On a small crest of land that juts out into the Indian Ocean in the town of Barka, there is a place where you can see the sun rise and set in a single arc in the sky. The areas is pristine and accessible only by a small road. The only people around are local fishermen bringing in the day's catch as six large islands loom in the background. As Oman's petroleum industry begins to dry up, this idyllic landscape has become ground zero of a new phase of the national economy. It will be the site of Blue City - or Al Madina A'Zarqa as it is called in Arabic - a giant, US$20 billion (Dh73.4bn) lifestyle development that will one day house 200,000 people on 32 sq km of land.

"There will be an aquarium here, at this point," said Richard Russell, the chief executive of BCC1, the company in charge of the first of a total of 12 phases of construction. "Over there will be housing, and beyond that a seawater lagoon." Qaboos ibn Sa'id, the Sultan of Oman, sold the land to Al Sawadi Investment and Tourism, a development partnership between Cyclone, based in Oman, and the Bahrain-based AAJ Holdings in 2005 as part of plans to diversify the economy. As many as 20 new property developments have since sprouted up between Muscat and Barka, which is about 45 minutes away from the capital. These projects will house dozens of new hotels - Blue City is considering as many as 20 - in an effort to put Oman on the tourism map.

Cooler than the Emirates and endowed with large, rocky mountains and a coastline rich in coral and natural cliffs, the country is hoping to become a popular, laid-back destination for Europeans and other westerners as yet unfamiliar with the country. It is already a favourite among GCC nationals, including Sheikh Mohammed bin Rashid, Vice President of the UAE and Ruler of Dubai, who has a large villa in Muscat that overlooks the sea.

Among the projects under way, Blue City is the largest and most ambitious - and it is also the first to run into problems. A complete redesign of the project last year by Foster and Partners, the firm founded by the renowned British architect Sir Norman Foster, and an ongoing ownership dispute between Cyclone and AAJ have delayed the project by nine months, resulting in less revenue generated than planned.

Ordinarily, this would not affect a developer publicly because the project could simply be delayed by a few months. But since Blue City's first phase is being financed in part by a bond, it became a public ordeal. Fitch Ratings announced in July that it had put the project on "ratings watch negative" for the $526 million worth of debt it had raised as part of a $925m bond. As of Aug 7, the company had booked a total of $31m, far short of its target of $101m. Mr Russell said the project had now risen closer to $50m, but it was unlikely to meet its next target of $186m by Nov 7.

The consequences of this are still unclear and Mr Russell said he did not want to speculate on "what if the sky falls". In previous interviews, however, he said the bond offering required certain actions to take place, including selling off assets, if revenue was behind schedule and construction costs were over budget. The Fitch report warned that while missing the targets would probably not lead to immediate sanctions by investors, it could mean other problems on the horizon.

"If sales performance does not improve significantly over the coming months and quarters, the borrower may eventually struggle to continue funding the construction costs of the project," the report said. Another report from Fitch is expected in the coming weeks. Ironically, the project is not behind on actual sales. The revenue problem is a result of the bond offering stipulating that the company would receive 60 per cent of the sales price for each unit in the first year, when the actual sales team were booking more like 20 per cent.

"There is a considerable disconnect between the bond targets and reality," Mr Russell said. "We are working to rectify that." He called the report from Fitch premature. "They should have investigated the business climate in the region, not played armchair quarterback," he said, adding that he had recently flown to London and met the research team behind the report. The other potential problem, according to the Fitch report, is the ownership dispute. Cyclone owns 30 per cent of Ocean Developments, which in turn owns Al Sawadi Investment and Tourism and Blue City. AAJ Holdings owns the other 70 per cent, but has alleged in court documents that Cyclone took control of the project even though it had only a minority stake. Both companies were unavailable for comment.

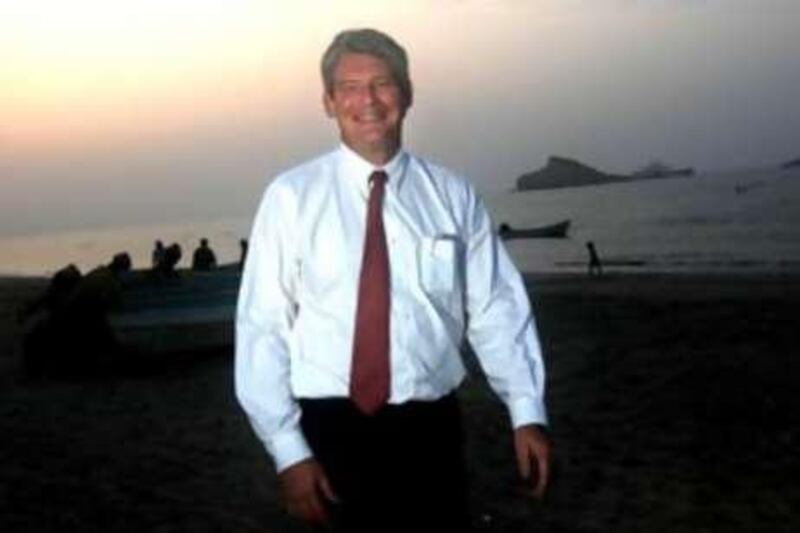

Fitch Ratings said in its report that the dispute had hurt sales because of "negative media coverage". Mr Russell, who was born in Iowa and has lived around the world and worked for Emaar in Dubai and Al Qudra in Abu Dhabi, said the ownership dispute did not affect his objectives. "My job is to build phase one and we are going to do it by the deadline in Dec 2012," he said. So far, only the most basic work has started at the site. But Mr Russell is preparing for major construction to begin in the coming months. The workers' housing is being expanded to accommodate 9,000 people, up from 7,000, and the site will operate around the clock to meet the deadline. Aeco, a Greek-Turkish partnership, is heading up the engineering and construction work.

The first phase will include housing for about 27,000 people on a 2.2-square-kilometre section of the project. It will include a golf course, three five-star hotels, schools and civic buildings such as post offices and police stations. Eventually, the project will bloom over the entire 32-square-kilometre site and include hospitals, sports arenas, schools and all the other trappings of a major metropolis.

Mr Russell said the project was in discussion with several universities in the US and the UK about opening campuses at the site, similar to the arrangement that Abu Dhabi had with New York University. "This place is about the government's plan, his majesty's plan, to diversify the economy away from oil," he said. "About 70 per cent of the population is below 20 years of age. That's an incredible resource and it's an incredible responsibility. These people need to be given opportunities."

Meanwhile, the sales team is about to begin its first international push for the project at Cityscape Dubai next month. They have had the luxury of waiting this long because about half of the sales so far have been to nationals. "Omanis see this place and they want to be a part of it," he said. "We are doing everything we can to maintain the look and feel and traditions of the country, from the architecture to the way people interact in the public areas."

bhope@thenational.ae