As government after government around the world dig into their coffers to bail out failing banks and companies, it is sentiment that is now leading markets and not the other way around. Whether in developed economies or in the Gulf, it no longer seems that pure economics and government-intervention mechanisms, however rational, might be sufficient to induce the "green shoots" of confidence and market revival. Complex market blowouts and recessions are no longer to be entirely solved using mathematical modelling and pseudo-scientific assumptions.

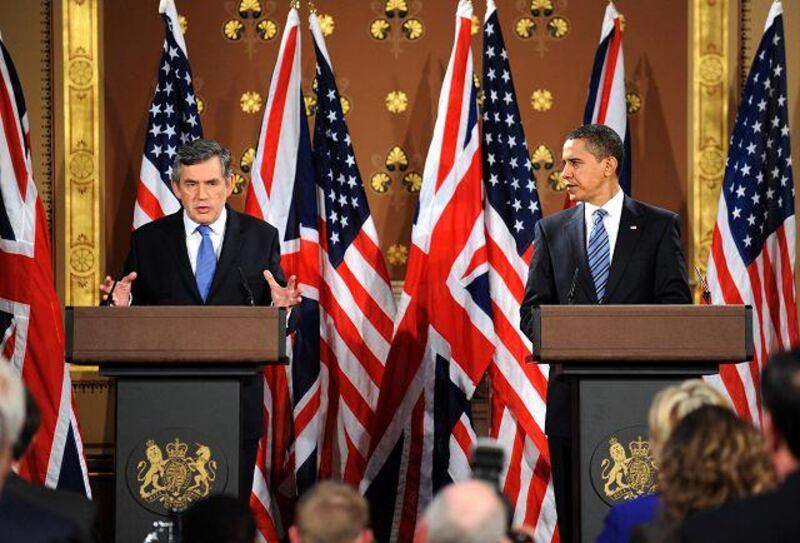

The reason is simple. For such modelling to be applicable, standard economic analysis has to assume that economic agents - investors and consumers - act perfectly rationally. Under such scenarios, optimum predictive equilibrium-based outcomes and models can be derived. But life is not so simple. If real life followed the route map set out by economic theory, why is there no rush to borrow when rates are at near zero? And why are depositors, savaged by low returns on bank deposits, not returning to the real economy and buying depressed assets? In the climate of fear now gripping the world, share prices will be marked down and consumption expenditures postponed. Rallies can be short-lived if confidence retreats, and when that happens market gains are shed with a vengeance. The world's ailing stock markets, and the savage losses in Gulf bourses, testify to this. People need more assurances. The Gulf is experiencing another rally due to the "feel good factor" following the meeting of the leaders of the Group of 20 leading and developing nations in London and the sheer size of the US$1.1 trillion (Dh4.04tn) package related to IMF programmes. If the promised funding does not materialise quickly, then despondency and selling will return.

Two years ago, now seemingly an eternity back, the climate was one of greed and unbounded optimism that everything can only go up, whether that meant stock and commodity prices or skyscraper heights. Because the future is inherently uncertain now, emotion and sentiment will drive all manner of behaviour. This is what frustrates policy makers around the world. People cannot be put into a controlled setting and be obliged to act in a certain way. Under such conditions, the extent of the downturn cannot be predicted, as it is like trying to put out a raging bushfire which takes on new life and direction from small sparks.

The capitalist, free-enterprise "animal spirit" is depressed and lying low. The animal spirit can be partly rekindled if a dose of "infectious greed" sets in, but this time around it will be with the excesses restrained through greater oversight by regulators and some old-fashioned human decency and self-control. More than that, economics would do well to be bounded by something else. Possibly the emergence of faith-based ethical economics. One might hope to see fear of damnation in the afterlife create a check on greed. Many ex-politicians in the West are rediscovering faith and setting up "faith foundations" after leaving office.

It might not be too long before we begin to hear of ex-financiers doing the same. Who knows, there might even be a "Madoff faith foundation" to atone for the misuse of $60 billion of investor funds by Bernard Madoff, the US fraudster. Such ethical transformations of the financial elites would be welcomed by market regulators and make their life easier. Unfortunately, some sections of the global business class are beyond eternal damnation. Ego and lust for wealth and power are still human failings.

Nevertheless, leaders around the world who are more in tune with popular feelings, resentments, bewilderment and anger are now stressing the importance of the ethics and politics of the whole community, which can be formulated for the market as well. Thus, a restatement of values is taking place and it behoves regulators, financiers and businessmen to take note. To revive market confidence, you cannot take people for granted. This is, of course, assuming we have learnt our lesson from recent painful episodes, and have not lapsed back into amnesia and another cycle of greed.

Dr Mohamed A Ramady, a former banker, is a visiting associate professor at the department of finance and economics at King Fahd University of Petroleum and Minerals in Dhahran, Saudi Arabia