Samsung Electronics warned investors on Wednesday that Japanese curbs on the export of chip-making materials was blurring its outlook and said it would delay a plan to return money to shareholders due to "significant new challenges".

The South Korean tech giant also posted a 56 per cent plunge in June-quarter profit as an oversupply of memory chips continued to weigh down prices.

The second-quarter profit decline and uncertain outlook overshadowed the company's optimism that the chip market had bottomed out and would start to recover in the second half. Samsung shares were down almost 3 per cent, underperforming the broader market.

"In addition to already high uncertainties caused by prolonged global trade conflicts, the external environment regarding our component business has recently come under significant new challenges," said Robert Yi, Samsung's head of investor relations.

"As a result, we no longer believe it is possible to reasonably predict or forecast our free cash flow for 2018 through 2020," Mr Yi added.

Like other global tech companies, Samsung has been hurt by a long-running trade war between the United States and China, and an escalating dispute between Japan and South Korea is likely to pressure third-quarter results.

Outlook from the chip leader is closely watched by investors as a barometer for demand of smartphones and other electronics, as well as servers that process massive amounts of data.

The company will be flexible about memory-chip production, Samsung said. Smaller South Korean rival SK Hynix, which also has warned of possible disruption in its chip manufacturing due to the Japanese curbs, said it would cut investment and production to curtail supply.

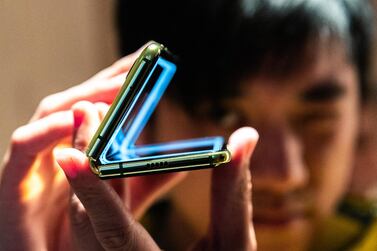

Samsung, also the world's biggest smartphone maker, said its mobile business remained weak. Its stock, which has gained 20 per cent so far this year, fell 2.6 per cent as of 6.38am UAE time while the broader market was down 0.9 per cent.

"Server demand is expected to increase gradually as customers adjust their inventory levels and resume purchasing, while PC demand is also likely to expand," Samsung said, referring to Dram demand.

Operating profit in Samsung's chip business, its biggest earner, plunged 71 per cent to 3.4 trillion won (Dh10.55 billion), from 11.6tn won a year earlier.

The mobile business booked 1.6tn won in quarterly profit, down 42 per cent from a year ago, weighed by slower sales of flagship models and increased marketing expenses.

Global smartphone shipments fell 3 per cent in the second quarter, according to research firm Strategy Analytics, while Samsung boosted shipments by 6.7 per cent and stayed on top with a 22 per cent market share.