Nuclear companies of all sizes are competing for a piece of the UAE's atomic energy programme after losing the main contract to a Korean group in December. Representatives from more than 40 US companies are in Abu Dhabi this week to gauge business opportunities in what is expected to be the first of a number of visits from established nuclear suppliers.

US companies are hoping to play a role as subcontractors to the Korean consortium, led by Korea Electric Power Corporation (KEPCO), said Danny Sebright, the president of the US-UAE Business Council. "The relationships here are obviously going to be mostly in the area of being subcontractors, but getting certified and approved on the Korean supply chain would be a big part of what this initial thrust is about," Mr Sebright said. "We see this as a much bigger, broader opportunity in the long run."

US executives will meet with the Emirates Nuclear Energy Corporation (ENEC) and KEPCO, and saw opportunities in providing equipment such as valves and pipes, or offering services such as security for the reactors, he said. KEPCO had the option of sourcing most material and services from its Korean partner companies, but US firms were hoping to compete as subcontractors on the basis of price and quality, Mr Sebright said. "They know this is a long-term proposition, this isn't something that's going to happen tomorrow," he said.

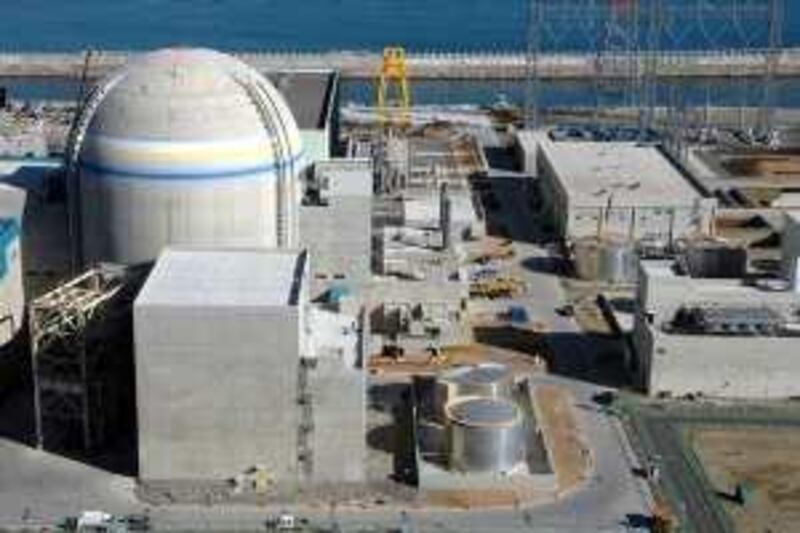

ENEC in December awarded a US$20 billion (Dh73.46bn) contract to KEPCO and its partners to build four nuclear reactors by 2020, over rival bids from French firms and a US-Japanese consortium. The Koreans were expected to build, start up and "help operate" the plants and supply initial uranium fuel, but a number of additional contracts are yet to be announced. Analysts have speculated about large contracts for fuel, operations and security for the plants, noting that the programme last year was widely described as a $40bn opportunity. But ENEC has many years to make these decisions, industry sources say, and is still talking with KEPCO about the structure of joint venture firms that are likely to operate and fuel the plants.

ENEC is "continuing work on the planning, scheduling and resourcing for the project", said Fahad al Qahtani, a spokesman for ENEC. "It is too early at this point to talk definitively about potential upcoming opportunities or contracts." US companies can offer experience in making high-quality components, said Lisa Steward, a senior director at the Nuclear Energy Institute, an industry lobby group based in Washington. "It is great that Korea is offering one-stop shopping, but they may not be able to offer everything," Ms Steward said. "We have valve manufacturers, spent fuel cask manufacturers, uranium producers - they really are the small to medium-sized companies in the supply chain."

US companies also saw opportunities in selling nuclear fuel to the UAE, she said. France, which was once considered the favourite to win the prime contract, still saw a number of opportunities in Abu Dhabi, especially in providing enriched uranium and reprocessing the fuel after it is used, said a French government source who spoke on condition of anonymity. The French company Areva is a particular favourite, the source said.

"Where we are best talking about large contracts is the nuclear fuel cycle, we are one of the world leaders," he said. "Reprocessing, we are the only one; also enrichment, even mines." Areva declined to comment. KEPCO is looking for more opportunities in Abu Dhabi, said Byun Jun-yeon, the company's executive vice president. The Korean consortium is expected to help build any additional reactors beyond the first four and would be willing to play a greater role in operating the plants, Mr Byun said last month in Seoul.

"If the UAE does not have [another] particular or preferred entity for the operations, KEPCO is willing to participate in this process actively," he said. cstanton@thenational.ae