Irfan Khan poses for a selfie, with Mumbai's majestic Victorian Gothic railway station building, Chhatrapati Shivaji Terminus, in the background.

The 27-year-old sales executive, from Chennai in south India, is on holiday in the country's financial capital, exploring its heritage attractions, markets and restaurants.

“I've never travelled abroad,” says Mr Khan.

“Every few months I go on holiday in India. It's cheaper and there's so much to see. Mountains, cities, jungles, beaches.”

Like Mr Khan, more and more Indians are increasingly travelling within their home country.

Figures from India's ministry of tourism show that the number of tourist visits within India across the different states, or domestic tourism visits, totalled 16.5 billion last year, up 2.3 per cent over the previous year and rising from 526 million visits a decade earlier.

Travel and tourism companies in the country are eager to tap into the vast market on their own doorstep, with a population of more than 1.3 billion and rising incomes.

“With India regarded as one of the must-visit countries by foreign tourists, it is beginning to witness an increasing interest from domestic tourists as well,” says Neelu Singh, the chief executive and director of Ezeego1, an online travel company. “With destinations and services packaged innovatively [and the] increase of disposable income, the demand for domestic travel has grown exponentially."

She adds that “with the influx of social media, millennials are driving the luxury market, travelling the country in search of new experiences and ready to spend more”.

Travel by Indians within the country already plays a much larger role in the domestic travel and tourism sector. The number of foreign tourists visiting India is, in fact, relatively small considering the vast size of the country and the attractions it has, such as the Himalayas, the Taj Mahal, and its vibrant culture. Last year, India received just over 10 million foreign tourists. By comparison, more than 15 million international tourists visited Dubai alone last year.

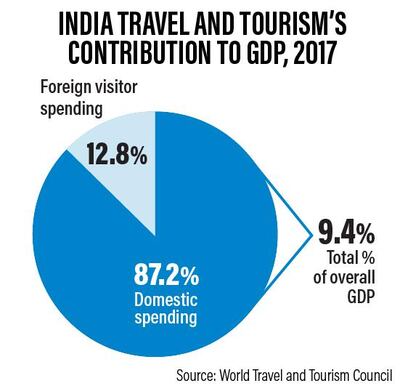

Domestic travel spending in India last year generated 87.2 per cent of the direct travel and tourism contribution to GDP, while foreign visitor spend accounted for just 12.8 per cent, according to the World Travel and Tourism Council.

It forecasts that domestic travel, tourism and hospitality spending will expand by 7.3 per cent this year to 12.9 trillion rupees (Dh647.94 billion), and grow by 7.4 per cent a year to 26.4tn rupees in 2028. Travel and tourism accounted for 9.4 per cent of overall GDP in India.

“The tourism sector in India, as far as domestic tourism is concerned, has tremendous potential and we believe it is still grossly under exploited,” says Vineet Verma, the chief executive and executive director at Brigade Hospitality Services Limited, a Bangalore-based company involved in hotel, spas and convention centres.

_______________

Read more:

[ India likely to lean on expatriates to support its battered currency ]

[ Technology is changing the face of the Indian workplace ]

_______________

He says one of the factors driving the growth is the fact that state governments are putting in greater efforts to promote domestic tourism, including destinations such as the coastal state of Goa, popular for its beaches and Portuguese architecture, and Kerala in south India, known for its lush greenery and backwaters.

“Indians are beginning to take shorter holidays as well,” says Mr Verma.

The sector is also being driven by the expansion of budget airlines in India and the rise of internet use, which is making booking trips and finding information about destinations a much easier process, industry insiders say.

“Many new domestic routes and flights have been added under the [government] Udan scheme, making it easier for travellers to explore different regions,” says Karan Anand, the head of relationships of Cox & Kings, an Indian holiday company.

Udan is a flagship scheme of prime minister Narendra Modi’s government, which aims to improve regional connectivity by subsidising flights to dozens of under-served airports in the country.

At the launch of the first flight under the initiative in April last year Mr Modi said that the goal of his government was to get people wearing “chappals”, Hindi for sandals, to take to the skies, in a reference to the country’s poorer citizens. Currently, it is only a single-digit percentage of the population that travels by air.

One company aiming to tap the domestic travel market is Angriya Cruise, a new cruise service that launched this month, sailing between Mumbai and Goa.

The company's managing director, Nitin Dhond, says that the cruise sector in India is completely undeveloped and there is enormous potential in the country for its expansion, given the extensive coastline.

“This cruise could set a precedent where many ships could come and connect the tourist destinations in India,” says Mr Dhond.

For wealthier Indians, their appetite for travel is only growing.

“Though India is a price-cautious market, seasoned travellers are willing to spend more for the choicest of destinations, experiences, food and stay,” says Mr Anand. “Indian travellers are welcoming upmarket travel experiences with open arms, such as luxury camping, luxury train journeys and stays in regal palaces.”

He says wildlife trips and religious travel in the country are among the holidays that are fast gaining popularity among Indians.

But there remain some major challenges that are preventing the industry from realising its true potential, according to the travel industry.

One of the major hurdles to overcome is insufficient infrastructure, particularly a lack of good roads connecting different parts of the country, which makes it difficult and time-consuming for people to reach many destinations in India.

“India stands at a juncture where development is in process and the same must be fast-tracked [on infrastructure] with utmost focus,” says Ms Singh. “There must be more highways connecting the significant tourist spots in the country. The hotel industry is another vital part of the infrastructure that must be looked conclusively. There is scope for an increase in the number of four-star and five-star properties that will open up the luxury and semi-luxury market at many potential tourists spots in India.”

She adds that Mr Modi's Udan scheme needs to be accelerated.

“The aviation game changer holds extreme potential for the growth of domestic tourism,” says Ms Singh. “Regional connectivity is essential for the growth. While the work is in process, the same needs to be sped up and more airports must be made operational.”

Improvements to safety and security will also help boost travel flows, while authorities could also do more to ensure that prices remain low, she adds.

“While the prices may be lower or competitive at various fronts in the tourism industry, the taxes levied upon them makes the finished product more expensive,” says Ms Singh.

The journey may not be easy, but everyone agrees that the domestic industry will only expand over the coming years.