Elon Musk, the billionaire founder of Tesla Motors, said the price of Bitcoin and Ethereum "seem high" after the cryptocurrencies surged to record levels on Saturday.

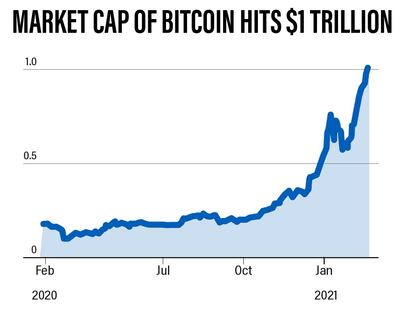

Bitcoin, which has surged more than 55 per cent since the start of February, increased almost 3.5 per cent to a record high of $57,527 per coin on Saturday. After soaring almost 350 per cent in the past six months, its market value reached more than the $1 trillion mark on Friday.

Ethereum, the second-largest cryptocurrency by market capitalisation, hit a record $2,040.6, for a weekly gain of nearly 12 per cent, on Saturday.

"That said, BTC & ETH do seem high lol," Mr Musk said in a tweet in response to a user who said gold was better than crypto and cash.

"An email saying you have gold is not the same as having gold. You might as well have crypto. Money is just data that allows us to avoid the inconvenience of barter. That data, like all data, is subject to latency & error. The system will evolve to that which minimises both," he added.

That said, BTC & ETH do seem high lol

— Elon Musk (@elonmusk) February 20, 2021

Earlier this month, Tesla, the world's biggest electric vehicle company, said it plans to accept Bitcoin as a mode of payment for its EVs and has invested $1.5 billion in the cryptocurrency.

The announcement led the digital currency to rally and sparked more interest in Bitcoin, which is mostly used as a speculative investment instrument rather than a mode of day-to-day payment. Some industry analysts are bullish and expect it to touch the $65,000 mark.

On Friday, Mr Musk defended Tesla's purchase of Bitcoin, saying it is "adventurous enough" for an S&P 500 company.

But he also said: "Tesla’s action is not directly reflective of my opinion. Having some Bitcoin, which is simply a less dumb form of liquidity than cash, is adventurous enough for an S&P500 company."

Tesla’s action is not directly reflective of my opinion. Having some Bitcoin, which is simply a less dumb form of liquidity than cash, is adventurous enough for an S&P500 company.

— Elon Musk (@elonmusk) February 19, 2021

Tesla's stock closed almost 1 per cent down at $781.3 per share on Friday. Its shares have dropped more than 7.5 per cent in the past month.

"To be clear, I am not an investor, I am an engineer. I don’t even own any publicly traded stock besides Tesla. However, when fiat currency has negative real interest, only a fool wouldn’t look elsewhere," he said.

Uber's chief executive Dara Khosrowshahi has also supported the cryptocurrency. He said the ride-hailing giant will start accepting Bitcoin and other cryptocurrencies as a form of payment if it benefits the business and if there is a need for it.

Global payments firm Mastercard is reportedly planning to offer support for some cryptocurrencies on its network this year. It already allows its customers to do crypto transactions but outside the company’s formal network.

The US food and beverage company Pepsi is also discussing options to buy Bitcoin.

In an interview with Bloomberg TV last week, Nouriel Roubini, a professor at New York University’s Stern School of Business and a fierce critic of cryptocurrencies, said Bitcoin’s surge was a result of "a massive amount of manipulation".

He said the digital currency had no value and described its gains as a "bubble".

Mr Roubini said Bitcoin was not a currency or a unit of account.

"It is not a scalable means of payment [and] it is not a stable store of value ... the Flintstones had a better monetary system than Bitcoin," Mr Roubini said.

"These are not currencies. Calling them cryptocurrencies is a misnomer; they are not even assets."