As the two-day Middle East Shiptech 2013 conference starts on Monday in Dubai, UAE ports are expanding their capacity.

New facilities are being created as the Government invests in new projects, industrial output rises and imports edge up with the economic growth in the country.

The value of projects relating to ports in the Gulf region, which are under execution and those not-yet-awarded is US$30 billion, with $8.6bn alone being in the UAE, according to MEED Projects.

About $23bn of the $30bn are currently under execution, with about $1bn worth of projects being implemented in this country alone, based on MEED Projects data.

The Federal Government has helped the development of ports here as it seeks to create jobs and diversify income away from oil through increasing the country’s importance as a trade hub and creating free zones and industrial zones.

“Ports are vital for the connectivity of an economy and generate direct and ancillary economic activity,” says Giyas Gokkent, the chief economist at the National Bank of Abu Dhabi.

“Ports facilitate growth in other sectors through trade with other regions. Ports create employment.

“The UAE is the regional trading hub by virtue of its ports. The UAE accounted for 50 per cent of GCC imports of $444bn and 33 per cent of GCC exports of $1.06 trillion” last year.

Some of the largest projects are taking place at container ports in the country, which has become a gateway to several shipping lines traversing waters of the Arabian Gulf.

Traffic is picking up at Abu Dhabi’s $7.2bn Khalifa Port, which started operations last year, backed up by the Khalifa Industrial Zone Abu Dhabi (Kizad),

The zone and port, built on a man-made island on the edges of the capital, when complete will be two-thirds the size of Singapore. The modern port replaces the 40-year-old Mina Zayed located within the city surrounds that was getting congested with its 1 million twenty-foot equivalent units (TEUs) capacity.

Khalifa Port fully intends to become a global mega port. It and the Kizad zone are forecast to create more than 100,000 jobs and contribute 15 per cent of Abu Dhabi’s non-oil GDP by 2030, when capacity is expected to reach 15 million TEUs, which equals the current capacity of Jebel Ali port.

“There will be some element of overlap, but this has not stopped success in other sectors such as aviation where duplication was a concern,” says Mr Gokkent.

“On the contrary, the UAE’s status as a hub has been further reinforced. Khalifa Port is a key part of the infrastructure layout of Abu Dhabi’s 2030 plan.

“For example, it will be the outlet through which home-based companies in Kizad such as Emirates Aluminium [Emal] will export their output.”

Khalifa will primarily be an exit point for the increased exports from industrial projects, including smelter Emal, whose volume of exported metal will grow to 750,000 tonnes in 2015, from 600,000 tonnes in 2014.

Khalifa is forecast to handle up to 1.2 million TEUs this year and 1.7 million TEUs in 2015, Martijn van de Linde, the chief executive of Abu Dhabi Terminals, which operates Khalifa Port, said in March.

Although about 95 per cent of current cargo at Khalifa Port is bound for Abu Dhabi, Mr Linde forecasts that in two years up to 20 per cent of throughput could be transshipment cargo for the upper Gulf and India.

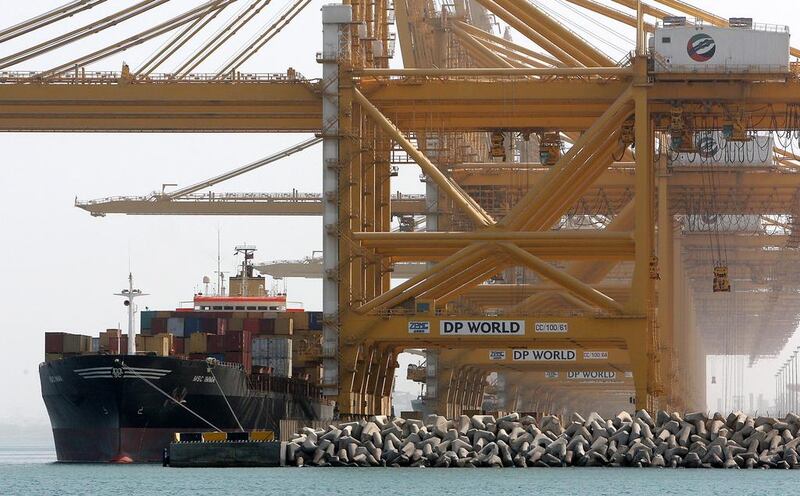

Another huge container terminal expansion in the region is taking place in DP World’s Jebel Ali port, already the world’s ninth-largest container port, where capacity is set to rise to 19 million (TEUs) next year from 15 million TEUs this year.

The port, which handled 13.3 million TEUs last year, increased its capacity by 1 million this year to reach 15 million TEUs. Its 4 million additional capacity will help cater to very large ships that carry 18,000 containers and will be able to handle 10 of them simultaneously.

“Recently what we have noticed in the shipping line industry, ships are getting bigger in terms of size and in term of their demands,” says Mohammed Al Muallem, the senior vice-president and managing director of the UAE region at DP World.

“That means the bigger the ships, they expect more speed, and from that perspective we are building up capacity and capabilities.”

Jebel Ali has attracted both cargo headed solely to the UAE and also transshipment business to neighbouring cities and countries. The traffic at Jebel Ali is split 50-50 between transshipment and UAE-bound cargo, according to Mr Al Muallem.

With Abu Dhabi competing for transshipment business, DP World is confident there is room for all and the port with the best service will win, Mr Al Muallem said.

“Everybody is building up to make sure they will be able to cater for the growth which his happening in the region,” says Mr Al Muallem

“It is long due for many countries in the Arabian Gulf or GCC that they have not upgraded their facilities, so what they are doing today should have happened years back.

“It was realised that some of the cargo will move from here to Port Khalifa, that we knew from the beginning. It is only Abu Dhabi cargo, which has gone to Abu Dhabi.”

Besides mega expansions, Sharjah’s Khor Fakkan Port outside the strait of Hormuz is capitalising on its location as a transshipment port.

Gulftainer, the manager of Khor Fakkan Port, is expanding its facilities to cater to expected demand into the UAE.

Gulftainer plans to boost capacity at Khor Fakkan to 7 million TEUs form the current 5 million TEUs. Construction for the upgrade is due to start next year and expected to finish in 18 months, says Peter Richards, the managing director of Gulftainer.

The firm also expects to finish by the middle of next year upgrading its Sharjah Container Terminal, established in 1976, to 750,000 TEU from 350,000 TEU now.

The facility was the first purpose built and fully equipped modern container terminal in the Middle East the company says. It is adjacent to Sharjah’s industrial area, which accommodates more than 45 of the non-oil manufacturing capacity of the UAE, Gulftainer’s website adds.

The stimulus to undertake the development is provided by the country’s relatively easy weathering of the global economic storm that began in 2008.

“The reason we are undertaking these development in the UAE is because we believe the Middle East will be one of the first regions to recover from the economic crisis,” says Mr Richards.

“There are a lot of indications now that the UAE in particular is starting to return to a more level plane and people are projecting continuous growth within the construction industry and also the export industry from this region, which actually allow volumes to increase into the ports.”

business@thenational.ae