More than two years after the global financial crisis first hit property prices, developers in the Emirates are still facing steep challenges.

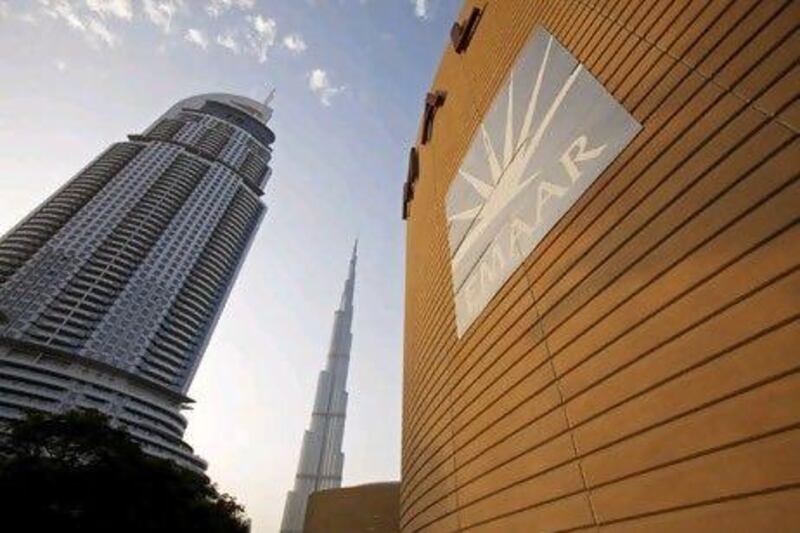

Only Emaar Properties, the country's first master developer and the builder of the tallest tower in the world, the 828-metre Burj Khalifa, has remained consistently profitable during the past two years.

This is largely a result of its growing portfolio of hotels, shopping centres and retail outlets, which boost income every quarter.

Gross profits for the last fiscal year may have declined by as much as 35 per cent for property developers in the UAE, according to the latest research from Nomura Securities.

In the next couple of weeks, only Emaar is expected to post a net profit for the fourth quarter of last year.

"These [other] companies are still clearing up their balance sheets and looking for a new model," says Chet Riley, an analyst at Nomura. "The numbers are going to reflect a challenging fourth quarter."

Emaar, he says, will stand out with a year-end profit of about Dh2.8bn on revenue of Dh11.3bn. But that could be tempered in the first quarter of this year when Emaar is expected to write down its investment in Amlak and, possibly, its Indian joint venture Emaar MGF.

Despite the sell-off of Aldar stock in the past few days on the back of its announcement about government support comprising a Dh10.9 sale of assets on Yas Island, Dh5.5bn of residential units and land and a Dh2.8bn convertible bond, analysts feel the company is now leaner and healthier.

Some say its balance sheet clean-up could push others to follow suit.

Ahmed Ali al Sayegh, the chairman of Aldar, said the new financial framework would "strengthen our capital structure and provide us with a stable and sustainable platform from which we can continue to capture commercial opportunities to deliver value to shareholders".

Credit Suisse says the support is a "better than expected financing plan" that will allow investors to focus on the more integral problems in the Abu Dhabi property sector, rather than the company's debt.

Majed Azzam, an analyst at Alembic HC Securities, says the fourth-quarter results should show further write-downs of assets from property developers.

That would reverse years of so-called "fair value" gains developers reported as profit when the market values for property was on the rise.

"Aldar is taking its largest impairment ever," he says.

"We'll probably see more asset impairments come through the income statement of all the developers … Aldar came clean so now there is a feeling in the market that all the developers should address asset quality."

Sorouh Real Estate is trading at a 30 per cent discount to its book value, which is the amount that could theoretically be raised if all assets were liquidated by the company.

That means investors are factoring in a possible write-down of assets of as much as a third, Mr Azzam says.

After balance-sheet restructurings, developers will find their "fates will be completely linked to a recovery in the property sector", he says.

"The market seems to be deteriorating much faster than people were expecting. The focus will shift to the sector as a whole and signs of any recovery."

While signs of stability in the property market are beginning to emerge in Dubai, prices and rents in Abu Dhabi are declining.

The property consultancy Cluttons says rents fell in the capital by as much as 16 per cent in the final three months of last year compared with the third quarter, while they declined by 3.2 per cent in Dubai.

Indian and Chinese property investors are bolstering the Dubai sector with billions of dirhams of purchases as they seek out investments that have more potential for growth than those available in their local, inflated markets.

Still, this is not providing much comfort for the emirate's developers. Many of those sales are taking place in the secondary market. Deyaar Development, once an ambitious and innovative development company, has not communicated publicly for almost a year after its chief executive and other top officials left the company.

Mr Riley says Deyaar appears to be completing the buildings in its portfolio but shows no plans to continue developing property after that.

Union Properties is expected to report a rise in sales during the fourth quarter after selling the Ritz-Carlton hotel near the Dubai International Financial Centre for Dh1.1bn, Dh400 million below its asking price.

The company is selling assets to help fill a funding gap for its projects in Dubai, including The Index tower and Limestone House.

In Abu Dhabi, investors and developers are waiting for the Government to issue laws to regulate the property sector. Analysts see this as an important move that could help increase confidence among prospective property buyers, but no timetable has been released.

Sales and rental rates could decline further this year as thousands of new homes come on to the market, primarily on Reem Island.