What a difference a week makes. Equity markets are responding positively to good news on several fronts.

Firstly, the US created more jobs in January than anyone had expected, bringing the unemployment rate down to a three-year low of 8.3 per cent. With 243,000 new jobs created, this was the best monthly performance since last spring.

On the other side of the Atlantic, Europe seems to be making progress in convincing the world that it is serious about solving its debt problems. The European Central Bank's offer to let banks borrow from it on generous terms through its long-term refinancing operation was introduced late last year, but its significance in stimulating economic recovery is only just being realised.

As a result, investors are now less worried about loan defaults and are more inclined to buy European government bonds. This pushes up the price of the bonds and, as a consequence, pushes the yields down.

Had you bought bonds issued by Spain and Italy when concern about their default was at its highest two months ago, you would now be sitting on a 20 per cent capital gain. Greece and Portugal are still of concern but, in general, the good news in the US and the rest of Europe is outpointing the bad news in these two countries.

This net flow of encouraging news on both sides of the pond is doing wonders for stock markets. The S&P 500, an index that represents stock values for the top 500 companies in the US, was recently up by 25 per cent compared with its lowest value in October last year.

This completed five successive weeks of growth. More impressively, the Nasdaq index, which is heavily weighted towards technology stocks, surged to its highest level since its peak during the dotcom boom 11 years ago.

European stock markets responded in much the same way, with gains of 3 per cent to 4 per cent over the week and leading to multi-month peaks.

What does all this mean for your investment portfolios? Well, first of all, if you kept your nerve, did not panic and held on to your equities or equity funds, you should congratulate yourself. If you bought more on the price dips, then you should be doubly pleased with yourself.

I was advising clients to do just this throughout 2011.Not because I had any special understanding of the debt and equity markets, but simply in the knowledge that, in the fullness of time, capitalism will do what it is designed to do - reward the risk takers and pay profits to shareholders.

You just need to hang in there and have faith in the long-term behaviour of risk-based assets, such as equities.

The key phrase in the last sentence is "long term". If you do not have a long-term objective, then you should not be highly exposed to volatile assets. Instead, you should reduce risk by giving more weight in your portfolio to less volatile assets such as bonds, fixed-interest products and cash.

If this sounds a bit mundane, then you might limit your downside risk by other means. Hedge funds can be used to reduce risk in a portfolio, but over the past three years, following the credit crunch, few of them have been performing as well as they did in the first half of the current decade.

Another option is to include structured notes in your portfolio. These allow you to participate in the growth of individual stocks or stock indices, but require you to sacrifice some of your growth for a degree of protection on the downside risk.

Of particular interest is an autocall note currently on offer from Maze Capital Solutions. The return you get from this note is dependent on the performance of four stocks: Exxon Mobil, Costco Wholesale, Tesco and IBM.

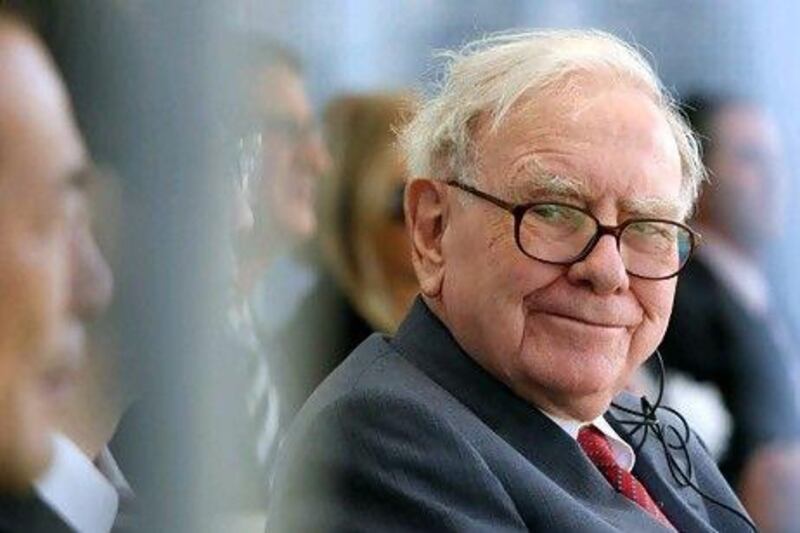

The common link between these companies is that they all feature strongly in the investment portfolios managed by Warren Buffett, often referred to as the world's most successful investor.

Your money is invested, potentially, for a period of five years. During this time, the price of these stocks is observed quarterly on 19 different occasions. If, on the first observation point, all four of the stocks have risen above their initial "strike" price, then you will receive a payout of 3.25 per cent with full return of your capital. If any of the stocks fall below their strike price, then no payment is made and the investment rolls forward for another three months.

At the second observation point (after two quarters), the same test is applied: if all four stocks are above their strike price, then you will get two payments at 3.25 per cent plus return of your capital. If any of them is below their strike price, then the investment rolls forward for another quarter, at which point the investor could potentially earn three lots of 3.25 per cent plus return of his capital.

This is a good investment if you believe all of these stocks will rise above their strike price in the next five years and will do so together at one of the observation dates. It is a bad investment if you require your capital in less than five years, or if one of the stocks becomes almost worthless. It is also a bad investment if Royal Bank of Canada, the bank that is underwriting the financial instruments that support this investment, goes into liquidation. This is unlikely to happen, but as Lehman Brothers proved, it is not totally improbable.

Bill Davey is a wealth manager at Mondial-Financial Partners in Dubai. Contact him at bill.davey@mondialdubai.com