After a tumultuous 2019 that saw the implosion of its WeWork public offering, SoftBank’s Vision Fund expects up to seven companies that it has stakes in, to go public by the end of next year, its chief executive said. In tandem, it will boost its investment in artificial intelligence and technology companies that helped propel it back into the black amid the Covid-19 pandemic.

"AI is going to disrupt and be a bigger disruptor than the internet, which took 20 years to disrupt a lot of industries," SoftBank Investment Advisers chief executive Rajeev Misra said in an interview with The National. "The acceleration of disruption went up dramatically due to Covid. The market share gain achieved by many of our companies that would have taken three years to happen, happened in the last nine months. Many of our companies have huge tail winds."

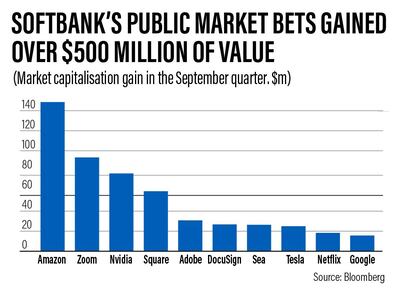

SoftBank Group posted a net profit attributable to shareholders of about 628 billion yen ($6bn) for the three months to the end of September, compared with a loss of 700bn yen in the same period a year earlier. The bottom line was helped by a $10bn gain from the Vision Fund's investments.

As of September, Vision Fund 1, backed by Abu Dhabi's Mubadala Investment Company and Saudi Arabia's Public Investment Fund, has returned $13.4bn to investors, who have put in $83bn out of $98.6bn of committed capital into its first fund. The fund’s biggest position is Uber, which is about $9bn in fair value.

Its second fund has made smaller-sized investments of $100 million-$200m and is entirely backed by $10bn committed from SoftBank. Of that, $2.6bn has been invested, which has more than doubled in value to $7.6bn, largely on the back of the listing of Ke Holdings (also known as Beike), an online Chinese real estate brokerage company that has 50 per cent of the market in Shanghai and Beijing.

The Vision Fund had invested nearly $1.4bn in Beike when the company had a $5bn valuation, ahead of its IPO in August after which its market cap surged to about $75bn. The fund’s investment in Beike is now worth more than $6.5bn, a 375 per cent return.

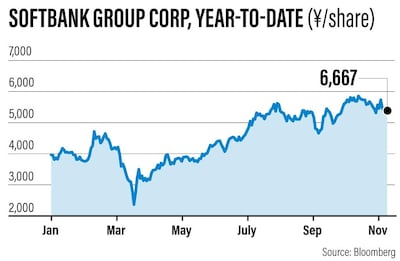

SoftBank Group’s stock price is up 43 per cent since the close of trading on Friday. Its balance sheet has gained from selling stakes in T-Mobile, Alibaba and may realise a profit of 30-40 per cent on the sale of UK chip designer Arm for up to $40bn to California-based Nvidia, if that’s finalised.

If ByteDance, the parent of TikTok which is back by SoftBank, lists on Hong Kong, the company is sure to gain. Vision Fund has invested $2.5bn in ByteDance, at a $70bn valuation.

SoftBank-backed food delivery platform DoorDash, which has more than 18 million customers and earned $1.92bn in the first nine months of the year, three times the same period a year earlier, filed for an IPO last week. The company is expected to go public next month.

“In the next 12 months until the end of December 2021 we should have another five to seven IPOs,” Mr Misra said. Though he plays down the WeWork debacle his investment outlook is very much risk on.

While the pandemic decimated the travel and lodging industries it has been a boon to many technology businesses that have augmented digitisation, facilitated communication, telemedicine and harnessed the power of AI.

“The investing thesis for the vision fund is that we invest in AI companies that are disrupting existing economies, that are disrupting bricks and mortar companies,” Mr Misra said. “We are investing more in companies that are asset light. In sectors like healthcare, online education, software, e-commerce. We believe even more after the last nine months that these companies will grow and disrupt even faster as human behaviour has changed permanently towards going digital and online.”

Covid has influenced the direction of the Vision Fund’s investment strategy and it appears likely Mr Misra will double down on tech and AI.

Last week, SoftBank through its Vision Fund 2 made its first e-scooter investment, leading a $250m investment in Germany’s Tier, which uses swappable batteries and local charging networks. That was the largest funding round for a European e-scooter company to date.

“Europe is going to go green. There are going to be large parts of cities like Berlin, Paris and others that are going to reduce cars,” Mr Misra said. The Tier investment “became a lot more compelling to make … post Covid when people are in lockdown and want to avoid public transport”.

To make his point Mr Misra pointed to Chinese ride sharing company DiDi, which he says is a bellwether of the future. China’s ride share analytics as of September, he said, were higher than any other month in the past and pre-Covid.

“China has recovered from Covid way ahead of any other economy apart from South Korea,” Mr Misra said. “DiDi is the pulse of China like Alibaba.”