My elusive search for a property continues, but with a slightly altered strategy. OK, so it's a major shift in strategy. But putting it into action is another thing, simply because I'm not sure if I'm brave enough to take the leap.

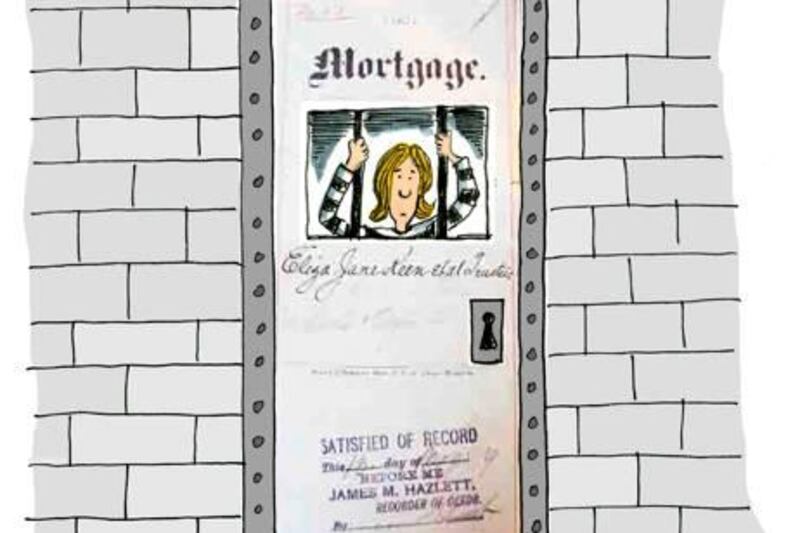

That leap equates to something I've been avoiding for the better part of my adult life; what I've always thought of as a noose around my neck. And no, it's not marriage. It's more frightening than that. It's called a mortgage. And you have to be nice about it because your partner - aka a bank - is much tougher and more powerful than your spouse.

It can take your home away if you fail to make a payment or two if, for instance, you lose your job. And when I think about this, I am reminded of the subprime crisis in the US, one of the earliest signs that not all was right with the economy and the world was about to tip into a recession. US lenders, which were responsible for the subprime debacle, were given a very generous bailout package by the Bush government (which I've written about ad nauseum) on the proviso that they pull back on their relentless quest to repossess homes. Of course, that didn't happen. The bankers continued to reward themselves with six-figure bonuses as they continued to make millions homeless.

So it is hardly surprising that I don't have anything positive to say about mortgages.

Growing up in Australia, it was ingrained into us that owning our own home, what we called the "quarter-acre block" back then, was the be all and end all - and a place to put that other rite of passage, your first barbecue.

Thanks to my mortgage-averse personality, I was a bit of a disappointment when it came to the great Australian dream of owning property. And I've never looked back. Until now.

A recent trip to London, where "For Sale" signs are everywhere, got me thinking. Then there was the peer pressure from family and friends, who all seem to think that going into debt for the next 25 or so years is the best thing for me and my personal finances, not to mention finally giving me a leg up on the property ladder, one step that I've been very happy to avoid for as long as I can remember.

But my family and friends do have a fairly convincing argument. "You can't go wrong with property in London," they say. "As long as you stick to London."

The property agents I spoke to back them up. "If you buy to let, you can be guaranteed that your mortgage will be covered and we've got a waiting list as long as your arm for all kinds of rental properties," they say.

But they failed to mention that banks are a little leery of London's booming buy-to-rent property market, which tanked a couple of years ago when rental prices fell.

In response to this, banks are asking for a heftier deposit - about 25 per cent - if you are buying to let. I'm OK with that aspect of it. What worries me is that the buy-to-let market has tanked before.

Everybody knows that what goes up must come down. And any prolonged property bubble is always something to be wary of. After all, nobody wants to be faced with negative equity, a situation that arises when property prices plummet and your loan is actually worth more than your home. And you can also say goodbye to a decent rental yield if that happens, leaving you to prop up your mortgage payments, which one of my friends is experiencing now.

It's no wonder I get palpitations just thinking about it. The mortgage, that is. All 25 or so years of it.

It took me a long time to come to terms with the fact that I'm ready for the responsibility of buying a property and the commitment that comes with it. Property is a whole new realm for me, more so with a mortgage. And then there's the whining renters you have to deal with. I know they are out there because I'm still one of them.

If I stick with my original plan, I can buy one property for cash and invest the rest. But if I follow my head and not my heart, I can ditch the investment idea and have a decent deposit for a property in London, as well as have my cash buy in Scandinavia. But I'd have to get a good rental return to cover said mortgage. And what if nobody wants to rent it? Then I'd be paying rent here and a mortgage there, not to mention funding the DIY project I've been planning for my so far elusive home in Sweden.

I'm feeling like a deer in headlights. I can't move, let alone make the phone call to an expat mortgage broker and get things moving before I'm priced out of an already expensive market.

It's tempting to take the easy way out and not do anything. But as the saying goes, you've got to spend money to make money. Even if it is the bank's.