The Middle East and North Africa (Mena) hospitality market is expected to remain weak with exception of few cities in the region that could see some improvements in the coming months, following mixed results in October across destinations, according to a new survey report.

"The Mena hospitality market is expected to continue the trend of a softer performance but will look to see improvements in a few cities over the next few months due to annual exhibitions, events, and festivals," said Yousef Wahbah, Mena real estate, hospitality and construction sector leader at advisory EY.

“Overall, internationally branded four and five star hotels in the Middle East witnessed a split among the increases and declines of KPIs [key performance indicators] in October 2017 when compared to the same month last year.”

Beirut had the highest year-on-year increase in hotel occupancy rates in October , while Doha had the steepest drop, the survey showed.

Geopolitical tension, and slowing economies in some markets are putting pressure on the hospitality sector in the region. Low oil prices, the strong dollar and ever-increasing supply of hotel rooms has also dented the performance in key cities in the Arabian Gulf region.

In the UAE, Abu Dhabi’s hotel occupancy rose 8.9 per cent to 86.7 per cent, thanks to an increase in guests coming through cruises and the emirate's hosting of the 44th World Skills Competition.

_______________

Read more:

[ On the move: the secrets of hotel success ]

_______________

The occupancy levels in Dubai, one of the region's top tourism and commercial hub, however, fell 2.4 per cent to 79.6 per cent. An increase in hotel supply has prompted hotels to lower their average daily rates (ADR) to maintain occupancy levels, according to EY study.

Doha's occupancy levels fell 11.1 per cent to 57.3 per cent. Tourism is one of the worst affected sectors in the gas-rich nation after the Arab quartet of Saudi Arabia, the UAE, Bahrain and their North African ally Egypt in June cut diplomatic and transport ties with the Doha for its support to terrorist groups in the region. Saudi Arabia and the UAE are among the main source markets for Qatar's hospitality sector.

In Saudi Arabia, occupancy increased in Riyadh and the holy cities of Mecca and Medina by 5.9 per cent, 13.9 per cent and 1.8 per cent, respectively.

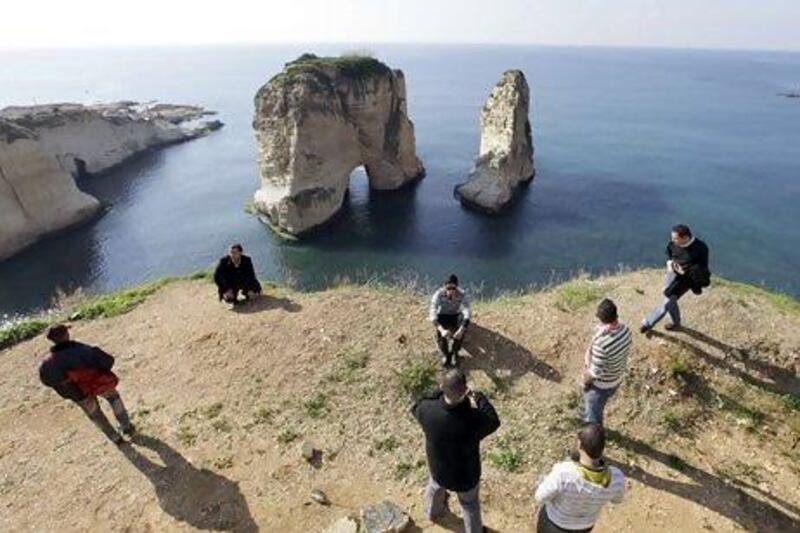

In Beirut, occupancy rates rose 13.5 per cent to 68.3 per cent, thanks to “the lifting of travel bans and favourable climate conditions attracting visitors,” EY said.