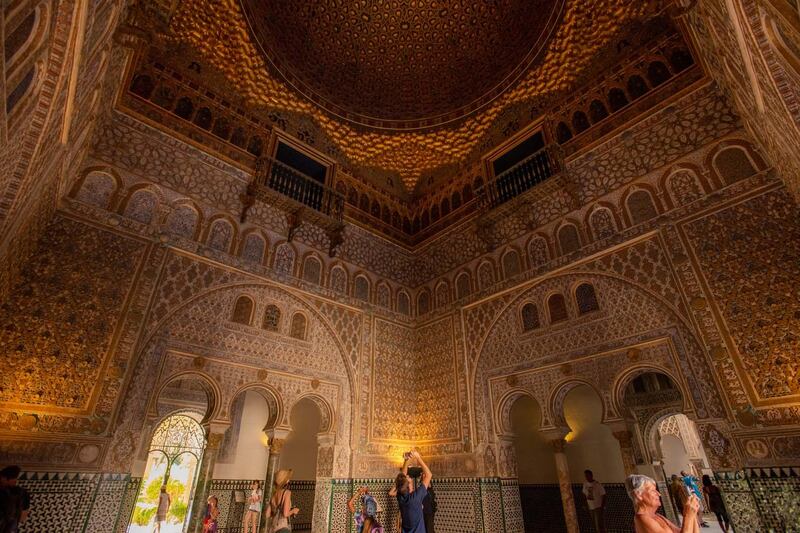

MADRID // The Alhambra is a hilltop palace at the foot of the Sierra Nevada mountains that was originally built for military purposes but, nearly seven centuries later, stands as one of the most exquisite monuments of Al Andalus, also known as Muslim Spain.

The palace, named from the Arabic al-qala’a al-hamra meaning ‘the red castle’, and its capital, Granada, hold immense symbolic value as the Emirate of Granada was the last Muslim dynasty on the Iberian Peninsula to relinquish power to the Catholic Kingdom of Castile, in 1492.

With an eye on this history, Spain is vying for a larger share of the halal tourism market, the fastest-growing segment in the travel industry, expected to be worth $274 billion by 2023, according to the State of the Islamic Economy Report 2018/19.

With its rich Islamic heritage, top football teams, Mediterranean climate and diverse gastronomy, tourism operators say Spain has the right ingredients to become an attractive halal tourism destination.

“The combination of Spain’s Islamic legacy, European history and glamour are not found anywhere else,” says Flora Saez, co-founder of Nur&Duha Travels, the first operator to offer halal tourism services in Spain.

Several operators in Spain are dedicated to halal tours, which typically weave between Barcelona, Madrid and Andalusia’s key historic cities – Granada, Cordoba and Seville. Others take in additional Spanish destinations, or tag on journeys to Portugal or Morocco.

Six consecutive years of record-breaking arrivals have made Spain the second most-visited country globally. Over 82 million tourists visited Spain in 2018, approximately two million of whom were Muslims from outside the EU.

The majority of Muslim travelers to Spain come from Algeria, Morocco and Turkey, according to Turespaña, the government body tasked with marketing Spain as a travel destination.

The exact number of Muslim tourists that visit Spain from within the EU is unknown but estimated to be around five million, says Barbara Ruiz Bejarano, director of international relations at The Halal Institute in Cordoba.

“Halal tourism in Spain has grown in parallel to that experienced globally, with demand increasing in the last six to seven years in particular. The improvement of flight links between GCC countries and Spain has undoubtedly been a factor in this growth,” Ms Saez says.

Between 2014-17, UAE visitors to Spain increased more than twofold, following a 2015 visa waiver for Emirati nationals and subsequent ease of travel. Market research company EuroMonitor International estimates 100,000 Emiratis will visit Spain in 2019. In the same period, Saudi visitors to Spain increased 88 per cent, despite no visa waiver.

The boost in numbers also coincides with the establishment of a permanent tourism council within the Spanish embassy in Abu Dhabi in 2016. The ongoing presence has enabled greater promotion of Spain in GCC countries, says tourism counselor Miguel Nieto-Sandoval.

The following year, Turespaña launched an Arabic-language tourism portal tailor-made for the GCC market, Nieto-Sandoval added. The content covers key destinations and attractions for GCC travelers (Barcelona, Madrid, Andalusia, the Balearic and Canary Islands and Valencia), and provides information on halal-certified and halal-friendly establishments and mosque locations throughout Spain.

The same year, Turespaña made its first explicit reference to halal tourism as a specific market segment to target. In Andalusia, the regional tourism board similarly stepped up efforts with the “Andalusia: your roots, your destination” campaign, enticing Muslim travelers with the notion that “the history of Andalusia is also your history”.

Though tourist numbers from GCC and Asian countries are up, halal tourism in Spain remains nascent in comparison to the main outbound countries of tourists to Spain from the UK, Germany and France, says Alfonso Vargas, professor at Huelva University, adding that it is due to “a lack of deliberate strategy based on a proper appreciation of the opportunities linked to this market”.

Ms Ruiz Bejarano stressed the Spanish government has been tepid towards this segment because they have not understood halal as an economic opportunity. “In the more than ten years we have been explaining this opportunity, only now are things changing.”

Muslim travelers level of expenditure and length of stay both exceed the average in Spain. Emirati and Saudi tourists spend an average of 392 and 294 euros per day respectively, in comparison to the median daily expenditure of 129 euros.

These numbers, along with the increasing Muslim population worldwide and growing middle classes across GCC and Asian countries, make halal tourism an attractive segment for Spain’s tourism sector to target as it pursues a new tourism model based on quality and sustainability.

Yet for Spain to become a premiere halal destination, experts and tour operators say there is still much to be done to make the country more Muslim-friendly.

“The needs of Muslim tourists have always been there, but no one had put a ‘label’ on them, and therefore they were not visible or recognised,” said Ms Saez.

Only two hotels in Spain are halal certified, both located on the Costa del Sol, a long favoured destination of GCC and North African travelers, and among Saudis in particular, Ms Saez noted.

Most problematic for Muslim travelers to Spain is the lack of halal food options.

Outside of Barcelona, Madrid and Andalusia, it is difficult for Muslims to find adequate food, said Mohamed Tawfik, director of Spain Baraka Tours. “Anywhere in the north of Spain becomes a big challenge.”

This is partially because Spain’s resident Muslim population of two million relies on halal-certified imports, mainly from Morocco and France, as nearly all Spanish-certified halal food and beverage products are made for export.

Ruiz Bejarano recently joined the Spanish tourism authorities on a mission to Thailand – which, like Spain, also borders a Muslim country and receives Muslim tourists – to learn about their national halal plan.

“The big difference we noticed is that … they encourage businesses to become halal-certified, they invest in halal industries, they promote and publish guides and apps to help tourists find hotels, restaurants and entertainment, anything they may need,” she said.

As competing Mediterranean markets Turkey, Tunisia and Egypt continue economic recoveries, halal tourism could help Spain keep visitor numbers up at the same time it diversifies its tourism base.

Recently, signs of change have begun to emerge.

This year, Spain’s Halal Institute introduced a “Muslim Friendly” certification scheme designed to help businesses adapt and cater their services to the needs and preferences of Muslim travelers.

Though a positive step, Ms Ruiz Bejarano says business owners then encounter bureaucratic difficulties.

To overcome this, she noted, Spain must first change its perception and see halal as a business, and then create a national plan to coordinate the halal and tourism industries to facilitate growth. “We need to train industry so they are aware of the particularities and the demands of this travel segment, and so they understand how they have to adapt their businesses.”