should also start generating this year.

Despite the higher emissions from coal, the combination of nuclear, renewables and improved efficiency should lead to carbon dioxide emissions from the UAE’s power sector falling significantly over the next few years.

Sharjah ran its first competitive bid round for oil and gas exploration last year, which attracted supermajor Eni and has found success with the emirate's first gas discovery in 30 years. Ras Al Khaimah has also awarded new exploration acreage, having announced its own energy strategy in 2018 – focused on 30 per cent efficiency savings, 20 per cent water savings and 20 per cent renewable energy generation by 2040.

In November 2018, Adnoc released its integrated gas strategy, which has the goal of making the UAE self-sufficient. This will be achieved by developing new and more technically challenging fields with international partners.

Adnoc also announced an increase in reserves to 105 billion barrels of oil and 273 trillion cubic feet of gas, taking it to sixth in the world rankings for gas. Oil production capacity is intended to rise from 3.5 million barrels per day to four million bpd this year and five million bpd by 2030, making it the biggest gainer amongst Opec nations other than Iraq. Carbon capture and storage, following on the first project with Emirates Steel, will be used to reduce greenhouse gas emissions while saving gas currently reinjected for improved oil recovery.

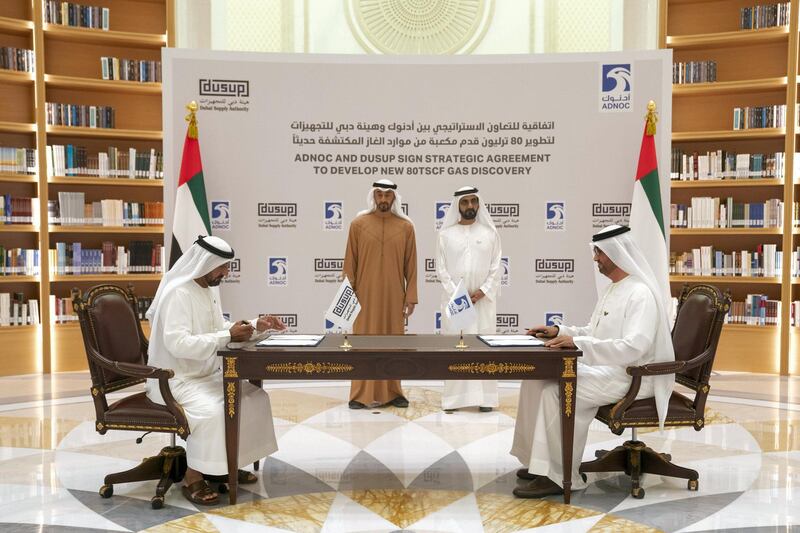

Early this month, Dubai and Abu Dhabi announced a massive gas find with 80 trillion cubic feet in place, in the area near Jebel Ali, between the two emirates. A mixed conventional-unconventional reservoir, type, it is still too early to know how much can be economically recovered. Yet even a modest level of production could substantially reduce Dubai's import needs.

These developments are impressive, particularly when set against slow advances in most of the UAE’s regional neighbours. Progress brings its own challenges, and the country has three major issues to solve in the current decade.

The first is how to restructure the country’s gas market. A large amount of new production will reach the domestic market at a time that demand is falling, at least temporarily, because of the arrival of nuclear, solar and coal. New industries are being planned, boosting consumption, but the country needs a pricing and trading system that will keep gas competitive and direct it to the most valuable uses.

The second is integrating the growing share of variable solar power alongside large and relatively inflexible nuclear and coal plants. Within a few years, solar power generation at midday in spring might exceed demand, while on summer evenings, demand will have to be met entirely by non-solar photovoltaic generation. Dewa is building a pumped hydroelectric storage facility at Hatta, and Ras Al Khaimah has also considered one in its mountains. Ewec’s Al Dhafra solar tender featured an option for bidders to include battery storage, to add to the 108 megawatts of batteries the utility already has.

The third, and the biggest challenge, is moving beyond the power sector to reducing the environmental impact of the rest of the economy. Electric vehicles are starting to appear on UAE roads, but remain a rarity. Industry still runs nearly all on oil and gas, although Dewa has begun a pilot scheme to make "green" hydrogen. The Emirates Steel project would have to be followed by more carbon capture schemes to cut greenhouse gas emissions from petrochemicals, oil refineries, cement, aluminium and the rest of the heavy industrial backbone of the economy.

One part of the solution to these three issues will be greater interconnectivity with neighbours. Another part will be technological and market innovation. The UAE is well on the path to a more diverse, secure and sustainable electricity sector. The challenge for the 2020s is to complete that task, while advancing on the rest of the energy system.

Robin M Mills is CEO of Qamar Energy, and author of The Myth of the Oil Crisis