Tesla Motors, the electric car company part-owned by Abu Dhabi investors, raised US$226 million (Dh830.1m) yesterday in an initial public offering (IPO). The company, which has yet to make a profit, said shares sold in the IPO were priced at $17, above the $14 to $16 range it expected. Tesla sold about 13.3 million shares to finance factories it needs to expand production and compete with makers of hybrid cars such as Honda and Toyota.

Tesla is about 4 per cent owned by Aabar Investments, a company that is in turn 70 per cent owned by the International Petroleum Investment Company, an Abu Dhabi Government investment arm. An additional stake of about 8 per cent is held by the Abu Dhabi Water and Electricity Authority, according to US Securities and Exchange Commission filings. Analysts said the higher than expected share price could boost stock markets, although they cautioned that the company's long-term prospects were far from certain.

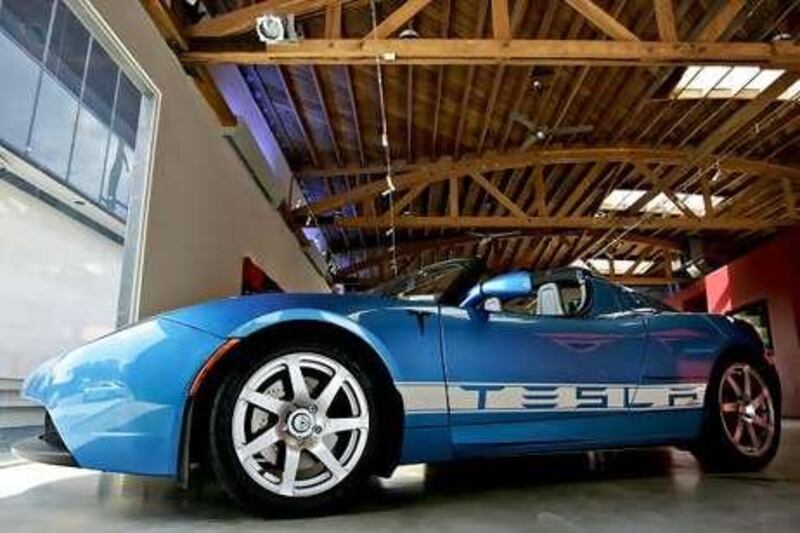

Tesla's only model, its $109,000 Roadster, has been snapped up by celebrities including the actors George Clooney and Brad Pitt but low production numbers and high prices have prevented it from entering the general consumer market. Tesla plans to sell a new Model S saloon by 2012 priced at less than $50,000 after US government tax credits. That model could see more interest from average US consumers, although cheaper electric cars slated to go on sale this year from Nissan and Chevrolet are expected to provide tough competition.

The Tesla IPO was the first for an American car company since Ford Motors went public in 1956. Elon Musk, the chief executive, helped start the company after selling two internet businesses, PayPal and Zip2, for almost $300m. While Tesla has lost more than $290m since its founding in 2003, it has received staunch support from the US government through a $465m department of energy loan. Barack Obama, the US president, has set a goal of putting a million electric cars and fuel-electric hybrids on the country's roads by 2015.

Trading in Tesla shares is expected to start today on the New York-based NASDAQ stock exchange under the symbol "TSLA". afitch@thenational.ae