Breast cancer is among the five most common cancers in the UAE, and it's unfortunate that many patients have found that their health insurance does not fully cover their treatment. As The National reported yesterday, the basic plans provided as part of the compulsory health insurance scheme for employees cover only up to Dh150,000 a year in Dubai and Dh250,000 a year in Abu Dhabi. Medical costs can be far more than this, meaning many residents face potential bills of hundreds of thousands of dirhams. Those who cannot afford it are forced to forgo essential treatment.

This isn’t an issue restricted to breast cancer. Full treatment for any form of cancer, especially in its advanced stages, can require at least Dh1 million a year. Treatments for other long-term illnesses are equally expensive. Cancer survivor Brigitte Chemla told the paper that each of her eight sessions of chemotherapy cost her about Dh55,000. Other hospitals charge at least Dh25,000 a session. Many patients also require surgery or radiotherapy. Expatriate women with serious cancers are often forced to go back to their home countries for treatment.

This highlights a gap in the health insurance system. We urge insurers to examine ways to support these patients.

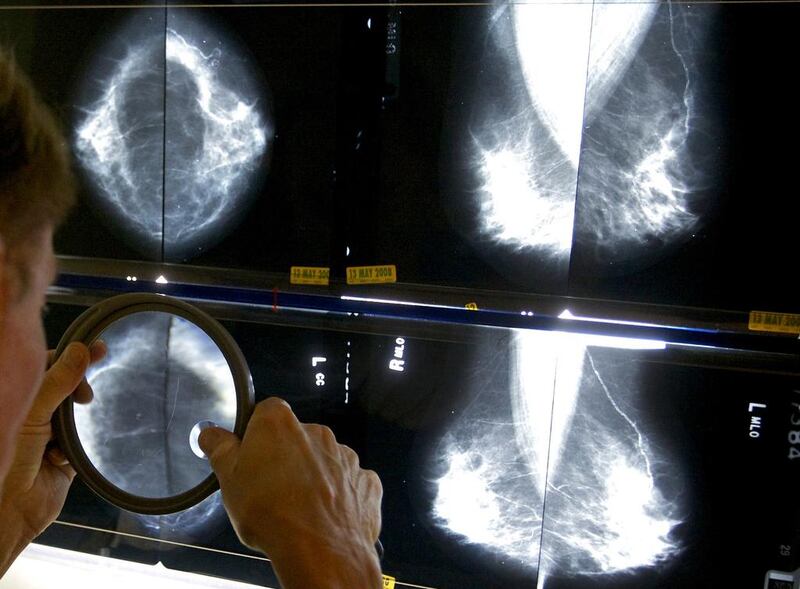

In this context, it is important to note that the cost of cancer treatment is substantially lower if the disease is detected in its early stages. This raises the issue of readily available free screenings for breast cancer and other common conditions. These could, perhaps, be subsidised by insurers because early detection works in their favour. Health authorities could also step up existing awareness campaigns to help people identify symptoms and risk factors for breast and prostate cancer and other common illnesses. Regular health checks should be a part of everybody’s routine.

Another way to address the issue could be to introduce top-up insurance plans for those people who want greater coverage beyond the existing threshold. These could be bought separately from the existing policy either by the employee or by employers as a benefit. In other countries, these policies have enabled many patients to bridge the gap between standard insurance benefits and the actual cost of treatment. Sadly, the incidence of cancer and other life-threatening illnesses remains high. Creative ways to fill the insurance gap are needed more than ever.