India’s new rules for foreign e-commerce platforms may be designed to protect local companies from Amazon.com and Walmart but consumers are likely to suffer the collateral damage.

Online marketplaces must treat all vendors equally by providing the same terms, India’s trade ministry said last week. In practice, this means barring e-commerce companies from forcing a seller to feature products exclusively on their platforms, and limiting ownership or control over the marketplace’s inventory. The government says the changes will promote fair trade and curb foreign companies’ influence in setting domestic prices.

This could mean that platforms offered by e-commerce giants such as Amazon and Walmart’s Flipkart may be prohibited from offering their own goods - such as the Echo smart speaker - at heavy discounts, while allowing rivals the opportunity to sell previously proprietary products.

“Consumers in India will most likely bear the brunt of these changes and be negatively impacted,” said Jennifer Bartashus, a retail industry analyst for Bloomberg Intelligence. “Prices will go up as discounts evaporate, and product options and availability may contract as e-commerce marketplaces strive to remain compliant with the new rules.”

The rules could be a blow for the US-based Amazon and Walmart, which are attempting to crack India’s consumer market and capture its growth potential. Amazon lost an estimated $3 billion on its international efforts in 2017, and analysts believe most of that was in India.

Walmart in May spent $16bn to acquire Amazon’s primary rival in India, online retailer Flipkart. China’s Alibaba has a stake in the country’s largest online grocer, BigBasket, and an investment in popular online retailer called Paytm E-commerce.

Currently, India’s regulation means that foreign investors are prohibited from running online platforms directly, barring them from selling anything other than food directly to consumers.

Foreign investors have circumnavigated this rule by investing in joint ventures with local businesses, and everything on the Amazon.in marketplace is listed by an independent seller.

The new rules are an attempt to stop foreign companies using the existing loophole. Foreign investors that have an equity stake in a platform will also not be permitted to sell their products on it.

The new rules, effective February 1, could help Prime Minister Narendra Modi’s Bharatiya Janata Party win support of local traders - a key voting bloc for the party that suffered defeats in provincial elections last month. The south Asian nation is key to global retailers as it has a billion plus population but only a few million of them own smartphones, offering them the opportunity of exponential growth in online consumption.

“It’s a big achievement after a long struggle,” said Praveen Khandelwal, secretary general of Confederation of All India Traders. “If it is implemented in proper spirit, malpractices and predatory pricing policy and deep discounting of e-commerce players will be a matter of past.”

Walmart’s Flipkart unit said e-commerce has the potential to create millions of jobs for India and any policy changes will have “long-term implications in the evolution of the promising sector.”

“It is important that a broad market-driven framework be developed through a consultative process in order to drive the industry forward,” Flipkart said.

BC Bhartia, president of the Confederation of All IndiaTraders, said some small businesses had seen earnings more than halve in the last few years as they struggle to compete with low prices offered by the American-controlled behemoths. He said the rule tightening would not be enough to help.

"The last minute policy change is too little and too late," he said.

In particular, retailers and traders believe Mr Modi turned a blind eye to what they say was the use of policy loopholes by major e-commerce companies to offer heavy discounts that allowed them to seize market share for goods such as electronic items.

Asked about those accusations, Amazon India said it had always operated "in compliance with the laws of the land" and that had more than 400,000 small and medium businesses on its marketplace.

_______________

Read more:

E-commerce players turn to physical store growth in India

Modi government misses target to provide electricity to every home

_______________

Flipkart declined to comment on the specific allegations.

Small Indian businesses have also been bruised by other Modi policies, including a sudden ban on the use of high-value currency notes in late 2016 and the launch of a national sales tax in 2017, both of which raised compliance costs, Reuters said.

Mr Bhartia said if the government was serious about the concerns of small traders, it should prosecute violators of trade rules and appoint an independent regulator to curb malpractice.

A government official told reporters last week the administration could consider demands for a regulator in its new e-commerce policy, expected to be released in the coming months.

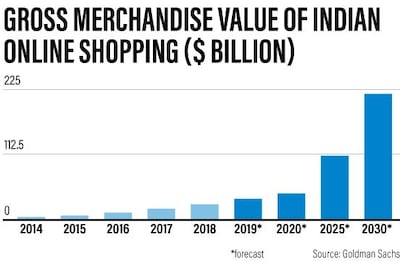

A September report by PricewaterhouseCoopers estimated online commerce in India would grow 25 percent a year for next five years, hitting $100 billion a year by 2022.

The new curbs could harm those growth prospects and discourage some foreign investors, said investment consultants.

"Sentiment is definitely hurt," said Harminder Sahni of retail consultant Wazir Advisors, adding that the policy suggested online retail business should only be done by Indians.

The new rules will create uncertainty for Flipkart as the company evaluates any strategy changes, Ms Bartashus said. If foreign players’ ability to offer products at discounted prices is hindered, that could impact sales and profitability, she said.

Amazon said it was evaluating the new guidelines to engage as necessary with the government so it could remain true to its vision of "transforming how India buys and sells and generating significant direct and indirect employment".

Flipkart said the advent of the e-commerce industry "was set to be a major growth driver for the Indian economy and create millions of jobs in the future".

"It is important that a broad market-driven framework through the right consultative process be put in place in order to drive the industry forward," it added.

The government boasts of attracting nearly $223 billion foreign investment in the last four years, compared with about $152bn in the previous four years.

In its own bid to grow presence in India, Apple is said to be about to start assembling its top-end iPhones in India through the local unit of Foxconn as early as 2019, the first time the Taiwanese contract manufacturer will have made the product in the country, according to a source last week.

Importantly, Foxconn will be assembling the most expensive models, such as devices in the flagship iPhone X family, the source said, potentially taking Apple's business in India to a new level. The work will take place at Foxconn's plant in Sriperumbudur town in the southern state of Tamil Nadu, said the source.

Foxconn, which already makes phones for Xiaomi Corp in India, will invest 25 billion Indian rupees ($356 million) to expand the plant, including investment in iPhone production, Tamil Nadu's Industries Minister M C Sampath told Reuters.

The investment may create as many as 25,000 jobs, he added.

Ivan Feinseth, an analyst at Tigress Financial Partners, said that the new e-commerce rules are politically motivated and will create higher prices for Indian consumers. The impact will likely be less for big e-commerce players like Amazon and Flipkart, meanwhile, since they already offer products from local merchants and will be able to operate with little or no profits for a while in a bid to gain market share.

“This is overall bad for the consumer, but it has been good for the current Prime Minister Narendra Modi,” Feinseth said. “The local vendors cannot compete on the scale.”