Uber’s sales are dramatically slowing even as the ride-hailing company is spending more to fuel global growth, particularly in its food delivery business.

Revenue growth of 38 per cent in the third quarter was almost half of what the growth rate was six months earlier, when the company was negotiating a $9.3 billion investment led by SoftBank Group.

That’s a troubling sign for a serially unprofitable business that hopes to get valued like a technology company in a planned initial public offering next year. Uber Technologies lost $1.07bn in the quarter ended September 30, an improvement over a year ago, but the loss widened 20 per cent from the second quarter.

Highly valued companies typically grow quickly or generate big profits - and great ones do both. In the fourth quarter of 2005, Amazon.com had about the same revenue as Uber’s today - just under $3bn, not adjusted for inflation. Yet, Amazon earned $199 million in profit and was worth about a fourth of Uber’s $76bn valuation.

Uber released a limited set of financial information on Wednesday, a move the privately held company voluntarily does each quarter. The San Francisco-based company also offered a glimpse into its food delivery business for the first time. A spokesman said Uber Eats generated $2.1bn in gross bookings. That represents 17 per cent of Uber’s $12.7bn in gross bookings last quarter.

The emergence of Uber Eats as a promising new business has been good news for a company that’s hoping to argue in its IPO pitch that it can build a suite of similar offerings. Uber is now eyeing electric-scooter rentals, logistics and autonomous cars.

But just as there is lingering uncertainty about the profitability of Uber’s core ride-hailing business, whether the company can build a profitable food-delivery service is unproven. While food is boosting Uber’s gross revenue, it’s shrinking the company’s margins. Uber didn’t provide exact figures on the impact.

_______________

Read more:

Daimler and China's Geely to launch ride-hailing service

Uber's Middle East rival Careem secures $200m in funding

_______________

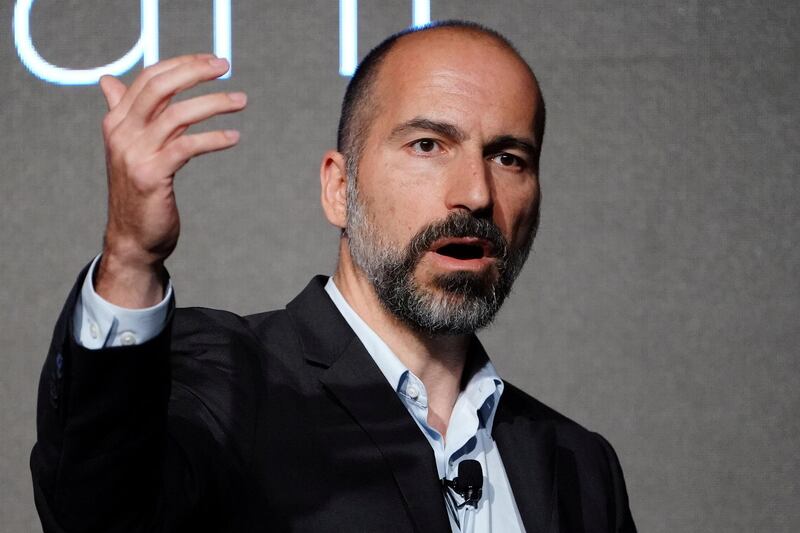

On Tuesday, chief executive Dara Khosrowshahi defended the company’s ability to achieve profitability. He argued that some ride-hailing markets generate profit for Uber after accounting for local operations teams, drivers and other regional expenses. In the US, however, the business is not profitable even by this lower standard. “In the US, which is our largest market, we’re in a big battle” with Lyft., he said.

Mr Khosrowshahi has said publicly that Uber is targeting a public offering in the second half of 2019. Privately, he’s told investors that he’s aiming for the first half of the year, people familiar with the matter have told Bloomberg. Lyft is also considering an IPO in the first half of next year, sources have said.

Uber had $6.55bn in cash on hand at the end of the quarter, not including the $500 million it recently raised from Toyota for its $2bn debt offering.

“We had another strong quarter for a business of our size and global scope,” chief financial officer Nelson Chai said. “As we look ahead to an IPO and beyond, we are investing in future growth across our platform, including in food, freight, electric bikes and scooters, and high-potential markets in India and the Middle East where we continue to solidify our leadership position.”