CAPE TOWN // South Africa's stop-start nuclear energy project is on the move again, but it will have to overcome ferocious opposition from civic activists and even government officials.

In December the country’s state-owned electricity provider Eskom invited bids to supply up to eight new nuclear reactors. The country already runs two reactors at the Koeberg plant outside Cape Town, and is Africa’s only nuclear energy generator.

In February Eskom said four major nuclear vendors indicated they would submit bids. Companies from China, France, Russia as well as the South Korean provider Kepco, which is overseeing the UAE’s nuclear project, are preparing their paperwork for what will be one of the largest such builds in the world.

South Africa needs new sources of electricity and it needs them fast. A heavy dependence on coal and ageing plants has caused intermittent power outages over the past decade. The planned nuclear fleet will add 9,600 mega watts of electricity; by comparison Abu Dhabi’s power utility produces up to 12,500MW to keep the emirate’s lights on.

Much of the new build will be along South Africa’s coastline, where cities now depend on coal energy produced up to 2,000 kilometres inland.

“Bear in mind that South Africa is geographically approximately the same size as western Europe,” says Kelvin Kemm, the chairman of the South African Nuclear Energy Corporation, a state-controlled organisation. “The distance from the coal power stations to Cape Town is the same as the distance from Rome to London. It would be strategically very unwise to supply most of the electricity of London from Rome. But that is what we currently do in South Africa.”

South Africa has already proved capable of running nuclear plants, which it has done for more than 30 years, so adding to the fleet to provide electricity to the coast is a logical step, Mr Kemm says.

Critics point to safety concerns, citing the 2011 Fukushima disaster in Japan and the earlier meltdown of Chernobyl in Ukraine in 1986. But Mr Kemm counters that these incidents involved earlier models of nuclear plants and South Africa will use the newer third-generation, or “Gen III”, plants that are deemed much safer.

“Gen III reactors have natural safety features built into them and the South African reactors are designed to be constructed in a fleet-type of manner. That means building the same reactor type in sequence. So they are the most cost-effective option.”

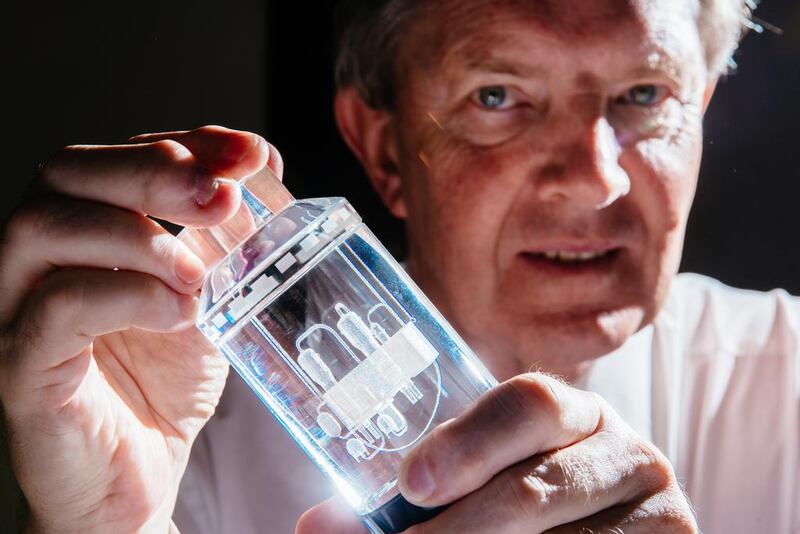

He adds that building a fleet will also lead to spin-offs in exports. Already South Africa is the world’s second-largest supplier of medical isotopes used in nuclear medicine. These products are used in specialist diagnostic machines and sales of more than 1 billion rand (Dh281.1 million) are made to medical facilities each year. With a target of 50 per cent localisation built into the programme, South Africa stands to become a significant exporter of nuclear products, Mr Kemm believes.

Much of the debate turns around money: what a nuclear fleet will cost; and whether the country can afford it. Some economists have used the United Kingdom’s planned £18bn (Dh82.58bn) Hinkley Point nuclear plant to produce a template of what it could cost, and estimate it could be as much as 1 trillion rand.

The counterargument is that the country is already losing money through power outages and slowed industrial growth. Eskom published figures last year claiming a net loss to the economy of 9bn rand in 2016 as a result of its renewable power purchases from producers.

“If these [nuclear plants] are not built, instability of electricity supply and rising prices will slow economic growth, and this will come with increasing poverty and political instability,” says Rob Jeffrey, an independent energy economist.

South Africa has one of the world’s highest rates of unemployment for an industrial society – about a third of the workforce is jobless, government statistics show.

While Eskom has commissioned dozens of private renewable projects to provide wind, solar and other forms of energy, these will never provide enough electricity, Mr Jeffrey says.

“Wind only supplies electricity at best on average 34 per cent of the time. It is highly variable, unreliable and unpredictable. Solar is only available to generate electricity on average 26 per cent of the time.”

For Africa’s only true industrial economy, the outages have been devastating. In just one quarter during 2015 when power cuts were at their height, the South African economy contracted 14 per cent, according to Bloomberg.

Although Eskom is bringing online two of the world’s largest coal stations, these will not be enough to compensate for the electricity shortages.

Whatever the case for nuclear though, proponents of it will have to overcome some formidable opposition. Earthlife Africa, an environmental organisation, is seeking a court stay of the project. “We will do everything in our power to stop the build,” says Makoma Lekalakala. “It is not in the economic interest of South Africa. It is intended to serve the interest of a small group of elite business people.”

Local media has buzzed with speculation over the past few years that the deal is being championed by a cabal of business and political interests that stand to gain financially. These include the country’s president, Jacob Zuma, and a Dubai-based family with close South African ties, the Gupta brothers. Both have repeatedly denied they will benefit from the nuclear deal.

Earthlife, however, believes it can show otherwise. “What we will be asking the court later this month is for documents from Eskom that we believe will show who is to benefit,” Ms Lekalakala says.

business@thenational.ae

Follow The National's Business section on Twitter