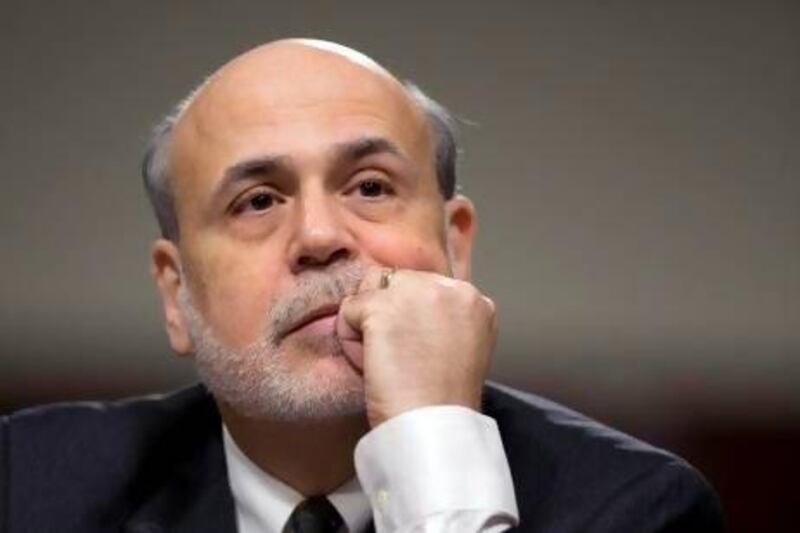

The US Federal Reserve's timetable for reducing its bond purchases is not on a "preset course", said its chairman Ben Bernanke, and the Fed could increase or decrease them based on how the economy performs.

In testimony prepared for delivery at a House financial services committee hearing he said the job market had made some progress since the Fed began buying US$85 billion a month in bonds last September. And he repeated his belief that the Fed could slow that pace later this year if the economy strengthens.

Mr Bernanke cautioned that the Fed wants to see substantial progress in the job market before scaling back the bond purchases.

If conditions worsen, the Fed could maintain its current pace, or even increase it, he said. The bond purchases are intended to keep long-term interest rates low and encourage more borrowing and spending.

The euro pared losses and the dollar gained against the yen in response to the testimony. US equity futures advanced after the comments were reported.

Mr Bernanke also said the central bank was weighing additional measures to strengthen capital standards for the biggest banks, including a leverage ratio.

Capital standards at the biggest US lenders would rise to 5 per cent of assets for parent companies and 6 per cent for their banking units under a July 9 proposal by US officials that goes beyond rules approved by international regulators.

"The Federal Reserve is considering further measures to strengthen the capital positions of large, internationally active banks, including the proposed rule issued last week that would increase the required leverage ratios for such firms," Mr Bernanke said.

Bankers and regulators are tangling over how high capital standards must be to prevent a repeat of the 2008 financial crisis.

The Basel Committee on Banking Supervision set the floor for capital at a flat 3 per cent of assets in 2010, regardless of how risky bankers consider their holdings.

The Fed "will propose capital surcharges on firms that pose the greatest systemic risk and will issue a proposal to implement the Basel III quantitative liquidity requirements as they are phased in over the next few years", Mr Bernanke said.

* Agencies