The producers of Tees Maar Khan, a much-awaited Bollywood film released on Friday, insist it is peppered with all the right ingredients to make a smash hit: kitsch song-and-dance sequences, strong comedy and candy-floss romance.

Inspired by the Italian comedy film After the Fox, the new movie features a swashbuckling con man played by the Bollywood superstar Akshay Kumar, who uses his knack for disguises to stealthily rob a consignment of antique treasures from a train.

Produced by UTV Motion Pictures for 500 million rupees (Dh40.7m), the not-so-cerebral yet entertaining format is a tried-and-tested formula that usually delivers box office success, Bollywood trade analysts say.

"Success of the film depends on the audience," says Farah Khan, the director of Tees Maar Khan, which bears a passing resemblance to her previous blockbuster hit Om Shanti Om, released in 2007. "They will either love my film or give it a thumbs down."

But much of Bollywood's hopes rest on this film. Trade analysts say that success for the movie could reverse the tide of flops that has blighted the Hindi film industry this year, resulting in losses of between 4 and 5 billion rupees.

Fewer than a quarter of the 237 films released this year made a profit, according to Box Office India, a Bollywood trade journal based in Mumbai.

The Tamil film Robot, starring Aishwarya Rai and Rajnikanth, was this year's highest grossing film, earning 2.5bn rupees.

Dabangg, a Hindi blockbuster starring Salman Khan, was another big hit this year, earning 1.45bn rupees.

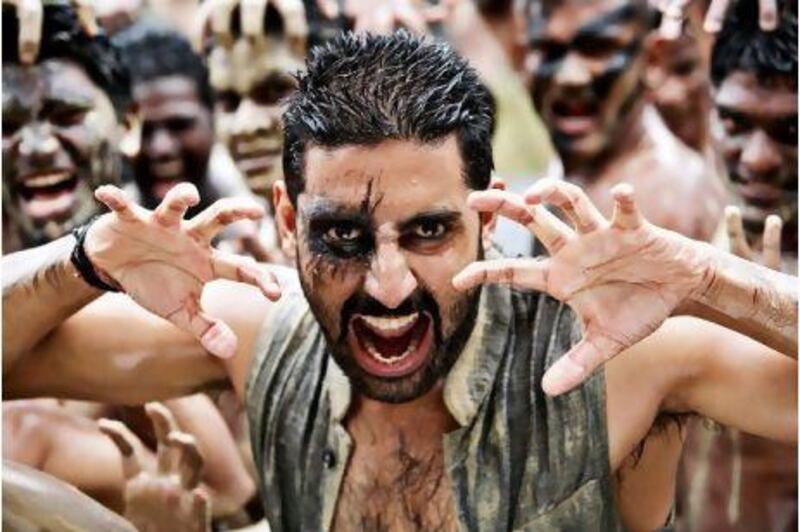

But many big-budget movies starring major stars flopped. Kites, starring Hrithik Roshan, reportedly lost 50 per cent of its total investment of 1bn rupees. Raavan, an offbeat, arty film staring the husband-and-wife pair of Abhishek Bachchan and Aishwarya Rai cost 900m rupees but lost about two thirds of that.

"If you take out the collections of Robot and Dabangg, the film industry had quite a rough year," says Timmy Kandhari, the executive director for entertainment and media at the global services firm PricewaterhouseCoopers (PwC). "More films failed and delivered poor returns on investment."

India's movie industry is the largest in the world in terms of ticket sales and number of movies produced each year.

Bollywood, along with other regional language cinema, produces more than 1,000 films annually in 20 languages, according to the global consultancy Ernst & Young. Close to 3.3 billion movie tickets are sold annually, the highest of any country, across 10,000 cinema screens. About 800 of those are in multiplexes.

Despite the industry's dismal financial performance this year, the future of India's entertainment sector looks bright, experts say.

The country is home to the world's second-largest population and one of the youngest. About 52 per cent Indians are below 25 years of age. This aspiring age group, with rising disposable incomes, is boosting spending on leisure and entertainment.

Last year, the sector - including films, television and radio - generated revenue of US$2.73bn (Dh 10.02bn), according to Ernst & Young. PwC estimates the industry will grow to $3.65bn in the next four years.

The growth drivers for the industry include such factors as "an increase in the number of multiplex screens, digital screens facilitating wider releases, higher cable and satellite revenues, improving collections from the overseas markets and supplementary revenue streams like digital downloads", according to a recent report by the consultancy KPMG.

Experts say the Indian government's relaxed regulatory initiatives and a liberalised foreign investment regime is creating a favourable climate for business.

With 100 per cent foreign direct investment allowed in most segments of the entertainment and media sector since 2000, it is relatively easy for private players to raise capital.

"Previously, the industry was dependent on only a handful of private financiers. However, it is now raising funds through private equity … and initial public offerings both in India and abroad," KPMG says.

The relaxed regulations are also attracting foreign entertainment businesses. India's department of industrial policy and promotion says the Indian broadcasting industry received foreign direct investment of $2.04bn in the past decade.

Cinepolis, a multiplex operator based in Mexico, plans to set up 40 multiplexes across India next year, with a total investment of $28m.

"India is a huge opportunity … as the market is under-penetrated," says Milan Saini, the managing director of Cinepolis.

Ernst & Young says the number of multiplex screens in the country is expected to rise from 800 to 1,500 in the next two or three years.

Active government support, low costs and world-class studio facilities are also helping India emerge as a favoured destination for foreign film production units.

More than 40 foreign projects, including the well-publicised productions such as Fox Studios' Life of Pi and Take One Productions' MI-4 have sought permission from India's information and broadcasting ministry to shoot in India. The ministry says that it has cleared 11 projects so far and that nine others are likely to be approved next year.

Television, which reaches an estimated 134 million households, is also making a major contribution to the growth of India's entertainment sector.

About 485 registered private television channels serve India, Ernst & Young says.

Over the next four years, the television sector is expected to grow at 12.9 per cent to reach revenue of $10.45. TV is expected to contribute 55 per cent of the overall market for animation entertainment, according to the Associated Chambers of Commerce and Industry of India. The animation market, growing at 20 per cent, is expected to touch $253m by 2013 from the current $122m.

India is also likely to overtake the US to become the world's largest direct-to-home (DTH) satellite pay market by 2012 with 36.1 million subscribers, according to a report by the research firm Media Partners Asia.