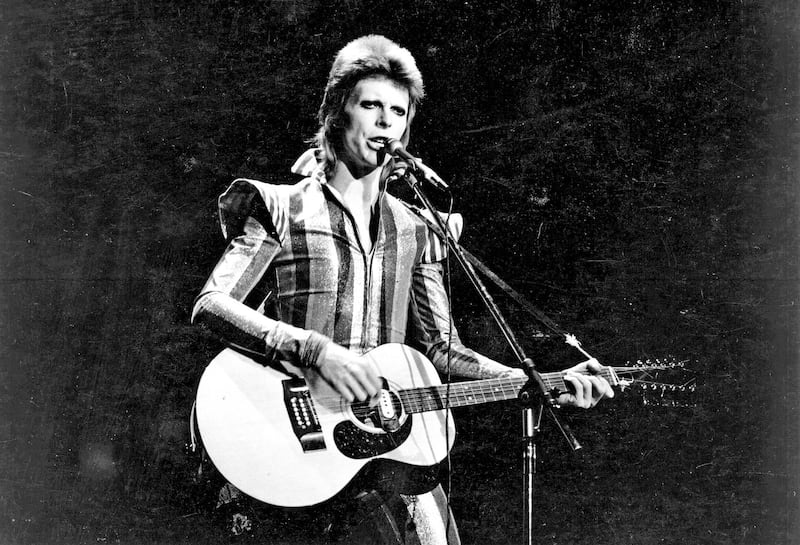

David Bowie will always be the bond market’s “Starman”.

Wall Street underwriters and bond traders were reminded of the late rock superstar last week because of a planned $560 million (Dh2.05 billion) asset-backed securities deal this week from Sesac a Nashville-based performing-rights organisation that has artists like Adele, Bob Dylan, Green Day, Guns N' Roses and Neil Diamond among its roster of about 35,000 musicians.

In the world of debt markets, running the numbers on pop stars doesn’t come up that often.

Don’t get too excited about the prospect of “Dylan Bonds” following in the footsteps of “Bowie Bonds”, though. Ziggy Stardust’s Wall Street debut will always be one of a kind because of his overwhelming popularity and because of his impeccable timing in sensing the shifting winds of the music industry. This debt from Sesac, a company backed by Blackstone Group, is instead latching on to the popularity of esoteric asset-backed securities known as “whole business securitisations”. which as I wrote last month have become a growing part of the structured-finance market.

The business model, of course, is different from the restaurant chains that typically tap this corner of the ABS market. As Bloomberg News’s Claire Boston reported, Sesac enters licensing agreements with bars, fitness centres and other businesses to play popular music from its artists. When that happens, it collects and distributes royalties to the artists. These agreements, in theory, will also pay back buyers of the company’s asset-backed securities. Sesac is the third-largest performing rights organisation but is a for-profit company, unlike nonprofits American Society of Composers Authors and Publishers and Broadcast Music.

The question for any potential investor is whether this deal represents a “top” of sorts for the music rights industry. After all, Bowie’s $55m bond sale in 1997 came mere months ahead of the launch of mp3.com and eventually other sites like Napster that sparked widespread peer-to-peer file sharing - and copyright infringement. Bowie’s bonds, which securitised royalty streams from his music, were hardly immune to the industry trends: they had an initial rating of A3 from Moody’s Investors Service, but in 2004 that was cut to Baa3, the lowest investment grade. Analysts said piracy led to a drop in sales. (In any event, the debt was reportedly paid off after 10 years.)

Sesac’s securitisation, by comparison, is starting off on shakier ground. Kroll Bond Rating Agency said it plans to rate the deal BBB-, one level above junk, and Morningstar Credit Ratings has it at BBB, a step higher. Morningstar, in weighing the pros and cons of the business, cited Sesac’s long history of revenue growth and ability to retain artists but noted it has a smaller footprint in television and radio broadcasting rights, which matters as online streaming gains in popularity.

Then there’s the question of whether the whole-business securitization market is nearing a “top” itself. I noted last month the deal from Massage Envy, which was founded in 2002 and lacks the much longer track record of brands like Domino’s, Dunkin’ and Taco Bell. On the other hand, it has more than 1,100 locations in 49 states, which aligns with the mold of a widespread brick-and-mortar chain. Sesac is something of the opposite: It got off the ground in the early 1930s, but its business model could be more susceptible to disruption in a way that burgers, tacos and massages are not.

None of this is enough to put the deal in question. The continuing reach for yield globally will see to that, given that $530m of the $560m will carry a fixed interest rate. On top of that, it has Blackstone’s stamp of approval: the private-equity behemoth reportedly paid $1.125 billion for Sesac in 2017. For now, there seem to be few (legal) alternatives for gathering places - even funeral homes - that want to play its artists’ music besides paying up.

Of course, the same could have been said about getting access to Bowie's Space Oddity and Changes when those songs were released.

Regardless, he will forever be a trailblazer bringing music to the bond market. Sesac is simply bringing its whole business.