When looking for a place to eat or a decent hotel, the last thing drivers of Audi's new A8 sedan will need to do is roll down the windows and seek the help of a passer-by. Instead, they will connect to Google's vast internet "cloud" of maps and user-generated reviews through a mobile broadband connection built into the car. The service, launched last week in Barcelona, is at the leading edge of what Etisalat's chairman, Mohammed Omran, sees as the future for the telecommunications industry.

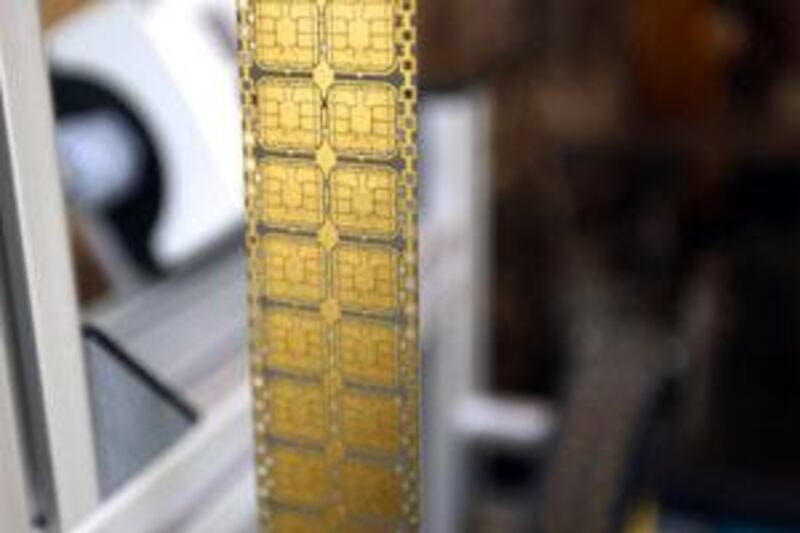

The market for traditional mobile phone connections is already heavily saturated, with the UAE home to more lines per person than anywhere else on earth. But Mr Omran sees "billions" of opportunities for new connections to the mobile grid. The A8, which is expected to arrive here by the end of the year, will be among the first of the 55 million cars that the electronics research group iSuppli predicts will be on the roads with mobile internet access by 2016.

"It's an absolutely amazing experience, straight out of the future," said Jeff Mannering, the managing director of Audi Middle East. "Linking to Google and Google Earth is great, you see everything that is around you from a satellite view all the way to a street view." The web-enabled cars are expected to be a big seller in the UAE, he said. "This region loves new technology, it embraces these kind of things and people love having it first."

A survey last week showed that this enthusiasm spreads to other places where mobile technology is extending its reach. Almost 60 per cent of consumers in the Gulf said they planned to buy Apple's new iPad, a touchscreen internet tablet that connects to the Web through a mobile network. Just 7 per cent of UK consumers responded the same way. "This is the kind of thing that is really going to drive growth for Etisalat in the UAE," said Irfan Ellam, the vice president of equity research at Al Mal Capital. "We are seeing mobile data becoming mainstream. I don't mind having two phone lines if one of them is in my laptop with a 10-gig data plan."

The trend is a global one; the US-based management consultancy PRTM said in a recent study that the number of mobile connections worldwide could reach 15 billion by the end of the decade - a more than five-fold increase from today. That would mean more than two lines for every one on earth, or the entire planet having the same saturation of mobile connections as the UAE has today. "There's no turning back this tide," the report said. "In the next five years, several billion more subscriptions and vast take-up of mobile data - both in users and in usage - is pretty well a given."

This tide has Mr Omran, who has led Etisalat, the UAE national telecoms, since 2005, unwilling to even hazard a guess as to how many subscribers the company will have by the end of the decade. Since joining the company as a graduate in 1977, he has learnt to avoid long-term predictions on a market that changes faster than almost any other. "We introduced mobile services in 1982. Do you know what our forecast was at that time? 5,000 lines was expected to last for five years," he said.

"When you are at a certain time, you see what you have to be. Especially in our business, nobody can tell you what will happen in five years. "Maybe we can estimate what will happen in two years to 70 per cent or 80 per cent accuracy. After four years, 30 per cent. After five years, I don't know." The transition to a future where growth comes from almost anywhere except traditional handsets will be a tough one for the industry. Mobile operators have spent the past decade mastering the art of competing in a mass consumer market, and spend vast sums of money on advertising and promotion, with their branding ubiquitous across storefronts, billboards and sports team kits.

That approach will change, analysts say, as growth in mobile connections shifts to cars, specialised electronic devices, metering equipment and a host of other products. Long accustomed to dealing with consumers, operators will need to develop the ability to become service providers in highly complex industries. "If your son wants to connect his hand-held game console to the mobile network, how prepared is the average operator to target that niche?" said Hilal Halaoui, a principal partner at the global consulting firm Booz & Co. "What we are seeing now is that mobile operators might not be the ideal entities to deliver every single one of these solutions.

"It has huge implications on the business model, and it will drive a new kind of partnership mentality at the operator level." Such a mentality is yet to be seen in the industry, which is famously reluctant to enter partnerships that involve revenue or profit sharing. But as the telecoms market has evolved, from servicing a rich corporate elite in the 1980s to a mass middle-class market in the 1990s and the majority of the third world over the past decade, it has undergone successive transformations in its business model.

"At each point, extending the old model would have been unprofitable and risky," PRTM's Radical Change report said. "But belief in the potential of the new market, combined with recognition of the need for a new operating model, made all the difference." tgara@thenational.ae