In our biweekly look at the world of billionaires, we find a clever Russian fertiliser tycoon swanning around in his $300 million yacht and a Chinese internet pioneer pledging 2 per cent of his company’s profit to charity.

Andrey Melnichenko

The stealth-like hull of Andrey Melnichenko’s superyacht is designed to cut through waves leaving barely any wake. The ship, costing about US$300 million, uses a unique submarine shape to remain stable in rough seas. Interiors combine Baccarat-crystal bling with fingerprint-reading gadgetry to unlock cabins.

The swanky boat reflects the same eye for innovation and high-tech detail that Mr Melnichenko, 44, is now focusing on the fertiliser business that helped make him one of Russia’s youngest billionaires. With revenue dropping because of a global surplus and weaker farm income, the tycoon is remaking EuroChem Group into one of the few companies in the world using microorganisms and polymers to tailor-make products so farmers can grow stronger crops.

“We aim to transform ourselves from a manufacturer of cheap commodities into a company that creates and promotes high-tech products,” Mr Melnichenko said in an interview in Moscow.

If Mr Melnichenko’s ambitions for change are uncommon in a Russian resource company, so was his route to commodity riches. Too young to gain from the 1990s privatisation that made many oligarchs’ fortunes, he began trading currency with two friends while a physics student at Moscow State University.

After the Soviet Union fell, the trio registered themselves as a bank, before Mr Melnichenko began buying assets, including in thermal coal and fertilisers. He sold his banking interests in 2007, just before the global financial crisis, allowing him to focus on those industrial investments.

Now he is worth about $10.3 billion, according to Bloomberg.

Shahid Khan

Shahid Khan has emerged as a front-runner in the bidding for the embattled Japanese airbag maker Takata Corp.

The Pakistan-born billionaire, who owns two football clubs – Jacksonville in the NFL and Fulham in the English Premier League – made his fortune selling car bumpers. His breakthrough was coming up with a seamless bumper that was easier to manufacture than bumpers that required several pieces to be welded together.

Mr Khan’s Flex-N-Gate Corp is among the five bidders for Takata. While all five have proposed that Takata seek bankruptcy protection, two of the bidders are insisting on that condition. That could give an edge to the less demanding bidders, which, along with Flex-N-Gate, are the buyout firm KKR and an alliance of Bain Capital and the airbag maker Daicel.

Mr Khan may be able to make up for a lack of experience in air bags with the work ethic that’s propelled his career, according to Jim Womack, who has written books on lean manufacturing and has spoken with Mr Khan about his upbringing in Pakistan.

“He can walk through a factory and have a real sense of what’s going on, unlike a thousand CEOs I’ve met who’ve never done what some of us would call real work,” said Mr Womack. “He’s a driven guy. Not an awful guy but he’s in this to win.”

Mr Khan emigrated as a teenager to the United States, where he started washing dishes for $1.20 an hour.

He began working for Flex-N-Gate while still an engineering student, according to a profile posted on the Jacksonville Jaguars website. He left the company to set up Bumper Works, which designed and manufactured lightweight seamless fenders. Two years later, Mr Khan bought his former employer when the company came up for sale and folded Bumper Works into Flex-N-Gate.

While his story as a hard-working immigrant has a feel-good factor, he can play the heavy.

For example, his company sued a husband-and-wife team over control of a bakery in Jacksonville, Florida, in which a Khan company had invested. The dispute was ugly – workers being served with notices of their dismissal by the Khan camp; the managers fired; the bakery shuttered – but in the end a Florida court sided with the billionaire. Last year, he reopened the bakery under new management.

Mr Khan, now 66, has a net worth estimated at $5bn.

Isabel dos Santos

Win some, lose some.

Isabel dos Santos is Africa’s richest woman, with a fortune that Bloomberg estimates at $2.2bn. She resides in Angola, where her father, Jose Eduardo dos Santos, has been president since 1979.

Ms dos Santos owns stakes in companies including Angola’s largest mobile phone operator, Unitel, and the Portuguese lender Banco BPI. In June, her father named her chairwoman of state oil company Sociedade Nacional de Combustiveis de Angola, known as Sonangol. The move was challenged by the country’s main opposition party, which accused the president of nepotism.

And now, a major bank has declined to do business with Ms dos Santos.

The deal in question involves Portugal’s Anorim Energia. Anorim wants to sell part of its stake in Portugal’s Galp Energia. Anorim is 45 per cent owned by a Sonangal subsidiary; Ms dos Santos is believed to hold a stake in the subsidiary.

Bank of America last month walked away from a role advising Anorim on the deal after the bank’s internal committee did not sign off on the job.

Global investment banks are becoming increasingly sensitive to risks to their reputation in an environment of higher regulatory scrutiny after a number of high-profile cases where companies have been accused of having inappropriate relationships with clients. Bank of America sources confirmed that reputational risk was among the issues the company weighed in making its decision.

Ms dos Santos says she is an independent businesswoman whose successful career is unrelated to that of her father.

Pony Ma Huateng

The Chinese billionaire Pony Ma Huateng, the founder of internet group Tencent, has said his company would donate 2 per cent of its annual profit to charity.

His pledge followed China’s introduction of new laws that provided a legal framework for approved internet companies to raise and manage funds for charity. Mr Ma said the new law provided a missing legal framework in Chinese philanthropy operations and allowed more flexibility in their administration.

Mr Ma tends to keep a low profile. An article last week in Nikkei Asian Review described him thusly: “The tall, slim, steely-eyed 44-year-old remains largely emotionless at the few news conferences he attends. No matter what the question, his expression seldom changes as he calmly reels off his answers as though they were scripted in advance.”

