When it comes to emerging markets for luxury car brands, China is the one everybody talks about because, despite a recent slowing of sales growth, its place at the head of the table is beyond question. The population is huge and there's money being spent - lots of it. But there's another player, closer to home, that ranks highly with manufacturers of premium automobiles: India.

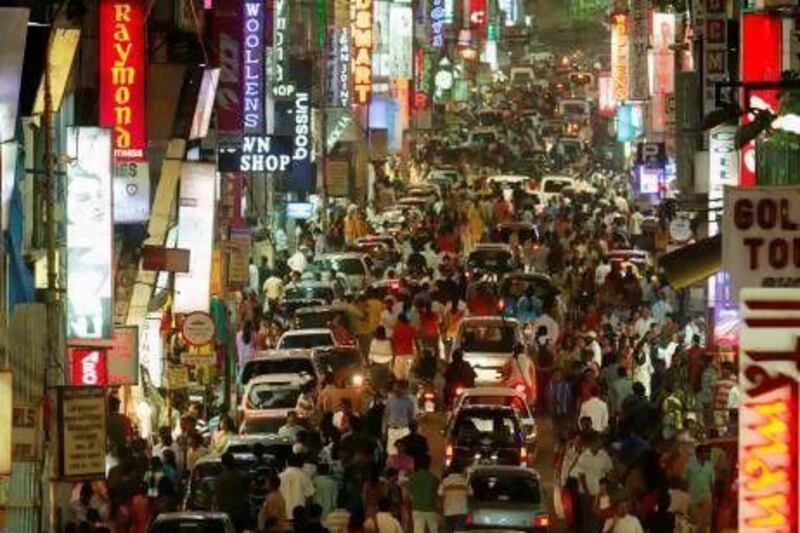

If your idea of motorised transport in India is nothing more than antiquated trucks, Hindustan Ambassador taxis or the ubiquitous tuk-tuks that tear around the crowded streets of New Delhi, it's time for a reappraisal. Because the world's second most populous country is also one of its fastest growing economies, and its purchasing power is threatening to overtake that of the USA. So, naturally, the makers of the world's most prestigious cars have taken heed and are busy expanding into a country that, not long ago, would not have been on their radars.

Mark Kenworthy is the MENA region and India's manager at Aston Martin and he's keen to report that New Delhi is now home to a new dealership. "Aston Martin opened its first in Mumbai last year," he says, "and this new facility is the culmination of 18 months' hard work. It's a sign of our company's faith in this market that so much investment has been made, both by us and our partner [Select Cars], and we're very proud of what's been achieved."

Located in the Mohan Co-Operative industrial area, the new showroom is immediately identifiable as being Aston Martin, with its gorgeous yellowy marble floors and walls, its glass enclosure where customers are greeted by paint samples and leather swatches and, of course, the cars themselves. There's room for four in the showroom and there's a full workshop facility on the premises, too.

"There's a great deal of connectivity between India and the United Kingdom," says Kenworthy. "Indians who have spent time in the UK, many of them extremely wealthy, have been exposed to the brand and many have bought into the ownership experience. Some of them, when returning to their home country, have taken their Aston Martins with them, but previously there were no official back-up facilities for parts, servicing or repairs. Now that's all changed."

Yadur Kapur is the executive director for Select Cars and seems equally happy with the way things are going. "Our customers yearn for supreme exclusivity," he says, "and we are sure this iconic brand will provide the Indian audience with an unparalleled driving experience." Kapur's business also represents Rolls-Royce and its sister company (Deutsche Motoren) imports BMW, Mini and Honda vehicles into India via 16 dealerships, with a further two to open before the year is out.

However, The Times of India reported, just a few days ago, that new car sales are experiencing their slowest growth in the past 10 months (up 3.4 per cent in April). This is down to higher interest rates, steep petrol prices and an overall economic slowdown. "Uncertainty in fuel prices, hikes in excise duty and hikes in local taxes in some states continue to put a lot of pressure on the automobile market," The Times quoted GM's Indian vice president as saying.

This is not to say that India's current state of flux will cause car companies too many sleepless nights. Sales are expected to rebound this year as a result of government policy changes, and anyway, this market didn't figure on the luxury brands' balance and forecast sheets until recently so any sales at all will make a positive difference.

Financial news service Bloomberg stated last October that Lamborghini was about to open its second dealership and Ferrari was planning to open no fewer than five by the end of this year. It also reported that the number of millionaires in India is projected to double by 2015 - all this in a country where it's estimated that 75 per cent of people live on less than Dh7 a day.

The gap between the rich and the poor is startling and the slowing down of demand for normal cars is reckoned to be down to the fact that they're usually bought using bank loans, which are getting harder to arrange. The exploding wealth at the top of the pyramid is seemingly immune to this and, because these clients don't need to rely on financial assistance, the luxury and supercar manufacturers are having something of a field day. Who'd have thought?