As I considered leaving my job of seven years, Amman Jesani told me what to expect if I took the leap and became a full-time trader.

"It's a tough job to crack. One in 300 can make it work for them," he said. "But if you do, it's the best job in the world."

I can't say he did not warn me, but I was less worried about the risks than the rewards.

Could I trust Amman? He definitely knew the field, given that he was a hedge fund manager.

But should I leave a full-time job and steady income as a recruitment consultant for the uncertainty - and volatility - of the investing world?

My interest arose from an acute awareness that, at the current rate, it would take an agonisingly long time to rise to the ranks of a millionaire. And I'd always been interested in trading and liked the idea of working on my own.

I decided to do it.

When I began looking at my options, I came across a small company in Jumeirah Lake Towers called Dubai Professional Trading Group, or DPTG. Established in 2007, the firm was founded by a former investment banker and specialises in trading futures.

In the past two decades, futures and other financial derivatives have become central to the fast-moving global financial system, with the range of traded goods extending to oil and currencies and the volumes of trade reaching trillions of dollars every day.

As I quickly learnt, the most liquid of these futures markets are those trading the bonds issued by governments and companies, and the Eurostoxx, an index of 50 leading European blue-chip shares.

The way DPTG works is that after candidates pass a basic screening, the company provides a desk, a computer and a simulated trading account for three months. If you show promise, the company will let you trade with real dollars and cents.

There are two options: show enough promise and the firm will back you, supplying you with money with which to trade on a profit-sharing basis. Or you can work out of the office trading on your own, as long as you are willing to open an account with at least US$15,000 (Dh55,100).

I must admit I am far from being a mathematical genius. My inclinations are oriented towards using more of the right side of my brain.

But during my interview at DPTG, the company founder told me there are three primary skills required to be a successful trader: discipline, commitment and at least average intelligence. Of the three criteria, I know I have the first.

Only time will tell about the others.

As a futures trader, I will not be trying to move markets but rather position my holdings to take advantage of what I expect large institutional investors and speculators to do next.

The minimum lot size to trade is €10 (Dh53.85) and I normally will not remain in an exposed position for more than a few minutes. They tell me that after factoring in the cost of renting the desk and the commissions for each trade (about €1.5), I need to be on the plus side in about 70 per cent of my trades in order to make a decent overall profit.

This as an opportunity to run my own little trading desk, my own miniature company. And, yes, if I pull it off it would be the best job in the world for me. I am ready to take the plunge.

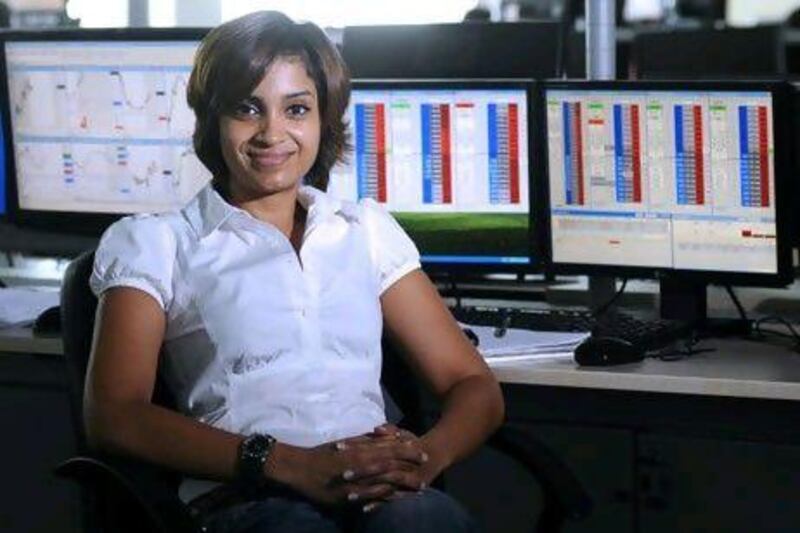

Renee Tauro will write regular updates about her attempt to become a successful trader