SW1 is London's most expensive postcode, exclusive research for The National conducted by property brokers Savills has found.

London's prime market is also proving resilient to the pandemic. Sales in the first four months of 2021 were 65 per cent higher than at the same stage in 2019.

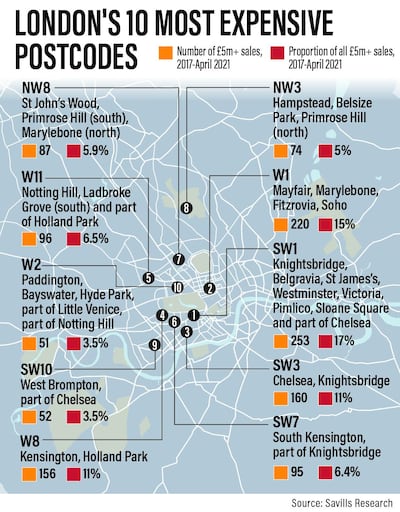

SW1’s position at the pinnacle of the postcode top 10 is of little surprise. Encompassing a sweep of Knightsbridge, Belgravia, Victoria, Sloane Square and Westminster, it forms the bedrock of central London’s prime market.

The prestigious postcode had 253 £5 million-plus ($7m) property sales take place between January 2017 and April 2021, representing 17 per cent of all prime transactions in London during this period.

London’s 10 most expensive postcodes

The list was compiled by Savills for The National. It is based on the number of £5m-plus property transactions that took place in London between January 2017 and April 2021.

1. SW1 (Knightsbridge, Belgravia, St James's, Westminster, Victoria, Pimlico, Sloane Square and part of Chelsea)

2. W1 (Mayfair, Marylebone, Fitzrovia, Soho)

3. SW3 (Chelsea, Knightsbridge)

4. W8 (Kensington, Holland Park)

5. W11 (Notting Hill, Ladbroke Grove (south) and part of Holland Park)

6. SW7 (South Kensington, part of Knightsbridge)

7. NW8 (St John's Wood, Primrose Hill (south), Marylebone (north))

8. NW3 (Hampstead, Belsize Park, Primrose Hill (north)

9. SW10 (West Brompton, part of Chelsea)

10. W2 (Paddington, Bayswater, Hyde Park, part of Little Venice, part of Notting Hill)

Pushing SW1 close were W1, SW3 and W8, which span an illustrious swathe including Mayfair, Chelsea, Soho and Kensington.

SW1's presence at the top of the chart may be immutable but Savills's research highlighted several newer trends, with London's prime market subject to centrifugal forces driven by the new space race – a clamour for bigger properties with gardens.

Leading the way is W11 (Notting Hill, Ladbroke Grove), which had a 1.3 per cent increase in property price points across London's prime market in the first quarter of 2021, compared to an average of 0.4 per cent.

“If you think back to 25 to 30 years ago, places like Notting Hill weren’t even considered to be prime,” said Frances Clacy, Savills residential research associate director.

“It was considered to be an up-and-coming area but now it is extremely prestigious.”

The W8 and W11 postcodes don’t merely represent a geographical expansion of London’s prime market, they also illustrate the increasing power of the domestic buyers who have fuelled their heady rise.

With a greater selection of housing stock than more traditional prime areas, and featuring the green expanse of Holland Park, W8's and W11's booming popularity is unsurprising.

Even back in London's prime heartlands, Clacy has noticed a move towards houses with "access to either a private or communal garden".

Areas that didn't quite make it into the top 10, such as leafy Barnes and Putney on the banks of the River Thames in south-west London, have also had significant levels of £5m-plus property transactions in recent years, again mainly driven by house sales.

Pent-up London property demand from international buyers

Apartments are still a draw, however. In SW1, the bulk of transactions are still flats and for international buyers, the apartment remains king.

Jonathan Hewlett, head of London residential at Savills, is convinced the city has lost none of its cachet for overseas buyers.

"We need to see London like any city around the world back up to full speed," he told The National.

“With all the theatres open again, the restaurants, and everything working properly and fully ... I have a feeling London’s supposed decline will be a distant memory.

"It's got so much to offer, international buyers will all tell you how much it's got."

Hewlett said Covid-19 travel restrictions in 2020 had created huge pent-up demand, with Middle Eastern buyers showing plenty of interest in SW1 in particular.

With many international buyers in absentia last year, domestic buyers filled the void, propelling more £5m-plus sales in 2020 than in 2019.

The trend was abetted by favourable prime property values. They started to creep back up in 2019 but even now lie about 20 per cent below 2014 levels.

An expanding prime sector, good value properties, and the return of international buyers – the rest of 2021 looks most auspicious for prime London.