Start-ups in the Middle East and North Africa secured $659 million (Dh2.4 billion) in funding in the first half of the year, an increase of 35 per cent year on year, according to data platform Magnitt.

The increase was largely driven by a few start-ups that were involved in sizeable and high-profile funding rounds before the coronavirus outbreak began, Magnitt’s Mena Venture Investment Report for the period said.

Major funding rounds in the first six months of the year included $60m for Dubai's cloud kitchen company Kitopi, $40m for Egyptian health technology start-up Vezeeta, $150m for Dubai-based Emerging Markets Property Group and $36.5m for Saudi Arabia's food delivery app Jahez.

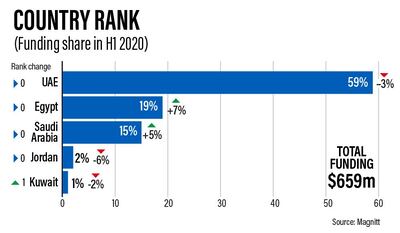

The UAE received the largest share of funds raised, which was attributed to several later-stage investment deals, while Egypt still ranks first in terms of the number of deals, accounting for 25 per cent of the Mena region's total.

While the amount of funds raised increased, the number of deals in the first six months fell by 8 per cent year on year to 251, with the biggest drops recorded in March and April.

“We are seeing a shift in investor appetite when it comes to start-up development stages,” Philip Bahoshy, Magnitt’s founder and chief executive, said.

“There are two key factors at play: first, the full impact of Covid19 is likely to hit later in the year ...

"Second, what we see is that more later-stage investments with larger round sizes have been taking place.”

That illustrates “larger bets” are being made on more established companies, “which can provide them [with] a longer runway to weather the challenging times ahead”, Mr Bahoshy said.

The report highlighted how the coronavirus crisis is affecting investment in Mena start-ups. Besides the preference for later-stage investment deals, many investors are opting to back industries such as e-commerce, FinTech and healthcare technology.

Another 27 per cent of investors indicated they had shifted their focus to industries that were positively affected by the virus, according to a separate study carried out by Magnitt and France’s Insead graduate business school.

Among the sectors most popular with investors, FinTech start-ups accounted for the largest share of investment deals in the first half.

Property was ranked first in terms of total funding, as EMPG counts property portal Bayut and classifieds site dubizzle among its brands.

The food and beverage sector registered the largest jump in total funding due to Kitopi’s $60m fund-raising round.

E-commerce accounted for 14 per cent of all deals. Delivery and transport accounted for 10 per cent, recording a jump in activity in the second quarter.

Looking forward, 75 per cent of investors said they believe the Mena region is heading towards a recession, according to the report.

The International Monetary Fund forecasts that the global economy will contract by 4.9 per cent this year and slide into the deepest recession since the Great Depression.

Start-ups are more pessimistic, with 24 per cent saying that the region is heading towards a depression, compared to just 6 per cent of investors.

However, most start-ups and investors expect the crisis to be over within nine months, with 61 per cent of founders and 48 per cent of investors expecting the crisis to end by the first quarter of next year.