He studied computer science at Shenzhen University and went on to found the predecessor company to Tencent in 1998, just as the internet was about to take off in China.

Bloomberg estimates Mr Ma’s worth at $23.5bn.

Mr Ma’s family is from the Teochew people of coastal China’s Guangdong province. The Chinese billionaire Li Ka-shing is also of Teochew heritage and it was Mr Li’s son Richard who was among the earliest investors in Tencent.

Li Ka-shing

He was an early investor in Siri and Facebook, and now Li Ka-shing is examining start-ups involved in artificial intelligence and 3D printing.

Through his charity, Hong Kong’s richest man has most recently been looking at investing in carmaking via 3-D printing, said Frank Sixt, the director of the Li Ka Shing Foundation, in an interview in Hong Kong on Tuesday. Mr Li is also keen on start-ups involved in artificial intelligence, big data and high-tech food such as the meatless “Impossible Burger”, he said.

Providing seed money may only be a small part of Mr Li’s empire – the 88-year-old runs telecommunications-to-infrastructure giant CK Hutchison – but his interests provide a rare glimpse into the views of a man known as Superman by the local media for his business acumen. Other tech investments he has made in include Siri, Spotify, Airbnb and Google’s DeepMind.

Artificial intelligence, in particular, has been on Mr Li’s mind. In an interview this year the tycoon mentioned the topic at least four times.

David Zalik

An American billionaire who began attending university at age 12 is being credited with having created “the single best fintech company created in the last 10 years, by far”.

David Zalik’s company is called GreenSky. It has 650 employees and is valued at $3.6bn, based on its latest financing. The company matches manufacturers of big-ticket items with consumers – and with banks that are willing to lend to those consumers so they can buy the goods.

A typical loan, to buy windows or roofing for example, might offer 0 per cent interest for 12 months, after which the rate leaps to 17.99 per cent a year.

The opinion that GreenSky is the best company in the vaunted fintech sector comes from an experienced if not impartial source: Steven McLaughlin, a former Goldman Sachs banker whose firm, Financial Technology Partners, advised GreenSky on the September 14 deal in which Fifth Third Bancorp of Cincinnati announced a partnership with GreenSky and simultaneously bought a $50m stake in the company.

Mr Zalik was only 12 years old when, after he achieved an exceptionally high test score, Auburn University asked him to come take courses. He did so for two years, riding his bike to the campus after school, until he enrolled at Auburn full-time at age 14. As he got busier with his computer assembly company, MicroTech, “I started taking fewer and fewer classes”, Mr Zalik said. He eventually dropped out.

He sold MicroTech in 1996 for “a few million dollars” and, at 22, moved to Atlanta, where he started investing in commercial real estate. His timing was good, prices were rising. But after a few years he got itchy to try something new and started a web and mobile-development consulting firm called Outweb. That venture planted the seed for GreenSky.

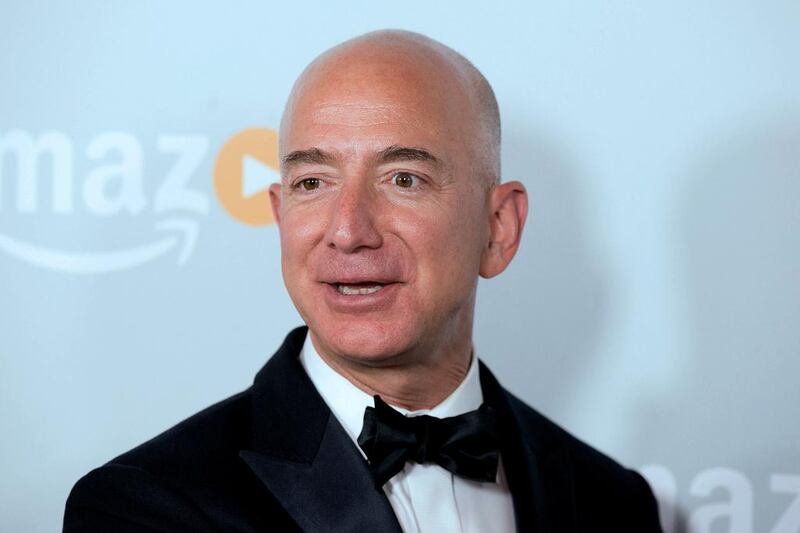

Jeff Bezos

The Amazon king is the second-richest American, according to Forbes.

The magazine’s US rich list for this year places Mr Bezos at $67bn, knocking Warren Buffett and his $65.5bn down a notch to third.

Mr Bezos is riding the surge in Amazon shares, which are up 53.4 per cent for the past year. Mr Bezos had been in fifth spot on last year’s list with a mere $45.2bn.

Mr Buffett has not been helped by the fake-accounts scandal at Wells Fargo, which accounts for about a sixth of his share portfolio. The bank’s stock is down 16.5 per cent over the past year.

Bill Gates retains the top spot for the 23rd year in a row with $8bn. Rounding out the top 10 are Mark Zuckerberg in fourth, followed by Larry Ellison, Michael Bloomberg, the mining magnates Charles and David Koch, and the Google co-founders Larry Page and Sergey Brin.

Mr Bloomberg owns the Bloomberg business-news service, which does not include him in its rival index of the world’s wealthiest people. The Bloomberg list, which is updated daily, has the rest of the US top 10 in the same order as Forbes, though with slightly varying values.

* Agencies and The National