For the 23-year-old student who already has a couple of companies under his belt, Startup Weekend Fintech Abu Dhabi seemed the perfect opportunity for Hashim Alzaabi to hone his business skills.

There was just one problem: his, and his team members, had their finals less than a week after the event, so the 54-hour entrepreneurship hackathon – the challenge to take an idea from zero to a minimum viable product over a weekend – did not exactly come at the most opportune time.

“We decided to do it,” says the Emirati from Sharjah.

And his team – called Sahim – was pretty glad it did because it went on to win. The students created a platform for investors to buy and sell Sharia compliant stocks from around the world. It was selected as the best idea among the 10 teams to pitch financial technology (fintech) solutions.

The fintech event, held earlier this month, was organised by GlassQube and Startup Weekend, a global movement coordinated by TechStars and supported by Google for Entrepreneurs, with the support of Abu Dhabi Global Market, Abu Dhabi’s financial free zone and financial regulator, and Temenos, a global financial software vendor. It brought together more than 100 developers, designers and aspiring entrepreneurs – many of are at university and some still at school – and challenged them to build a functional minimum viable product.

“We took those products and judged them based on their technical aspects, their commercial viability, how thoughtful those teams were about what is the actual potential of these products and services to find a market,” says Bernard Lee, GlassQube’s chief executive and a co-founder.

“What’s important here is that it’s not just an idea. It is how do we take this idea and how do we actually convert it into something that is real? Something that shows how a consumer base can potentially interact with this particular application.” Mr Alzaabi heard about the event through the Sharjah Entrepreneurship Centre (Sheraa), based at the American University of Sharjah, where he is a student.

“I announced a small talk about fintech: what it is; what are the emerging trends; what are examples of fintech start-up companies,” says Ahmed Agour, the programme coordinator at Sheraa.

Almost 30 attended the talk and 15 signed up to take part. By the time the event came around, the number was down to eight, five of whom joined together as Sahim.

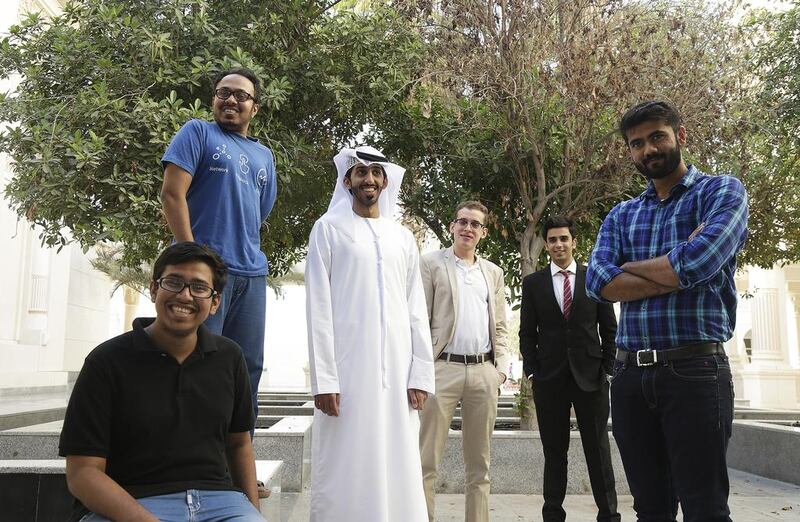

Mr Alzaabi and the rest of the team, Abdulla Alhajkhalil, 22, an American-Jordanian; Vinay Naresh, 22, from India; Mohamed Rashid, 23, from India; and Saif Rehman, 22 and Wasi Rehman, 16, both from Pakistan, came to the event knowing what they wanted to build. Mr Alhajkhalil had devised the idea as part of an earlier university project. “It wasn’t just a matter of an idea – we had the implementation already. That gave us the edge over our competitors,” says Mr Alzaabi, who started two companies this year while studying economics and management information systems. One company, Aebiss, creates websites, applications, IT systems and internet of things systems. The other, Tayar, sells home automation systems.

“We have the finance background. We have the management and some of the general regulations of what was happening in the market and this industry specifically. And then we had the programmers who were able to create a real-life demo within two days. It was tense. It was a little bit tight but, Alhamdulillah, we were able to do it,” says Mr Alzaabi.

The prize included Dh18,000 cash and 24 hours of mentoring from experts from a range of disciplines, including law.

Second place went to InOneKey, an idea for an integrated platform for managing a person’s entire portfolio of cards that can be used on any system, such as a computer, mobile or even at ATMs. It was devised by Ralph Vreman, a 14-year-old Brighton College pupil in Abu Dhabi to improve customer convenience and prevent fraud.

Third place went to “AR. Go”, a team who came up with an integrated purchasing and payment solution that uses augmented reality and blockchain to scan items, add them to a cart, scan payment card details, encrypt and checkout, all in augmented reality.

“A hackathon is a really exciting but cruel way of refining the ideas,” says Jennifer Warren, a managing partner and co-founder at Pure Private Equity, who mentored the teams over the weekend. She plans to invest or take at least three of the ideas to fintech and tech investors, although she will not say which ones she is interested in.

“If they were in a normal environment these ideas would probably take months to flesh out. With a start-up weekend you also can scout the right talent and team members,” she says. “You can see how well people work together. How innovative they are. How resourceful they can be with market research. And what comes out in the end is an indicator of something that might have potential.”

business@thenational.ae

Follow The National's Business section on Twitter