US President Donald Trump’s administration struck a deal with the Senate Democrats and Republicans for a US$2 trillion (Dh7.34tn) stimulus package, the largest in the country's history, to soften the impact of the coronavirus and shore up the economy.

Senate majority leader Mitch McConnell and Senate minority leader Chuck Schumer said the legislation will be passed later on Wednesday.

"This is not a moment of celebration but one of necessity," Mr Schumer said.

News of a breakthrough after days of stalled talks between Washington policymakers and the approval of a deal, led to a rally in the Asian and the Gulf markets.

Japan’s Nikkei 225 Index climbed more than 8 per cent at 10.35am UAE time on Wednesday. Hong Kong’s Hang Seng Index advanced 3 per cent, while the Shanghai Composite Index gained 2 per cent.

In the GCC, the benchmark Dubai Financial Market General Index climbed 4.2 per cent, the main gauge in Abu Dhabi surged 6.8 per cent, while stocks in Kuwait climbed 2.4 per cent. Oil rebounded with the Brent benchmark gaining 2.5 per cent to $30.50 and WTI up 3.6 per cent to $24.89 per barrel.

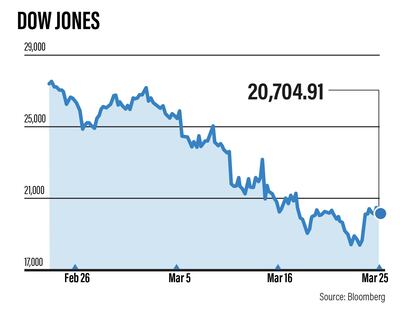

On Tuesday, the Dow Jones Industrial Average surged 11.3 per cent, its biggest daily percentage gain since 1933, after the US Federal Reserve said it is committed to using its "full range of tools to support households" as it announced an unprecedented open-ended asset purchase programme. The broader S&P 500 also advanced 9.4 per cent while the Nasdaq Composite Index gained 8.1 per cent.

Though details about the stimulus and how money will be allocated are not entirely clear, the package does account for a large portion of the population, a range of businesses, direct checks to households, unemployment insurance and tax deferrals.

"Is this package an economic vaccine to the virus? It is too early to tell, but the knee-jerk market reaction is rather cheery," Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, said in a note to investors.

“The million-dollar question is; will this optimism last, and how long?”

The size of the economic package dwarfs the nearly $800 billion stimulus deal in the Barack Obama era that was passed five months after the 2008 financial crash.

"One major issue with these stimuli packages is that they are addictive. The bigger the stimuli, the more investors demand," Ms Ozkardeskaya, said.

The coronavirus outbreak has wiped at least $20tn from markets globally since the peak in January. Global equities have not recorded back-to-back daily gains since the first half of February, but the US equity futures on Wednesday rose, signalling the trend may end. Dow Jones futures rose 2.4 per cent, while those of S&P gained 1 per cent.

Covid-19 has infected more than 425,000 people worldwide and killed about 19,000, according to Johns Hopkins University, which is tracking global data on the outbreak. More than 109,000 people have also recovered. The US has more than 55,000 infections which are still on the rise, about half of the cases are in New York. The World Health Organisation has warned the country could become the next global hot spot of the pandemic.

The agreement in Washington comes a day after US companies reported the steepest downturn since 2009 in March as measures to limit the Covid-19 outbreak hit businesses across the country. The IHS Markit Flash Composite PMI Output Index fell to 40.5 in March, down from 49.6 in February, a second successive contraction in output and the steepest slump recorded since October 2009, from when comparable survey data is available.

"The downturn in demand and gloomier prospects meant jobs were slashed at a pace not witnessed since the global financial crisis in 2009, as firms either closed or ran at reduced capacity amid widespread cost-cutting," Chris Williamson, IHS Markit's chief business economist said.

Similar marked rates of decline were recorded for both service sector and manufacturing payrolls.

IHS' survey "underscores how the US is likely already in a recession that will inevitably deepen further", Mr Williamson said. The March PMI is "roughly indicative of GDP falling at an annualised rate approaching 5 per cent, but the increasing number of virus-fighting lockdowns and closures mean the second quarter will likely see a far steeper rate of decline."

Goldman Sachs forecasts US GDP is set to decline 24 per cent in the second quarter of 2020, but projects a recovery in the second half for the world's biggest economy. JP Morgan forecast a shallower GDP decline of 14 per cent in the second quarter, but also a shallower recovery.

It remains to be seen if traders have "already priced in this aid package in terms of equity markets price action" said Avatrade's chief market analyst's Naeem Aslam.

Traders, he said, are unsure if the current rebound is temporary or the equity markets have finally found a bottom.

"If the equity markets have put a bottom then investors have the opportunity of the decade on their doorsteps because major indices ... are still down over 25 per cent from their all-time high."