The resurgence of Covid-19 infections threatens to derail India’s economic recovery, which prompted the country’s central bank to intervene last week after industry leaders mounted pressure on government to introduce a nationwide lockdown.

There is a sense of urgency in Asia’s third-largest economy to save lives and livelihoods but it remains to be seen if the government and central bank measures will be enough.

“If the second wave persists for longer or if we get hit by an equally intense third wave, then sectors and economic activity can get more affected and that, in turn, could necessitate more supportive policies,” says Anubhuti Sahay, head of South Asia economics research at Standard Chartered.

On Saturday, India reported 401,078 new daily Covid-19 infections and a record number of fatalities, topping 4,000 in the past 24 hours, according to its health ministry.

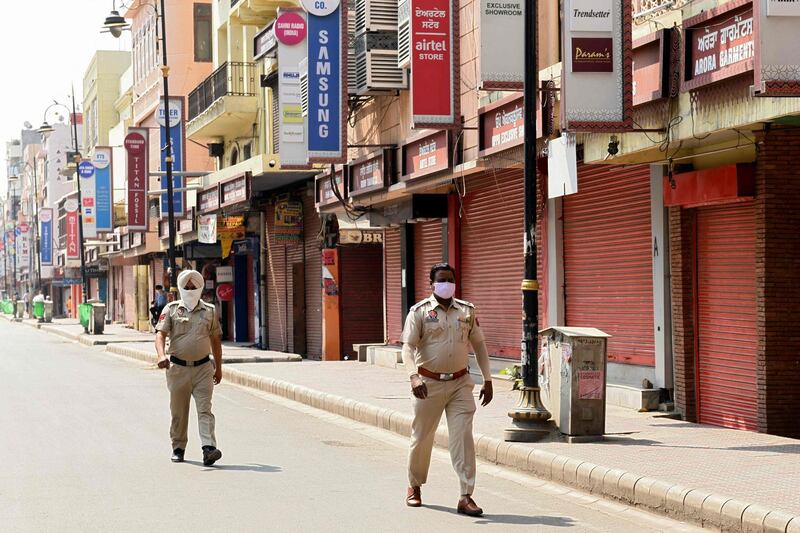

The massive second wave of the coronavirus has pushed the country's healthcare system to the breaking point and has forced many state governments, including Maharashtra – home to the financial capital, Mumbai – to impose local lockdowns, temporarily curtailing business activity.

Despite mounting pressure from health experts and worsening Covid-19 crisis, Prime Minister Narendra Modi's government has refrained from introducing another nationwide lockdown, citing concerns about its economic impact.

Last year's restrictions – among the strictest in the world – pushed the country into a rare recession. India, however, emerged from the slump, with its gross domestic product growth edging up by 0.4 per cent in the last quarter of the calendar year. The country’s economy was projected to grow 12.5 per cent this year before tapering to 6.9 per cent in 2022, according to the International Monetary Fund.

On Wednesday, the Reserve Bank of India (RBI) announced a number of steps, including loan relief measures for small businesses and 500 billion rupees ($6.82bn) of liquidity for banks to lend to healthcare companies including vaccine makers and hospitals to further support the economy.

“We believe the RBI has announced effective measures which will provide relief to the most affected borrowers after the resurgence in Covid-19 cases and the announcement of a lockdown in several states,” says Nitin Aggarwal, a research analyst at Mumbai-based Motilal Oswal Institutional Equities.

Economists say the impact of another lockdown will not be as severe as last year.

“The second wave is far more intense than the first wave,” Ms Sahay says. “However, the impact on the economy has been muted until now relative to the national lockdown of early 2020.”

Better global growth and the government's expansionary fiscal budget are factors that are staving off a deeper negative effect on the economy and the RBI's announcements “complement existing measures”, which includes lower interest rates.

Standard Chartered is still projecting India to post double digit economic growth, but the bank has lowered its forecast from 11.5 per cent to 10.2 per cent for the current financial year until the end of March. This growth also comes off the back of a low base, Ms Sahay says.

Several other financial institutions have also slashed their forecasts for India’s GDP growth, while the International Monetary Fund said it will revise the outlook for the world’s second most populous nation by July.

S&P Global Ratings says the second wave “may derail a strong recovery in the economy and credit conditions”.

In a moderate case scenario, India's GDP will grow at 9.8 per cent in the current fiscal year, down from its earlier projection of 11 per cent, according to S&P. In its severe case scenario, the rating agency forecasts that the economy could be hit by 2.8 percentage points on its earlier forecast, with growth of 8.2 per cent.

The possibility of further local lockdown restrictions “may thwart what was looking like a robust rebound in corporate profits, liquidity, funding access, government revenues and banking system profitability”, according to S&P.

During the second wave, officials are also showing a preference for support measures from the central bank rather than additional fiscal spending from the government, the agency said. But should the second wave persist, “the government and the central bank will likely extend support to borrowers, albeit with much reduced fiscal capacity than during wave one”.

The steps taken by the RBI “towards restructuring of loans of small borrowers and MSMEs are timely and prudent”, Kiran Chonkar, a partner who heads the resolution advisory practice at BDO India, a network of accounting and tax firms, says.

“However, the pandemic has affected [the ] industry across segments,” he says. “A roll-out of broader relief measures applicable to mid-corporate and large borrowers and towards sectors heavily impacted by the pandemic such as hospitality would have been welcomed.”

Consumer spending, the main driver of India's economy, is also the hardest hit by the pandemic.

Amuleek Bijral, the co-founder and chief executive of Chai Point, a large chain of cafes in India, said that before the second wave, “we started seeing green shoots appear in the overall recovery of the food and beverage sector [and] by January, we noticed walk-ins gradually rising as more stores opened”.

But “as Covid gripped us again, the store business took a hit as we had to shut down a few as per [state] government restrictions”, Mr Bijral says, explaining that a recovery has been pushed back by about three months now.

Many retailers that were just starting to get back on their feet have been forced to shutter stores once again to comply with local lockdowns.

“It [the second wave] has slowed down the recovery witnessed at the beginning of 2021,” says Harkirat Singh, the managing director of Aero Club, which owns the Indian footwear brand Woodland.

Although the economic impact of the second wave is “quite unpredictable, he remains hopeful that the impact will be transitory “and the sales will revive once the crisis subsides”, pointing out that the sector has already demonstrated resilience.

“The Indian retail sector staged a decent comeback after the lockdown in 2020 and witnessed a 50 to 60 per cent revival in sales with the beginning of the festive season in October to November 2020,” Mr Singh says.

How deep a scar the second wave will leave on the economy is dependent on its duration, and India’s vaccination drive – which is considered to be key to controlling the pandemic – also has a role to play in the economy’s heading, economists say.

So far, the pace of inoculation has been slower than expected as the country runs low on doses, despite being the world's largest manufacturer of vaccines. The vaccination drive is set to pick up pace over the coming months, according to the government.

For now though, Tanvee Jain, the chief India economist at UBS Securities, says “we expect [economic] activity levels to sequentially weaken further in May as most states extend mobility restrictions to flatten the curve”.

If the second wave “flattens out by, say, June and there is no third wave, economic activity should pick up in the second half of the financial year”, Ms Sahay says.

But given the uncertainty and depth of the Covid-19 crisis, many experts believe that India's central bank and the government will be forced to take more action to mitigate the effects on the economy.

“We believe these measures are first in the series of the relief measures to be announced by the RBI and more should come from the RBI and government as the situation evolves,” a research note by analysts at Mumbai-based Emkay Global Financial Services said.