Small-time investors from the Middle East, India and China drove a big increase in demand for gold bars, coins and jewellery in the first three months of the year, according to the latest data from the World Gold Council.

The data mark the first official recognition of a complete turnaround in the world gold market since the price collapsed by more than 20 per cent in early April.

Since then there have been shortages of actual gold — referred to in the market as "physical" — as hoards of Chinese and Indian investors sought to take advantage of the price drop by buying bars, ingots and coins in small denominations.

Indian gold bar and coin sales were up 52 per cent year on year while Chinese bullion demand was up 22 per cent. In the United States, demand for bars and coins was up 43 per cent compared with the same quarter last year.

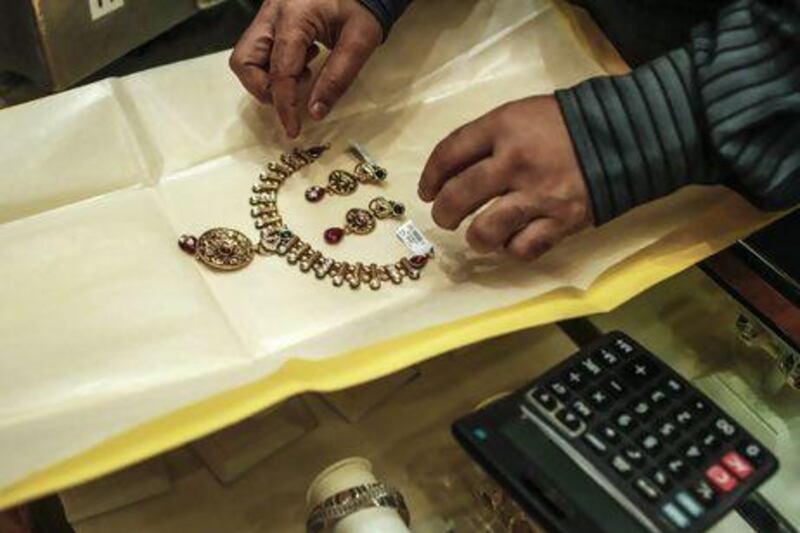

Total jewellery demand was up 12 per cent in the first three months of the year compared with the same period in 2012, again driven mainly by Asian markets.

Jewellery demand in China was up 19 per cent on the same period last year at a record 185 tonnes.

Demand for jewellery in both India and the Middle East was up 15 per cent while in the US, where jewellery sales were up 6 per cent, demand showed its first increase since 2005.

Marcus Grubb, the managing director of investment at the World Gold Council, said: "The price drop in April, fuelled by non-physical moves in the market, proved to be the catalyst for a surge of buying that has left many retailers short of stock and refineries introducing waiting lists for deliveries. Putting this into context, sales of bars and coins, jewellery and consumption in the technology sector still make up 81 per cent of the market."

Gold is perhaps the best barometer of global economic prospects. When the worldwide recession began in 2008 the price of gold rose steadily from about US$850 to hit an all-time high of more than $1,920 in September 2011.

The bull market was dominated by large investment funds known as ETFs (exchange-traded funds) and hedge funds seeking shelter from the economic storm.

In the first months of this year, however, those funds started an unprecedented sell-off, dumping hundreds of tonnes of gold as they bet that the US economy was beginning to show signs of recovery.

US stock prices had been rising steadily, as they still are, and much of the ETF cash was switched from gold into shares.

On April 12, some 400 tonnes of gold were dumped in a matter of hours, sending the price on a downward spiral the likes of which had not been seen for more than three decades. Since then, with prices in the low $1,400s, small-time investors have been snapping up as much gold as they can.

Positions held by gold-backed ETFs, which in 2012 accounted for 6 per cent of the world's gold demand, fell by 177 tonnes in the first three months of the year compared with the same period last year, the World Gold Council said.

Central banks remained significant acquirers of gold, making purchases in excess of 100 tonnes for the seventh consecutive quarter.

Total global demand for gold in the first quarter of the year was 963 tonnes, down 19 per cent from the final quarter of 2012.

Tarek El Mdaka, the managing director of Kaloti Gold in Dubai, said his office in Hong Kong had reported queues of would-be gold buyers around the block in recent weeks, so desperate are small-time investors to take advantage of the recent drop in price.

"All over the world it is like this," he added. "In Australia it is going crazy right now too."

Kaloti is a refiner of gold with a mint house that makes gold bars and coins of the type that are proving so popular in India and China.

The Kaloti group reported an increase in demand of 47.4 per cent for the first three months of the year but expects the second quarter to be even stronger.

"The big price drop came in April, so we saw an increase in demand of maybe 65 per cent or 70 per cent in the first four months of the year," he said, suggesting that the World Gold Council's next report on global gold demand will show an even greater increase in demand than in the first three months.