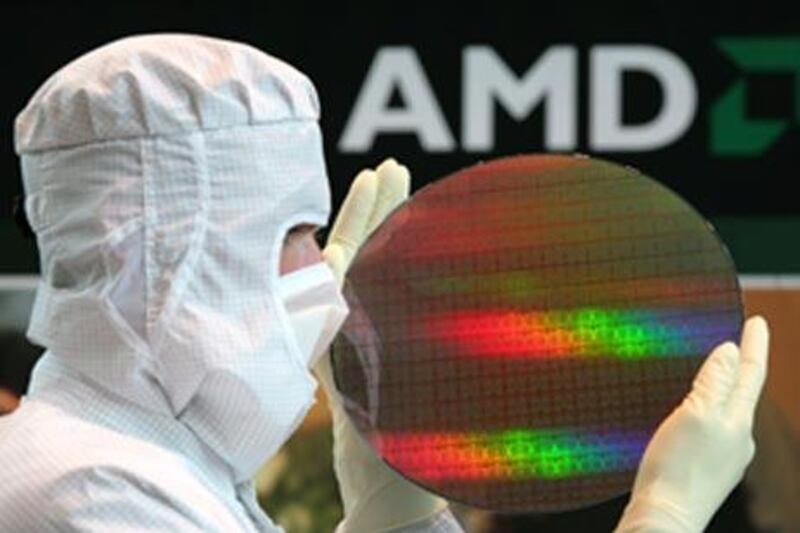

The US computer chip maker, AMD, failed to obtain approval for a multibillion-dollar joint-venture deal with Mubadala Development Company on Tuesday, because too few shareholders participated in a special meeting to vote on the issue. The venture is the UAE's largest technology investment and will provide a foothold in the competitive global market for semiconductor products. Although 97 per cent of votes were in favour of the plan, just 42 per cent of shareholders took part in the vote. For such a vote to be valid, more than half the company's shareholders must participate and at least half of those must vote in favour. AMD management acknowledged the company moved too fast in holding the vote, and said it would ensure more shareholders take part in a new vote, scheduled for next Wednesday. The proposed deal will spin off AMD's manufacturing system into a new company majority-owned by the Advanced Technology Investment Company (ATIC), a Mubadala affiliate. Mubadala will also double its ownership of AMD, to almost 20 per cent, and obtain a seat on the AMD board. The agreement, which was approved by the US government last month, is widely seen as a financial and strategic lifeline for AMD, which has struggled to turn a profit in the past decade as it competes with Intel, its larger rival. AMD's value has plummeted since the Mubadala agreement was first announced, and the company lost a further 8 per cent of its value after Tuesday's failed vote. Abu Dhabi officials close to the deal reiterated that their investment in the chip-making business was long-term and strategic, saying difficult economic times and the troughs of a cyclical industry do not detract from the long-term appeal of the plan. ATIC aims to eventually build microprocessor fabrication plants in Abu Dhabi. On the same day as the unsuccessful vote, Intel announced it would invest US$7 billion (Dh25.71bn) upgrading its US plants in the coming years. The investment will enable the company to produce microchips made of silicon wafers just 32 nanometers, or billionths of a metre, thick. Both Intel and AMD are currently producing chips using a 45nm process, and AMD is not expected to shift to the new 32nm process until 2011. Intel said its first products made under the new process would come out by the end of the year. "Intel always needs to move first because of their system architecture," said Gaith Kadir, the general manager of AMD in the Middle East. "AMD's architecture means that we don't need to shift to the next process as fast as Intel does." But by shifting to the thinner silicon wafers, Intel will be able to cram more processing power into smaller spaces, while decreasing power consumption and heat output, key factors for both laptop makers and corporate data centres. It will also help Intel to push its chips into smaller, increasingly complex consumer electronics devices such as mobile phones. "These manufacturing facilities will produce the most advanced computing technology in the world," said Paul Otellini, Intel's chief executive, who will visit the UAE next week. "The capabilities of our 32nm factories are truly extraordinary, and the chips they produce will become the basic building blocks of the digital world, generating economic returns far beyond our industry." tgara@thenational.ae

No show hits AMD move for deal

US computer chip maker fails to obtain approval for multibillion-dollar deal with Mubadala Development Company.

Editor's picks

More from the national