The global tourism industry might face a cumulative drop of $8.1 trillion in spending as a result of the Covid-19 pandemic, a new report from global consultancy McKinsey found.

The world's tourism industry is also unlikely to see the same level of spending achieved last year until 2024, the consultancy said.

“Our tourism recovery model forecasts a cumulative drop of $3tn to $8tn before tourism expenditure returns to pre-Covid-19 levels,” the McKinsey report said. “Recovery will be slow and driven by the underlying dependencies countries had on domestic and non-air travel. Different countries should prepare for their own recovery curves.”

The pandemic has severely disrupted the travel and tourism industry across the world. Renewed lockdown measures in some countries, travel restrictions, reductions in consumers’ disposable income and low confidence levels could significantly slow the sector’s recovery globally.

The United Nations Conference on Trade and Development forecast in July that the pandemic could cost the global tourism industry losses worth $2.2tn, or 2.8 per cent of the world’s gross domestic product if the break in international tourism lasts for eight months.

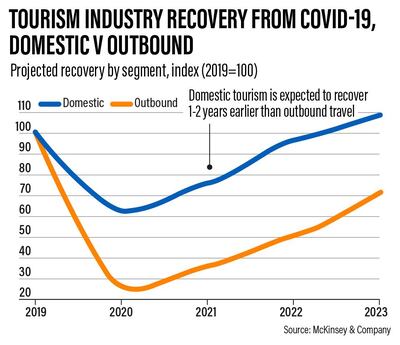

The McKinsey report estimated a recovery to 85 per cent of 2019 tourism volumes by 2021 and a full recovery by 2023 in an optimistic scenario that assumes a rapid containment of the virus and rebounding economies. In a more pessimistic recovery scenario, 2021 global tourism levels could be as low as 60 per cent of 2019 levels.

Factors that could affect tourists' decisions on where to travel include the attractiveness of domestic destinations, health standards in destination countries and health concerns and supply reductions in air travel, the report said.

McKinsey said dependence on domestic travel and non-air travel will likely determine tourism recovery in each country.

The consultancy predicted that domestic tourism will return to pre-crisis levels around one to two years earlier than outbound travel. This is because it is easier to travel by methods other than flying, such as cars and trains.

“In addition, domestic travel is expected to recover faster than hotels as we see a substitution toward vacation rentals and friends and family in certain markets,” according to McKinsey.

In terms of recovery rates within countries, tourism in Germany is expected to recover faster than in other markets, driven by a strong health system, its effective Covid-19 response, a strong economy and land-based tourism options. Domestic tourism has also rebounded quickly in China, but outbound recovery is expected to be slower as travel restrictions remain in place and many Chinese tourists fear catching the virus abroad.

Meanwhile, the UK tourism industry is expected to recover only in 2024 because of a slow Covid-19 response combined with Brexit and its heavy reliance on business travellers and air travel, the report added.

“Industry leaders can seek to improve their rate of recovery through a variety of measures, including improving [the] perception of air travel safety, actively promoting domestic destinations, and ensuring government and insurance policies guarantee access to healthcare – even away from home,” the report said.