The coronavirus crisis has put the European Union under some stress. This is partly triggered by a single judgment delivered in a court in Karlsruhe in south-western Germany. The ruling has put the eurozone economy on an emergency drip-feed of positivity and promises from European officials even as it raised questions among some about the long-term health of the project as a whole.

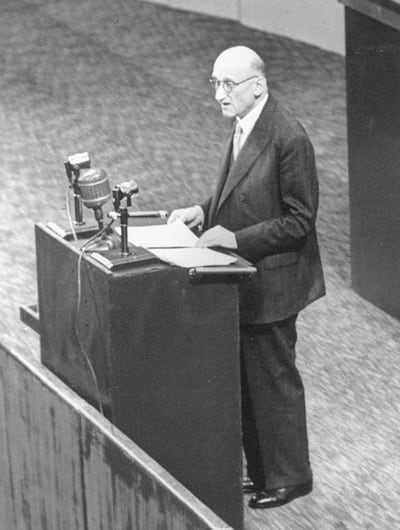

All of this in the very month that the EU marks the 70th anniversary of the Schuman Declaration, which started the journey towards shared continent-wide peace and prosperity. When French foreign minister Robert Schuman proposed a European coal and steel community in May 1950, he could not have dreamed that it would evolve into the world’s largest single market, the pinnacle of European integration.

The Schuman Declaration

Why should one verdict in a German court affect all that has been achieved? First, it was no ordinary court but Germany's constitutional court, which has extraordinary powers to police the country's democratic institutions. Second, because it reveals the bloc's institutional and political challenges.

The facts about the Karlsruhe verdict are stark.

Germany’s constitutional court ruled against the European Central Bank's five-year-old bond-buying programme, with the judges refusing to accept an earlier European Court of Justice decision on the matter. In so doing, the German court effectively undermined the legitimacy of the EU’s highest legal authority and led the way for other national courts to ignore its rulings. As a result, the European bloc now faces something that analysts are calling an act of judicial secession and that too by its largest member state and dominant economic power.

A German lawmaker admitted that his country’s “constitutional court has put an explosive charge under the euro and the EU”. Indeed, after this, European policies on competition, trade, currency and the single market could, in theory, be interpreted very differently by every national court in the EU.

Very worried about the future of Europe post @BVerfG. Europe cannot work if national Constitutional Courts decide unilaterally when the Luxembourg Court has primacy. Expect Hungary´s and Poland´s constitutional court to follow this precedent https://t.co/fcTzKIjPA0

— Luis Garicano (@lugaricano) May 5, 2020

There is little clarity on how this will play out. Will the European Commission, as its President Ursula von der Leyen has threatened, really sue the German government for the verdict handed down by Germany’s independent court? Will the German government be minded or even able to bring its judges to heel after championing tough EU measures against Poland and Hungary for interference with the independence of their courts?

If the European Commission sues Germany, the case would probably drag on for years and there is no guarantee of a successful outcome anyway. Even if, as is often the case in European affairs, a fudge of sorts is found, the legal foundation of the monetary union will be seen as shaky.

Who is Ursula von der Leyen?

Either way, it is hardly likely to inspire investor confidence in the eurozone. Citigroup's chief European economist Arnaud Mares points out that single German court ruling comes at an especially perilous moment and could even call into question the viability of €750 billion worth of "pandemic bonds", which were launched by the EU in March.

The pandemic bonds lack the constraints and time limits imposed on prior bond purchases, to which the German court explicitly objected. It is entirely possible therefore that the open-ended pandemic bonds, which are meant to aid European recovery in the ongoing global medical and economic emergency, will add to long-running German disquiet about eurozone policies.

The German court

In this context, the warning sounded by Marcel Fratzscher, head of the German Institute for Economic Research, is worth noting. “The German mainstream view,” he recently explained, “is that ECB policies since 2008 have been designed to benefit weaker southern European countries at Germany's expense. That is not a problem that can be brushed aside."

The only attempt to solve a conundrum that could plunge the EU into a political, constitutional, perhaps even an existential crisis, came from German Chancellor Angela Merkel. But her suggested plan is as ambitious as it is vague. The German court ruling, Ms Merkel said, “will have to motivate us to do more to push ahead with integration in the area of economic policy”. The reference is to the eurozone’s incomplete union. It has a single monetary policy but not a single fiscal policy.

Angela's answer

Going even further, Ms Merkel quoted former European Commission president Jacques Delors, who led the creation of the single market and pushed through the idea of a common European currency. “We also need political union, a monetary union alone will not be enough,” she said.

Can any of this really happen?

Some market-watchers see an opportunity for the recalibration of differences in the three months from the German ruling to August 5, when the ECB is supposed to provide the German judges with economic justification of its policies. And despite the doleful German “mainstream view” of ECB policies, many leading German politicians remain attached to the overall idea of European solidarity.

Covid-19: A European response

For instance, late last week, Armin Laschet, Prime Minister of Germany’s most populous region North Rhine-Westphalia – and one of the top contenders to succeed Ms Merkel – called for more unity on quarantine rules across the continent. “We have been acting too much in the national interest and too little as Europeans,” he said.

That is heartening but it may not be enough. It has become a truism to say that the coronavirus pandemic will change everything. In some instances, it will simply accelerate the change that was already under way. European disunion may be a case in point.