Takahiro Hayashi won his first nationwide title in shogi - Japanese chess - while still in high school, and by the age of 22, he was the world amateur champion.

His coaches were urging him to turn pro.

But Mr Hayashi wanted to be an entrepreneur, not a chess player. And so, in 2009, he found himself in a room with some local venture capitalists, presenting a 120-page pitch about his social game firm. The financiers kind of tuned out.

“One of the investors told me that he didn’t really listen to the explanation of our business plan,” the 41-year-old Mr Hayashi said at Heroz’s headquarters in Tokyo. “He said that ‘You’re a world champion, so you’ll work something out.”’

Mr Hayashi got the financing. “It blew my mind,” he said. But so far at least, the VC executive’s bet has proved profitable. Mr Heroz, which went on to develop artificial intelligence technologies through the creation of online games such as shogi and then use AI for a range of other services, is now a public company, and its shares are thriving.

In April, the company listed on a start-up market on the Tokyo Stock Exchange. It was a record-breaking debut. The shares opened 11 times higher than the IPO price, the best ever start of trading by a Japanese listed company. The stock has almost quadrupled since going public, although the shares closed down 3 per cent at 16,580 on Monday.

“I didn’t think it would be so successful,” said Hideto Fujino, one of Japan’s most famous stock pickers, who took a stake in the company as a personal investment before Heroz went public and is now one of the top 10 shareholders. Mr Fujino, a keen shogi player himself, says he bought the stock initially to encourage the company, rather than because he expected to profit. “It was more a form of support,” he said.

Heroz released its game “Shogi Wars” in 2012. The following year, an artificial intelligence engine developed by an engineer of the company became the first to defeat a professional player of Japanese chess.

That was about 16 years after Deep Blue, a chess computer created by IBM beat then world champion Garry Kasparov. Shogi is more complex than chess because pieces return to the board after being captured, increasing the number of move permutations that must be considered.

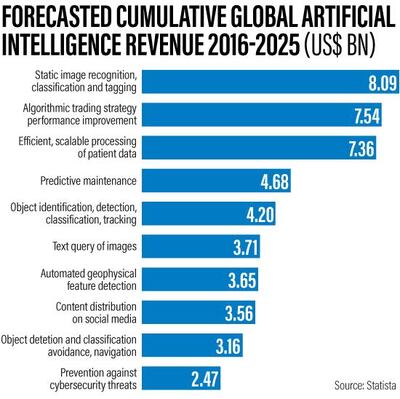

After building the new Deep Blue, Heroz used the deep learning and machine learning skills it acquired to expand into other areas - everything from construction to financial services.

It couldn’t have come at a better time. The AI industry is expanding rapidly in Japan, where a shrinking workforce is causing the tightest labour market in decades, creating an opportunity for companies to use the technology to help fill vacancies and improve efficiency. The Japanese AI market may top $18bn by fiscal 2030, a more than seven fold increase from fiscal 2016, according to Fuji Chimera Research Institute estimates. “There’s huge potential,” Mr Hayashi said.

Heroz has been working with Takenaka, the construction company that developed Japan’s tallest tower, to create an AI system to help design buildings. The system will crunch Takenaka’s existing structural design data and learn from its architects to provide various patterns for how buildings could be designed. Architects then compare the patterns and consult with clients to decide which one to use.

Takenaka expects to reduce the routine work associated with designing building structures by some 70 per cent, giving its professionals more time to focus on being creative. It aims to develop a prototype of the AI system by the end of this year and put it to use by 2020.

“Structural design is a lot like shogi in that you’re choosing the best of various options,” said Hirokazu Yoshioka, the head of technology planning at Takenaka. “So Heroz is the perfect partner for the AI system we want to make.”

Heroz has also formed a partnership with Tokyo-based Digital Hearts to use AI technology for software testing. If all goes to plan, the AI engines will learn by themselves the best way to test programs.

And in the world of finance, Heroz has tied up with online brokerage Monex to provide robo-advice for people who trade currencies. The system analyses their past performance and provides suggestions for improvement.

With all the excitement about Heroz’s stock, valuations have gone through the roof. The shares trade at 38 times book value and 210 times earnings.

_______________

Read more:

UAE to strengthen ties with Japan in technology, education and industry

Games licence approval freeze in China said to throw biggest market into disarray

_______________

Short sellers have been descending. Short interest stood at 59 per cent of the free float as of August 13, according to IHS Markit data. That’s the highest level among the 253 companies in the Mothers Index of emerging stocks.

“It’s overvalued,” said Mitsushige Akino, an executive officer with Ichiyoshi Asset Management in Tokyo. “It’s an excellent company, but people’s expectations are too high and the shares have gone up too far.”

Heroz now has a market value of ¥58 billion (Dh1.92bn). That means Mr Hayashi and his co-founder Tomohiro Takahashi, who each have 37 per cent stakes, are each worth more than $190m from their shareholding alone. The market decides the share price, so it’s difficult to comment on it, Mr Hayashi said.

But he does have one target in sight. The sixth-dan shogi player, generally the highest rank for amateurs, wants Heroz to become the next Japanese company with a market value of more than ¥100bn.

“When we founded Heroz, we told investors that we wanted to create a ¥100bn company,” Mr Hayashi said.

“It’s not worth doing if we don’t grow to that level.”