Tunisia intends to recapitalise its banks and carry on with subsidy and tax reform to strengthen its economy, the government has told the IMF.

It follows the country securing US$1.74 billion in a loan over two years from the Washington-based institution this month.

"The authorities are courageously addressing the twin challenges of successfully completing the political transition and restoring growth and employment in a difficult external environment and with pressing social demands," the government said in a letter sent to the IMF.

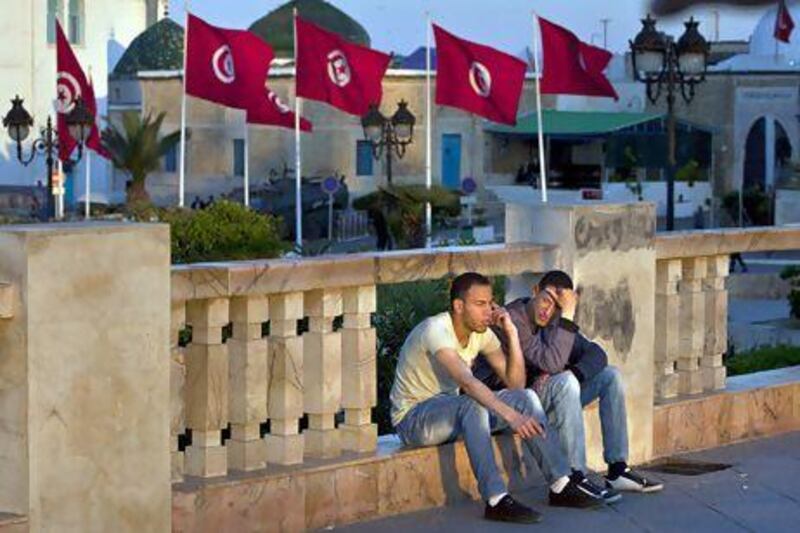

Tunisia has been rebounding from the January 2011 revolution that sparked the Arab Spring, toppled the former president Zine El Abidine Ben Ali and left its economy in a deep recession.

Since then growth has picked up and is expected to reach about 4 per cent this year, but challenges remain from a fragile banking system, social inequality and high youth unemployment. The authorities aim to carry out an audit of the three public banks, which account for 40 per cent of banking assets, beginning this month.

It plans to decide by mid-September whether to recapitalise or merge the banks or reduce the state's holding in them, said the letter, which was released by the IMF on Monday.

The amount planned to recapitalise the banks over the next two years was 2.6 per cent of GDP, according to the government. It has also prioritised reducing soured loans linked to the tourism sector.

"The authorities attach high priority to addressing the banking sector vulnerabilities, which will be an important building block in their reform strategy," it said in the letter.

Tunisia intends to use the IMF cash to help to plug its current account deficit, which deteriorated as exports to Europe weakened and spending on public wages and subsidies surged as a result of rising social demands. The fiscal deficit could rise to 7.3 per cent of GDP this year from 5.4 per cent last year, estimates the government.

"Restoring fiscal space will be accompanied by a better composition of public spending for priority social and capital programmes that support growth and poverty reduction," said Amine Mati, the IMF mission chief to Tunisia, in an interview with IMF Survey magazine.

In March, the government increased energy and electricity prices by 7 per cent, the second such move in six months. The move was accompanied by a rise in cash transfers to lower income households.

The latest increase was expected to generate total savings of about 1 per cent of GDP, estimated the authorities.