Uber said on Wednesday that it narrowed its quarterly losses from a year earlier, although the ride-hailing company is still a long way from proving it can be profitable as it gears up to go public in 2019.

Under the leadership of Dara Khosrowshahi, who became chief executive in September, Uber has juggled investing in new markets while retreating from others where it was losing millions of dollars. It is building services such as food delivery and freight hauling as it seeks new revenue, and possibly a path to profitability, outside its core business.

Uber's net loss narrowed to US$891 million (Dh3.27 billion) in its second quarter ending June 30, from $1.1bn a year earlier. Its adjusted loss before interest, taxes, depreciation and amortisation was $614m, down from $773m a year earlier.

Net revenue rose faster than gross bookings in the second quarter from the prior period as the company dialled back on promotional subsidies of rides.

_______________

Read more:

[ London taxi drivers lay plan for £1 billion Uber lawsuit ]

[ Uber to create separate business with trucking unit ]

_______________

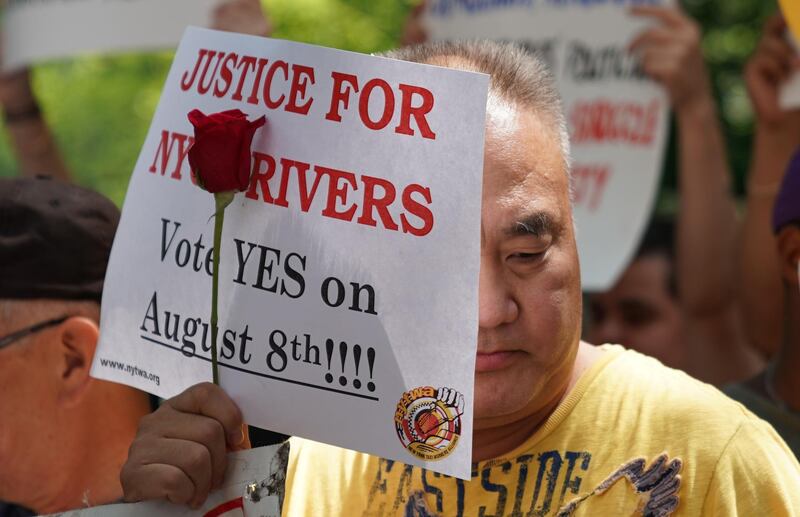

But its growth faces risks from decisions such as that by New York this month to cap licences for ride-hailing services for one year. Uber has also had to grapple with corporate scandals, and has lingering and costly legal battles, including over its classification of drivers as independent contractors, and federal probes to resolve.

“I remain unimpressed,” said Brent Goldfarb, associate professor of management and entrepreneurship at the University of Maryland. Improving losses by cutting “the lowest hanging fruit doesn’t mean the underlying model is profitable”.

The company's most recent valuation was pegged earlier this year at $72bn. But that was based on Uber becoming the global winner in ride-hailing and logistics, a vision it has retrenched from, and public investors may see a smaller company worth less.

Uber can expect a valuation haircut in an IPO if it does not show more progress towards becoming profitable, said David Brophy, professor of finance at the University of Michigan.

Adjusted losses in the first quarter were $312m, excluding gains from Uber selling some overseas businesses to local competitors. The sale of its Russia and South East Asia operations resulted in a one-time $2.5bn gain in the first quarter and lowered second-quarter costs.

Under pressure from its board, Uber has endeavoured to find more savings after years of a growth-at-all-cost mentality under prior chief executive Travis Kalanick, enabled by billions of dollars in private investment.

The company had $12bn in quarterly gross bookings, which includes rides and Uber Eats, up 6 per cent from the previous quarter and about 40 per cent from a year before.

Net revenue, which strips out what is paid to drivers as well as promotions and refunds, was $2.8bn, up 8 per cent over the first quarter and more than 60 per cent from last year.

“We had another great quarter, continuing to grow at an impressive rate for a business of our scale,” Mr Khosrowshahi said in a statement.

Uber is a private company and not required to publicly disclose its finances, but recently boosted transparency by starting to release selected figures as it eyes an initial public offering.

Faced with criticism about flooding cities with cars, Uber is spending on bike and scooter rentals, including its acquisition of Jump electric bikes in April.

While Uber has retreated from China, South East Asia and Russia, it says it is sticking with India and the Middle East, tough markets with strong local competitors.

“We are cementing our leadership position,” in India and the Middle East, Mr Khosrowshahi said.

Several Uber investors have told Reuters they want Uber to also leave these costly markets and focus on North America, where US-based Lyft continues to pose a threat, and pull back on ancillary businesses such as Uber Freight.

Uber has $7.3bn in cash on hand, up $1bn from the end of the first quarter. The company listed an inflow of $1.5bn from term loan issuance, net of costs.