A round of bankruptcies and acquisitions could be in store for Europe's solar industry as austerity measures and Chinese competition force a consolidation.

Once the beneficiaries of generous state subsidies, European manufacturers of solar power arrays will have to choose between scaling up or shutting down to compete in a market that today includes small factories in Germany and immense production lines in China, analysts say.

"Next year we will see much more bankruptcies and mergers and acquisitions of solar companies," said Martin Simonek, the European solar analyst at Bloomberg New Energy Finance in London. "It's possible that several of these companies which are quoted today won't be quoted next year."

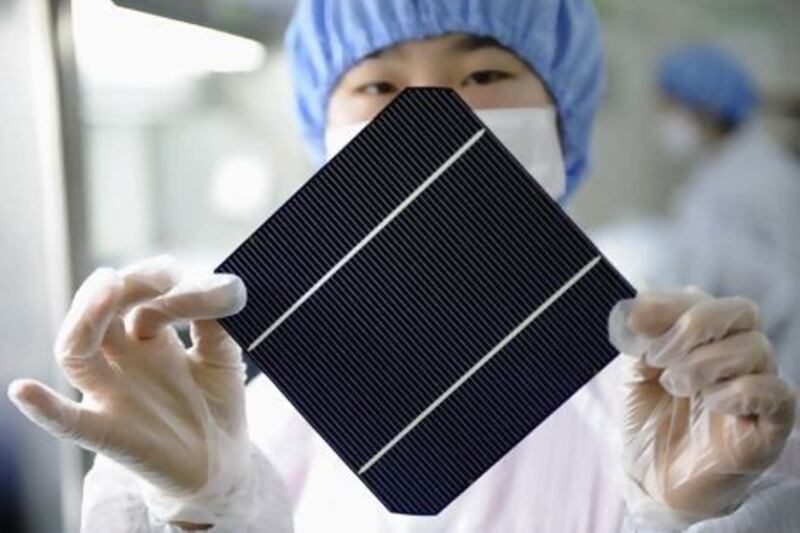

The shake-up in Europe is the latest development in a rapidly evolving industry. Companies in Germany and the US honed reputations as makers of high-quality solar panels, helped by subsidies and loans from their governments. But last year, China, which has also funnelled funds into its renewables industry, surpassed the US as the world's biggest maker of solar panels. The low cost of Chinese labour and technological advances have helped to push down the average price of a multicrystalline module from US$2.01 per watt of output in December to $1.16 per watt this month, according to Bloomberg New Energy Finance.

All of the three US solar companies that filed for bankruptcy in August - including Solyndra, a Californiaventure in which Abu Dhabi had invested through its clean-energy company Masdar - cited Chinese competition.

The battle between western and Chinese solar manufacturers developed further last week when seven US solar-panel makers filed a complaint with the US government, asking it to charge 100 per cent duties on solar imports from China because of what they said was unfair competition.

"China's predatory and illegal aggression is crippling the US industry," said the coalition of manufacturers. China rebutted by saying a trade war would hurt the global economy. "If the US government files a case, adopts duties and sends an inappropriate protectionist signal, it would cast a shadow over world economic recovery," the Chinese commerce ministry quoted an official as saying on its website.

The main company behind the US solar complaint wants to take its cause to Europe next.

SolarWorld, whose US unit led the group of seven manufacturers, is based in Germany, the heart of the European solar industry.

"The EU has to wake up now to make sure we are having fair competition over here, too," Frank Asbeck, the chief executive of SolarWorld, told Reuters last week. "We are currently reviewing several options for how to throw this forward over here."

European makers have come under pressure during the past year as governments roll back subsidies for solar installations. German executives are bracing for a cut in January of as much as 15 per cent from solar incentives. The reductions are part austerity measure, part practicality: European power grids have had a tough time integrating large amounts of solar power, which peaks during the day rather than producing at a steady rate such as coal-fired or nuclear plants. Subsidy cuts will have a direct effect on Europe's solar capacity, which is an important part of the EU's plan to cut greenhouse gas emissions by 20 per cent in the next eight years, said the French power conglomerate Alstom.

"One of the characteristics of this market is that it's purely incentive-driven," Robert Gleitz, the vice president of marketing for Alstom Power, a unit of the conglomerate, said from the company's headquarters in Paris. "If the incentives are disappearing, obviously the amount of megawatts will decrease."

In the coming consolidation, the biggest companies stand to grow through acquisitions as smaller competitors withdraw, said Kash Burchett, an analyst at IHS Global Insight in London. Among them are SunPower, the US's juwi solar, France's EDF EN, and Germany's Conergy, Phoenix Solar and Belectric - six companies that have each accounted for 1 per cent or more of installed solar capacity since 2008.

Even they will need to increase their scale of operations to compete with bigger Chinese makers and "flextronics", companies that can make nearly any electronic goods to order, Mr Simonek said.

"The industry is very fragmented across the whole of the value chain, and this is making a lot of the solar components too expensive," he said.

"Unless you can reduce the cost of manufacturing, you will not survive. You cannot expect a 50-megawatt manufacturer to compete with a 3-gigawatt, vertically integrated manufacturer. It's just not possible."