The sandstorm in August was so severe it could be tracked from the skies by satellite.

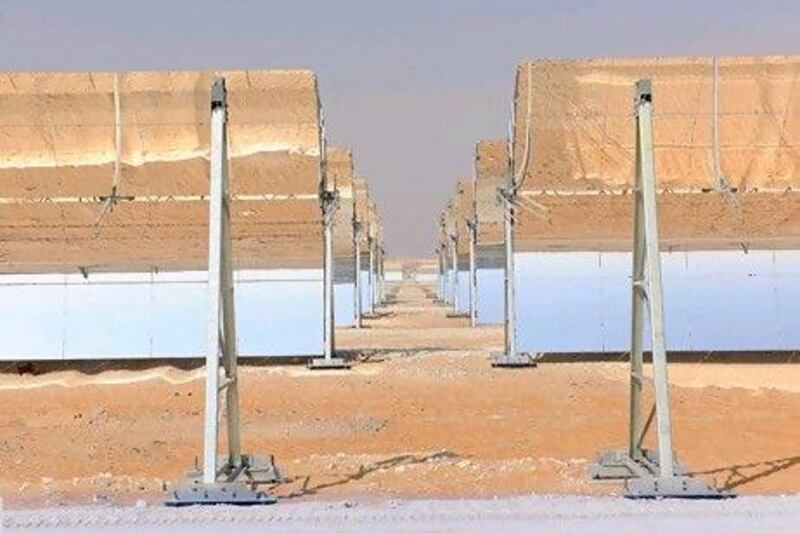

Little wonder, then, the wind shattered a dozen giant curved mirrors near Madinat Zayed, where one of the world's biggest solar power stations is now almost complete.

After the storm, workers quickly finished a fence to help shelter the 258,048 mirrors vulnerable to the desert's sometimes violent weather.

Shams 1 in Al Gharbia is Abu Dhabi's US$700 million (Dh2.57 billion) solar plant and the final component, an electrical transformer is en route from Germany. Developers hope to start commissioning the system this month and the plant's 100 megawatts could come online as soon as August.

"We are very happy with the way the Shams project is developing," says Jean-Marc Otero Del Val, a deputy senior vice president in the gas and power division of Total, the French energy giant that partnered Spain's Abengoa and Abu Dhabi's Masdar on the project. "So far, so good, I would say."

More plants the size of Shams, such as the second solar facility Nour 1 - and one every year through 2020 - will be needed if the emirate is to meet its grand clean energy goal. It calls for sourcing 7 per cent of all power generation from renewables, including thousands of rooftop solar panels and a wind farm on Sir Bani Yas Island.

The public targets are the most ambitious in the Gulf, and they have created an enticing hunting ground for the likes of Mr Otero and other executives hoping to win multimillion-dollar projects. Although no project to succeed Nour 1 has been announced, he said he was planning to prepare a bid for Nour 2.

The development of Abu Dhabi's renewables infrastructure is helped in part by troubles in the global solar industry. In the past three years the cost of photovoltaic panels, which will be used in Nour 1, have fallen by half as Chinese factories flooded the market with low-cost panels. That spurred consolidation last year, and three US solar firms filed for bankruptcy (including a Californian solar firm in which Masdar had been a minor investor) and the oil major BP shut its solar unit. Analysts forecast a wave of mergers and acquisitions.

One of those was Total's purchase of a majority 50 per cent stake in SunPower, a US panel manufacturer. Mr Otero spoke to The National about the Chinese competition and the role of renewables in the French oil company.

What's your target for the size of the solar business in Total?

So far Total has invested $1.5bn in SunPower. Plus all the activities in silicon, and we have an investment as well in the thin-film [solar cell industry]. So that makes a nice, sound business of about $2bn in terms of capital investment, which we want to multiply by a factor - it's not like 10 per cent or 20 per cent. We want to multiply that by a factor, and this factor will just depend on the appetite of general populations and governments for renewables investment.

What percentage of Total's business do you think renewables could represent?

Well, we have four axes of development within Total, and one of them, clearly, is solar and biofuels. So if you give a sizeable part of the capital which Total develops around the world - a few tenths of a per cent of the total activity.

US solar companies filed for bankruptcy last year, European companies are facing issues and BP Solar shut last year. And you made this investment in the same year, why?

Well, first of all SunPower is by far the best solar company in the world in terms of technology. They have a panel with an output with an efficiency of more than 20 per cent - way above any other company. Plus there is a pipeline to increase, to improve the technology. That's why we believe it's a good bet to go together to partner with them.

Secondly, we believe that we are on the verge of changing the dynamics around renewable energy. Now, for sure renewable energy these days is going through a tough time right now for many reasons. One of the reasons is the overcapacity of supply of solar panels from everywhere and China. The other reason is the difficulties with the debt in the OECD [Organisation for Economic Cooperation and Development countries]. So right now we are going through a storm, and it is difficult, this is true. Now, Sunpower is backed by Total capital, and we strongly believe that very soon, by the end of 2012, 2013, the market will pick up very strongly.

How will Total tackle growing competition from Chinese firms in the solar industry?

Certainly, Chinese manufacturers do produce a very cheap product. You have to recognise that that's changing the game: now solar energy is much more affordable to everyone. Now if you have space constraints, what you need is efficiency, if you are on your own roof, if you are in a country where space is limited — then you look for efficiency. If you have plenty of space, you can afford a low efficiency, cheap product, and of course the Chinese manufacturers are really strong at that.

After last year, are we now looking at a much more consolidated set of solar players?

China has announced that consolidation is on the way. I can read that in the newspaper just like you. I have no opinion on this. Because at the same time you've got start-ups with good innovation and at the same time you have consolidation between big companies, and between the two effects - between the start-ups coming up with the bright idea or the right product, and consolidation on the other hand - it's difficult to know.

What do you see as a good model for financing these projects?

There is one big issue with renewable energy, is that the energy is free - which is the sun or the wind - but the capital investment is huge. So you have to find a model where it's possible to bank it, to finance it. And that is the key of the development of renewable energy. Gas power is cheap to buy, cheap to construct [facilities], but expensive to operate. It's the contrary with renewables: expensive as a first capital investment, then extremely cheap to operate because it's free, really. So you have to find a model where you find the finance. That's really why SunPower has chosen Total, because of the capacity with our own equity and with banks as well to raise funds to invest.

twitter: Follow our breaking business news and retweet to your followers. Follow us