I have long been interested in the relationship between the brain and the rest of the body, specifically how the lump of grey matter actually works, what it's capable of, and how it can evolve, guide and influence us.

Now most of us know that what we do and how we think or feel are closely linked - and a big emphasis is usually put on dealing with emotional triggers when we want to address, say, kicking a habit.

Fine-tuning or improving self-control is a multibillion dollar business - whether it's losing weight, quitting smoking, getting financially fit, or stopping biting your nails. And as we know, we can have the best intentions in the world, but when it comes to making them a reality, a struggle can ensue.

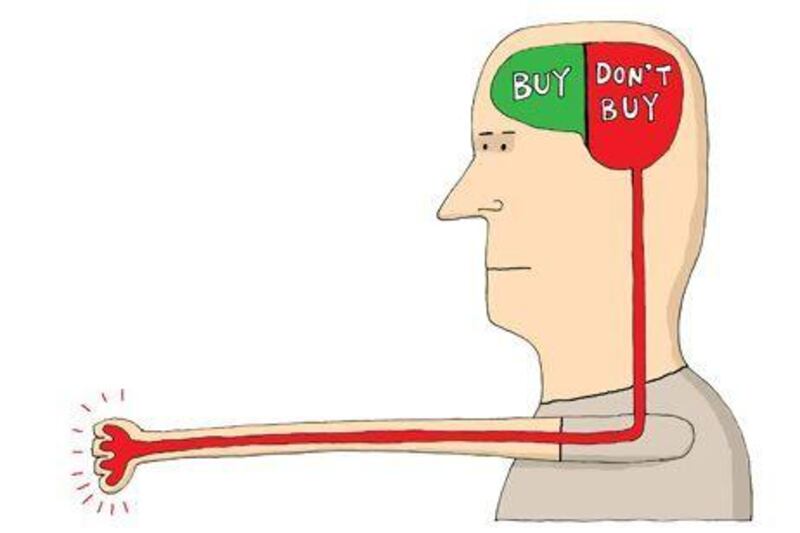

It turns out that, yes, the brain can help, but research has shown that we need to move beyond the idea that actions are the consequence of mental activities, and take on board that the body might significantly influence the mind.

So what can we do to create the right conditions for the brain to enable us to exercise more willpower. One key, it seems, is to use the body to influence the mind. Start with the physical - and follow through with the mental, and then translate that to the physical once more.

Why am I focusing on this?

Two reasons. The first is for us to raise awareness that simple physical actions can influence how we think and what we feel, and that this can also be used to address money matters.

The second is that self-control has been shown to indicate how well we'll do in our lives - and how we deal with our finances will be a major part of this. So who wouldn't want to find out more?

The first thing to understand is that self-control starts early.

If you don't know of the marshmallow experiment with children, look it up. It's become a classic experimental measure of children's self-control. In a nutshell, children aged four to six were presented with a mouthwatering marshmallow and told that if they didn't eat it and waited until the person came back 15 minutes later, they'd be given an extra one.

The children who exercised delayed gratification and waited not only got the extra sugary reward, they also went on to have more successful lives. The researchers tracked them for decades.

Unfortunately, I'll never know if I'd have gobbled up the treat or not … but I know how important longterm goals are, and how difficult delayed gratification can be.

Research by Iris Hung and Aparna Labroo, in a paper titled "From firm muscles to firm willpower" suggests that: "merely simulating many of the bodily actions that result from or accompany thought processes can also facilitate accessibility to those very thoughts".

If you tense up your abdominal muscles before you lift a weight, which would happen as a result of you lifting the weight anyway, you're prepping yourself to lift the weight. If you are going to (knowingly) dip your hand in a bucket of ice-cold water, you will cope better if you deliberately tense your hand muscles before you do so.

But how can we use this to help us with our financial goals? Especially when it would appear that it's our brain that is telling us to spend, want and buy in the first place. So how can we make this brain vs action? work for us, rather than against our financial well-being?

Attaining financial freedom, saving money, planning for the future, getting out of debt and getting a grip on our outgoings all involve self-control. And there's usually a dilemma: immediate pleasure or long-term benefits? And so, firming our willpower will help us through these opposing pulls.

It's not as simple as merely firming up and clenching muscles. You need to really believe in why you should be changing your habits and behave differently. Anything that can help us gain more control over our behaviour is surely a good thing.

So try this: figure out a financial goal - this could be paying off your credit card debt, saving for a deposit on a house, or starting your pension policy - then create the icy resolve to make it happen and not give in to temptation and spend the money that you need to save, by writing down that goal.

The next time you feel you might give into the temptation of spending on something you like, but definitely do not need, clench your fists, scrunch up various muscles, think of what you're saving for, and walk away - happy. Gives a whole new meaning to being tightfisted.

Nima Abu Wardeh is the founder of the personal finance website www.cashy.me. You can contact her at nima@cashy.me

Using willpower to best the marshmallow test

On the money: I have long been interested in the relationship between the brain and the rest of the body.

Editor's picks

More from the national