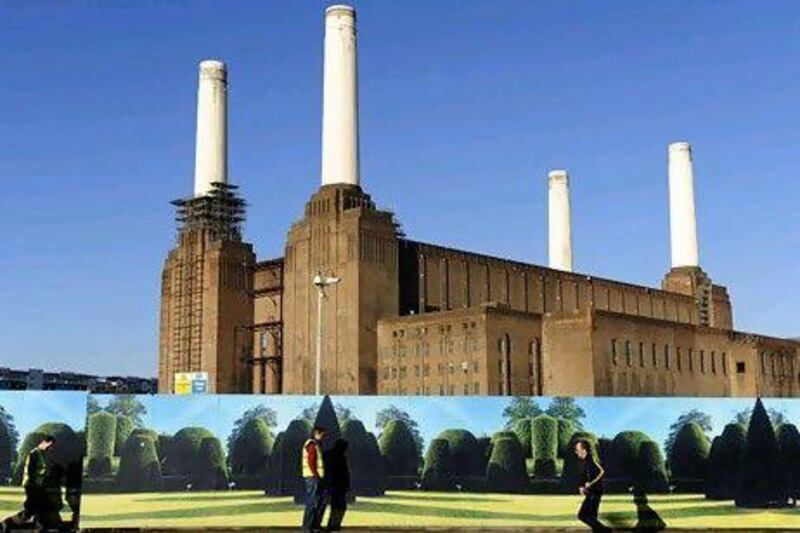

Battersea Power Station in London has burnt through cash as fast as coal since it was decommissioned in 1983.

Successive developers have tried and failed to turn Europe's biggest brick building into a commercially viable regeneration project. Now may be the time for Gulf investors to have a go.

A global roadshow aimed at showcasing the site to the world's wealthiest sovereign wealth funds is in full swing, with the UAE, Qatar and Saudi Arabia high on the list of potential buyers. Initial bids are expected to be submitted within weeks.

But finding a buyer for a site that has been loved by artists more than by investors since its coal-fired turbines stopped turning is shaping up to be the ultimate test in property salesmanship.

Battersea Power Station is iconic in an industry where the word has become a cliché.

It is featured on the cover of Pink Floyd's 1977 album Animals. It has appeared in movies including Monty Python's The Meaning of Lifeand The King's Speech as well as numerous episodes of the television series Dr Who. But that counts for little in turning this monument to post-industrial urban dereliction into a profitable enterprise. The past does not bode well.

The site is owned by the administrators of Real Estate Opportunities, an Irish company that paid about £400 million (Dh2.3bn) for it in November 2006. A succession of owners have employed more than a dozen architectural companies and held hundreds of meetings with community groups in an effort to develop the site over the past three decades.

The question must be why this time around should be different.

"There are two key things," says Alistair Elliott, the head of the commercial division at Knight Frank, the international property consultancy that is scouring the globe for a buyer for the site. "The first is the current strength of the central London market, particularly prime residential. It is also the first time it has been marketed with implementable planning permission."

Prime central London home prices certainly look strong, especially in Wandsworth, the London borough that is home to Battersea Power Station.

Prime property gained 8.7 per cent last year, according to the property consultancy Savills. That comes on top of the 27.9 per cent gains the market had already made since March 2009. Wandsworth was among the five boroughs in the capital with the most spent for home purchases last year.

But potential investors may be less interested in the strength of the market now as much as 10 or 20 years from now. Regeneration projects of this scale can take decades to become profitable, which dramatically narrows the field of backers.

"We think it unlikely that a single party will buy, take control and develop it. The way to get most value from the site is to do it in phases," says Mr Elliott. "This is not far off the scale of the first phase of Canary Wharf."

The 38-hectare Canary Wharf in east London is an interesting parallel to draw, but it may not be a good omen for the future of the power station.

Paul Reichmann, Canary Wharf's developer, had a vision to transform the derelict site on the Isle of Dogs into a vast financial district to rival the City of London.

But in 1992 the project bankrupted his company, Olympia and York, once one of the world's biggest property developers.

Today, Canary Wharf is home to Britain's tallest commercial tower and offices that comprise more space than London's Hyde Park. It is majority-owned by Songbird Estates, a company backed by Qatar Holding.

Qatar is also on the list of Gulf states being targeted by the Knight Frank team trying to find a buyer for Battersea.

"We are in the initial marketing campaign and we are taking the project to where we think it will be of most interest," says Mr Elliott.

One of the biggest obstacles to developing the site in the past has been the planning issues associated with a building that has no external windows and with four crumbling towers - all of which must be preserved under strict building heritage rules for structures that have architectural or historical importance.

"Given the nature of the building, which has a single internal space, and four significant chimneys, finding alternative viable uses that respect the historic fabric of the building and its river setting has always been a challenge," says Karen Charles, who heads the London planning team at DTZ, an international property consultancy.

"As the building has been redundant for nearly 30 years, its built fabric will have deteriorated, thereby increasing the costs of its conversion and affecting the viability of any regeneration proposal."

Another important factor for potential investors is transport links. Although located close to central London, the Battersea site is not especially well served by the Tube, London's underground rail system.

But that could change if the Northern Line is extended to serve the site. The government has made a commitment to add two stops at Nine Elms and Battersea, and a planning application for the extension could be made as early as this year. This will be "a key trigger" for any regeneration project, says Ms Charles.

Thirty-five years after Pink Floyd plastered an image of the power station across an album cover, the site continues to attract glitzy launch parties, car advertisements, film crews and art exhibitions. But finding a developer capable of seeing its regeneration through to completion has not been so easy. Initial bids to buy the site have been invited for a May 4 deadline. That could mark the end of its 29-year history as a film set and the start of a life as a place where people live.

Or, like the failed schemes that have gone before, it may represent just another brick in the wall.

twitter: Follow our breaking business news and retweet to your followers. Follow us