We have enough information now to start looking at the issues facing specific industries and analyse the implications for the wider economy when VAT launches across the GCC on January 1, 2018.

Some of you might remember as children playing the board game Mousetrap, something this circle of accountants has fond memories of. The object was to construct a mousetrap, then trap all the other mice on the board. Mice, in the context of the modern economy, stands for “meetings, incentives, conferences and exhibitions”.

Similar to the game, countries develop expansive trade centres as part of integrated master plans, which support the attraction and successful capture of this business – typically presenting themselves as annual gatherings.

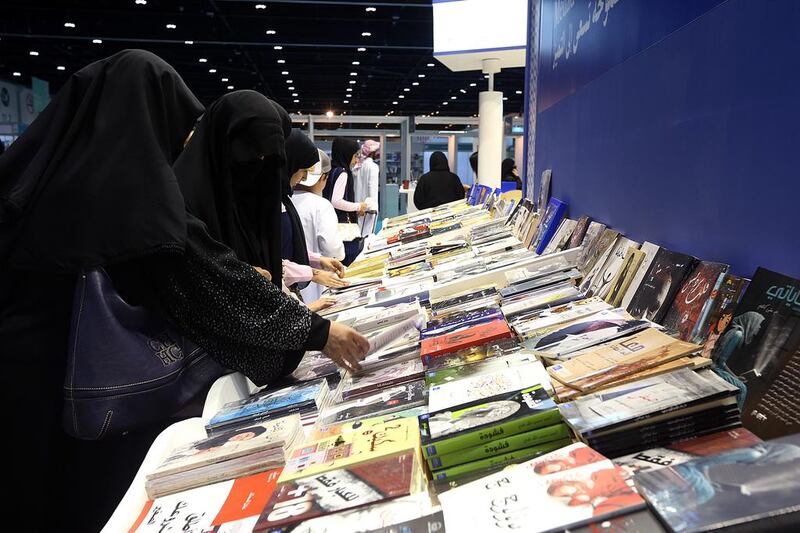

The Dubai World Trade Centre (DWTC) was home to more than a hundred events last year. A million people plus attended, generating economic activity worth north of Dh12 billion.

Include the Abu Dhabi National Exhibition Centre, and the multitude of hotels that host second-tier events, and we quickly arrive at a not immaterial component of the economy. Today the UAE stands above over the rest of the GCC in attracting Mice.

There are three groups who are either apprehensively awaiting clarity on rules or are already calculating the potential cost of value added tax (VAT).

These are event organisers, those businesses supply services and the attendees.

Parallel universe theory is an unwelcome reality for international Mice planners. Variable VAT rules and rates face them at whatever arena they choose to pitch up at.

Some countries offer general VAT rebates, others exclude named countries from the same. Adding insult to injury, some countries are very particular about the nature of what Mice can claim what rebates. The requisite supporting documentation is often no less discerning.

Few UAE contracts are likely to have VAT-related issues. While Mice are planned well in advance, they are not typically so far ahead that Federal Tax Authority engagement with businesses shouldn’t have informed active contracts.

A regional hub seeking differentiation could do worse than steal a march by taking a “Wimbledonisation” approach. In this case, it entails accepting that it is better to forgo VAT revenues than miss out on the economic activity that might otherwise occur in another country.

“Wimbledonisation” occurs when a country focuses on ensuring that economic activity happens in that country and is willing to forgo something, be it ownership or taxes, to encourage this.

If not, what might support a decision by the Government not to facilitate refunds is an IMEX Global Data Exchange survey that placed beneficial VAT treatment fifth in a conference industry wish list – one that the UAE has largely delivered on vis-a-vis its competitors.

Mice require a lot of short-term project support, normally delivered by SMEs and lone operators that provide services such as collateral development and stall builds. It is unlikely that any will be unable to register for VAT and most will face a legal requirement to do so.

The question they should be asking themselves is whether their customers want to work with entities that are not VAT registered? In my opinion they would be wise to insist on these entities being VAT registered. An unregistered contractor cannot reclaim their input VAT, therefore it is likely to increase its charges to compensate.

This goes to the heart of what VAT is. It is a progressive collection of tax that is ultimately paid by the final consumer along a supply chain. Where there is a break in the chain, additional cost creeps in and there is a cascade of tax cost. In many markets the value at which you must register for VAT is minimal. If the intent is to repeat a transaction event, i.e., trade, then VAT is applicable. Living in a destination country, one might be forgiven for forgetting the commercial tourists who, week after week, pack our hotels when not trudging around our convention centres.

One bit of good news for them is that VAT will not apply to local municipal transport – taxi, metro etc. Regular attendees are not a bunch of unintelligent mugwumps, they understand that VAT is being applied and are generally used to being able to reclaim it.

To encourage tourism, countries often allow tourists to reclaim VAT paid when exiting the country. The process is generally simple and quick, as befits encouraging repeat and referred visits. Although the agreed GCC framework allows for it, media reporting has been confused as to whether a similar scheme will be set up in the UAE. One talked about it applying only to commercial visitors, but such separation of treatment is unlikely.

Peter Whatley, the chief executive of Argent Gulf Consulting, said: “In mature VAT environments, the chargeable rate is such that an industry has grown up to support reclaims. The OECD average VAT rate is circa 19 per cent. In the UK, companies that handle your reclaim charge from 6 per cent to 8 per cent of that and quickly refund the VAT you have paid. As the standard rate in the GCC is a relatively low 5 per cent, it would make the commerciality of third parties providing a reclaim service improbable.”

Intuitively no country wants to compete in zero sum games, so I suggest reframing the approach as one that exploits competitive advantages, satisfying itself with benefit that accrues to the wider economy via the multiplier effect. The UAE has much to offer to those extending their stay as well as acting as a short hop hub to additional must-see destinations.

It’s not ideal that the GCC VAT area is being created with the possibility of differing launch dates, from January 1, 2018, to January 1, 2019. The absence of detailed VAT law from any of the participants leaves the late adapters open to accusations of seeking competitive advantage through playing, what one wag opined, was a staggered game of “rock, paper, scissors”.

As players of Mousetrap will tell you, while some games are advantageous to those who go first, the long planning cycle of Mice mitigates some of this risk. Having worked so hard to build an innovative solution, it would be a shame if some of the lustre was lost due to a delay in revealing the rules.

David Daly is a chartered accountant (CIMA) typically serving in chief financial officer or finance director roles.

business@thenational.ae

Follow The National's Business section on Twitter